Voyage Miles for every transaction & Airport Lounge facility via Dragon Pass

Like a personal assistant to fulfill your aspirational needs

Increase retail transactions min. IDR60 million and enjoy benefits Voyage Complimentary. Maintain savings balance min. IDR500 Million/month. Info: ocbc.id/voyagecomplimentary

Taking the MRT abroad just TAP

With the Contactless feature, valid in countries and transportation companies that accept payments by Credit Card and contactless

Contacless

Equipped with a contactless feature for convenience and security as well as transaction speed

Attractive Promotions

Enjoy various kind of attractive promos that you can enjoy with your family

Info: ocbc.id/promo

Access Cash Withdrawal

Free cash withdrawals at more than 1 million ATMs worldwide

Various Payment Methods

Pay credit cards easily anytime and anywhere

Pay Flexible Bills

Payment of credit card bills of at least 5% of the total bill

Easy transaction via Alipay/Weixin Pay with OCBC Credit Card

Now traveling abroad is easier because you can transact on Alipay & Weixin Pay with OCBC Credit Card. Info: web.ocbc.id/trxchina

Every retail transaction of IDR 10.000 will get 1 Voyage Miles

Enjoy Airport Lounge complimentary up to 2 times per year in 1,356 international airport lounges, in over 703 airport across 137 countries with DragonPass App. Airport Lounges can be seen in the DragonPass App.

To enjoy this facility, Cardholders are required to contact Tanya 1500-999 to get the DragonPass Membership Activation Code Number. For more information please visit : ocbc.id/dragonpass

Domestic Aiport LoungeGet unlimited free access at Airport Lounges in several big cities in Indonesia. List of participating Airport Lounges please visit: ocbc.id/loungedomestik

A package of services and benefits designed to enhance your lifestyle and experiences, giving you unparalleled access to an array of services, including a 24×7 Concierge Service to fulfills the following type of requests

Installment Conversion is a term credit facility for your credit card spending transactions ranging from 3 to 36 months with easy installment. The interest rate in the Installment Conversion is determined by Bank OCBC and may change at any time with prior notice. The period of installment is set by the Card Holder itself and cannot be changed again. Cardholder can request Installment through :

Send SMS from registered Mobile Phone at the Credit Card system and you will directly get SMS confirmation

SMS Format: OCBC(spasi)CICIL(spasi)16 Digit No Kartu Kredit#Jumlah Transaksi#Tenor

Contoh: OCBC CICIL 5241690000001234#30000000#12

OCBC Voyage is accepted worldwide with more than 29 Millions merchants and service partners that collaborate with Mastercard international.

Apart from being able to do fund withdrawal in all OCBC Branches, OCBC Voyage credit card can also be used for fund withdrawal in more than 1 Million ATMs worldwide, 24 hours a day and 7 days a week. You can withdraw up to 70% of your OCBC Voyage credit card limit.

Your OCBC Credit Card can be used to pay recurring utilities payment such as TELKOM, PLN, PAM, TV Subscription, IPL (building maintenance fee), and Insurance by:

OCBC Bill

Register your recurring bill for service providers in agreement with OCBC by contacting Tanya OCBC 1500999 or your Relationship Manager. More information, click here

OCBC ATM

Visit the nearest OCBC ATM and choose “Payment / Purchase / Cash Advance” menu using your credit card PIN. If you do not have your PIN yet, please create your PIN immediately. More info visit www.ocbc.id/pin

Your OCBC credit card payment can be done by paying the minimum 5% of the total bill or IDR 50,000 (whichever is higher).

You can pay your bill by various methods :

We are ready to serve you 24 hours a day 7 days a week to get information about OCBC credit card at 1500-999.

Definitions

In these Terms and Conditions, unless expressed otherwise in the context, the following terms shall have the following meaning:

"Automated Teller Machine" hereinafter referred to as "ATM" means a machine which can be used by the Cardholder to access banking services for 24 hours

"Bank" means PT Bank OCBC NISP Tbk, a banking company registered and supervised by the Financial Services Authority, domiciled in South Jakarta and having its address at OCBC Tower, Jalan Prof. Dr. Satrio Kav. 25 Jakarta 12940 including all of the bank's branch offices in Indonesia.

"Cash Advance Limit" means the maximum limit for cash advance made at the Counter or ATM pursuant to the limit approved by the Bank, where such cash advance shall be subject to Administration Fee and Interest, calculated on a percentage basis of total cash advance or a certain minimum amount determined by the Bank.

"Stamp Duty" means the tax levied on documents under the provision of the applicable laws charged to the Cardholder for every payment made.

"Administration Fee" means fees charged by the Bank to the Cardholder with regards to the use of Credit Card.

"Late Charge" means fees charged to the Cardholder when he/she pays the bill after the Due Date

"Billing Statement" means a notification to the Primary Cardholder which, among others, inform about Current Month's Total Bill, total Minimum Payment and the Due Date for making payment within a particular Credit Card billing period.

"Interest" means the interest expense charged to the Cardholder if Current Month"s Billing Statement is not paid in full and/or if the payment is made after the Due Date

"Call OCBC" means PT Bank OCBC NISP, Tbk banking call service, or Call OCBC which can be contacted at 1500-999 or other numbers informed by the Bank from time to time.

Interest and Fees

| Annual fee |

Private Banking Customer : Free annual fee for primary and supplementary cardholders as long as the primary cardholder are a valid Private Banking customer

Premier Banking Customer :

|

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR 50,000 (until 31 December 2023) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (until 31 December 2023) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100.000 and a maximum of IDR 250.000 |

| Lost/Damage Card Replacement Fee | IDR 100 thousand |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30.000, and Declined Check / Giro Fee IDR 25.000 |

| Duty Stamp Charged for Payments with Certain Amount |

Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10 thousand |

| Installment Request Fee |

Through OCBC mobile Application or other channels IDR 15,000 per transaction Through Contact Center - Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer Fee | IDR 10,000 to OCBC account IDR 25,000 to another bank account |

|

E-Statement via Email fee Increase Limit Fee Notification Charges Voyage Miles Redemption Fee |

IDR 5,000 per month IDR 50,000 per request IDR 10,000 per bill per month IDR 10,000 for every request |

| Important Information |

|

Interest Calculation for Purchasing Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total new bill, or pays after the Due Date. Interest for Shopping Transactions is calculated based on the Posting Date of the transactions made. The interest rates that apply to spending transactions are listed on the Billing Statement. Unpaid fees, penalties, or interest are not included in the interest calculation component. Interest will be charged on the next billing statement. For a complete interest calculation, see the illustration of credit card interest calculation.

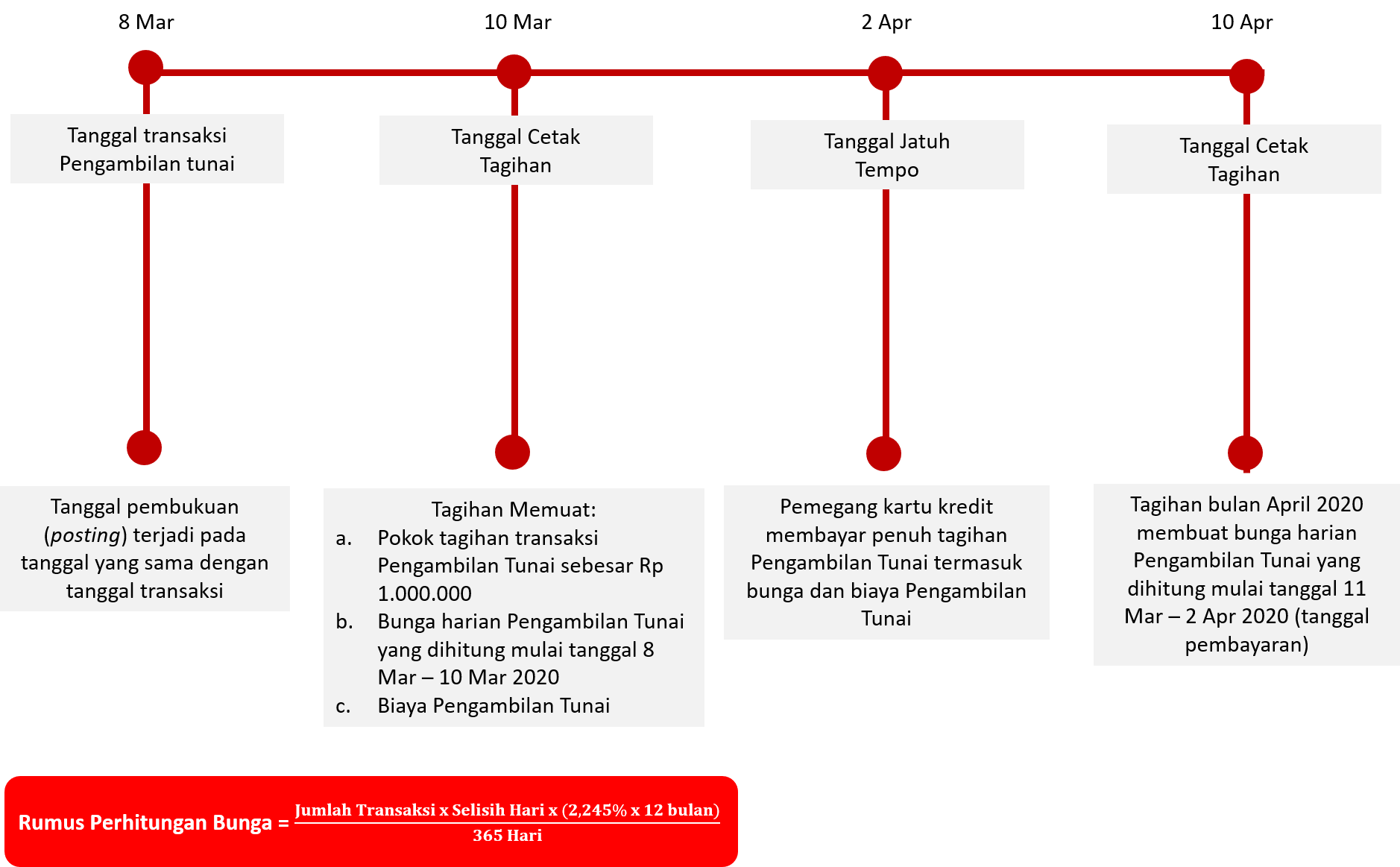

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Cash Advance Date until the date of full payment of the Cash Advance transaction. The interest rates that apply to cash withdrawal transactions are listed on the Billing Sheet. Unpaid fees, penalties, or interest are not included in the interest calculation component. For complete interest calculation, please see the illustration of Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 2,215 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Difference of days = (10 - 8) + 1 = 3, Interest = IDR 1,000,000 x 3 x (2,245% x 12 months) / 365 = IDR 2,215

General Requirement:

| Card Type | Special Requirements | Income Documents |

|---|---|---|

|

|

Cardholder who registered as a Private Banking with a total placement of funds of at least IDR 10 Billion |

General Requirement:

| Card Type | Special Requirements | Income Documents |

|---|---|---|

|

|

|

General Requirement:

| Card Type | Special Requirements | Income Documents |

|---|---|---|

|

|

|

The billing statement is a summary of transaction details of your OCBC Credit Card (from the previous month's billing date up until the subsequent billing date). Details of transactions printed are transactions made using the primary card and the supplementary card (if any). There is no separate billing statement for supplementary cards.

Primary Credit Card Number

This is OCBC Primary Credit Card number.

Statement Date

This is the date of transactions and other outstanding balances billing. It will fall on the same date each month.

Payment Due Date

This is the payment deadline for the outstanding balances on which the payment shall have been received by PT. Bank OCBC NISP, Tbk, namely 16 days for Platinum Credit Card and 23 days for Titanium Credit Card as from the billing date. A minimum payment must be paid off each month on or before the due date even if you have not received the Billing Statement. Payment received after the due date shall be subject to late charge.

Current Month's Bill

This is the outstanding balance on the billing date which includes previous month's outstanding balance and transactions made up to the billing date, fees, interests and corrections deducting payments and credit.

Minimum Payment

The minimum payment is 5% of the outstanding balance or IDR 50,000 (whichever higher)*. If your outstanding balance exceeds your credit limit, such excess shall be added to the minimum payment which is about to become due. If you have not paid off the previous month's minimum payment, such amount shall also be added to your minimum payment which is about to become due. If there is any instalment transaction, it shall be billed in full.

*Until 30 June 2024 or always binding with Bank Indonesia regulations

Transaction Date

This is the date of the transactions of purchase, cash advance or other transactions made using OCBC Credit Card.

Posting Date

This is the date on which your transaction is posted or charged to your OCBC Credit Card account.

Transaction Description

This column contains information on the details of transaction made using your OCBC Credit Card:

Purchase

This is the total amount of purchase transactions of your OCBC Credit Card in the current month.

Administration Interests & Fees

This is the amount of interest (only if there is an interest expense) and administration fees charged.

Payment

This is the amount of payment of the OCBC Credit Card bill which you have made.

Total

This is the total amount of bill you have to pay in the current month.

Combined Limit

Total credit limit assigned to a cardholder through 1 or more credit card(s) owned. The total credit limit of your OCBC Credit Card constitutes the combination of credit limit of all credit cards you own. If you only have 1 card, the combined limit is equal to your Primary Card limit.

Remaining Combined Credit

This is the remaining amount of credit limit up until the billing date and can be used for transactions.

Current Month's Points (Platinum Credit Card only)

This is the total Reward Points you have earned in the current month.

Previous Total Points (Platinum Credit Card only)

This is the information on the previous month's Reward Points.

Redeemed Points (Platinum Credit Card only)

This is the information on the amount of Reward Points you have redeemed up until the current month.

Expiry Date (Platinum Credit Card only)

This is the expiry date of your Reward Points.

Total Points (Platinum Credit Card only)

This is your effective Reward Points.

Interest Rate (% of Retail Interest)

This is the information on the interest rate to be applied due to the customer's failure in making full payment of a bill. The rate is determined by the bank.

Interest Rate (% Cash Advance)

This is the information on the interest rate to be applied for cash advance transactions, the rate is determined by the Bank.

Note:

You will be charged the interest for:

Partner Merchants in Indonesia

Deal with special offers from Bank OCBC partner merchants in Indonesia

VISA Partner Merchants

Trade with special offers from VISA merchants all over the world

Partner Merchants in Singapore and Malaysia

Trade with special offers from VISA merchants in Singapore and Malaysia

cc-voyage

Debit Card, GPN Debit Card, Online Debit Card, Premier Debit Card, 90°N Credit Card, Platinum Credit Card, Titanium Credit Card, Voyage Credit Card

1 Jun 2022 - 1 Apr 2026

Debit Card, OCBC Nyala Platinum, Voyage Credit Card, 90°N Credit Card

14 Mar 2024 - 31 Dec 2025

| Terms | OCBC Premier Voyage Credit Card | OCBC Voyage Credit Card |

|---|---|---|

| Age | Main Cardholders aged 21 - 75 years | Main Cardholders aged 21 - 65 years |

| Citizenship | Indonesian citizen and foreign national | Indonesian citizen and foreign national |

| Income | Min Revenue: IDR 100 Million per month or Min AUM: Average IDR 1 Billion for the last 3 months. |

Min Revenue: IDR 100 Million per month or Min AUM: Average IDR 1 Billion for the last 3 months. |

| Personal Identification Documents | Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of NPWP |

Photocopy of KTP or Photocopy of Passport / KIMS / KITAS (For foreigners only) or Photocopy of NPWP |

| Income Document | A checking account with an average AUM of the last 3 months at Bank OCBC with a minimum of IDR 1 billion | A checking account with an average AUM of the last 3 months at other banks ≥ Rp 1 billion or Public Company Annual Report or Original Salary Slip or SPT. |

For every transaction Rp 10,000 will get 1 (one) Voyage Miles without an expiry period

Exchange of Voyage Miles can be done through Voyage Exchange at +6221-26506363

Exchange your Voyage Miles for:

Always use Voyage Miles to purchase any airline ticket, and get more Frequent Flyer Miles from that airline.

Benefits of Voyage Exchange

To enjoy a variety of services above, please contact Voyage Exchange at +6221-26506363

Get comfort on every trip with the following exclusive facilities:

Free access at executive airport lounges in major cities throughout Indonesia. (For more information click here)

Free access 2 (two) times per year in executive airport lounges at more than 850 airports worldwide. (For more information, click here)

Private Banking Customer : Free annual fee for primary and supplementary cardholders as long as the primary cardholder are a valid Private Banking customer

Premier Banking Customer :

File an objection due to a transaction incompatibility, no later than 45 calendar days from the date the Billing Statement is sent. Please submit your objections to Call OCBC 1500-999 or + 62-21-26506300 (from abroad)

OCBC mobile Application *

Download the latest version of the OCBC mobile Application and follow these steps:

(* Create PIN via OCBC mobile only for Primary Card holders)"

Credit Cardholders can simply contact OCBC Call 1500-999 or + 62-21-26506300 (from overseas) for the process of blocking a lost Credit Card and submit a credit card replacement at a cost of Rp 100,000 for OCBC Titanium and Platinum, and costs IDR 2,500,000 for an OCBC Voyage Credit Card.

Did not find what you're looking for?

See FAQ