Easily manage business and personal transactions separately

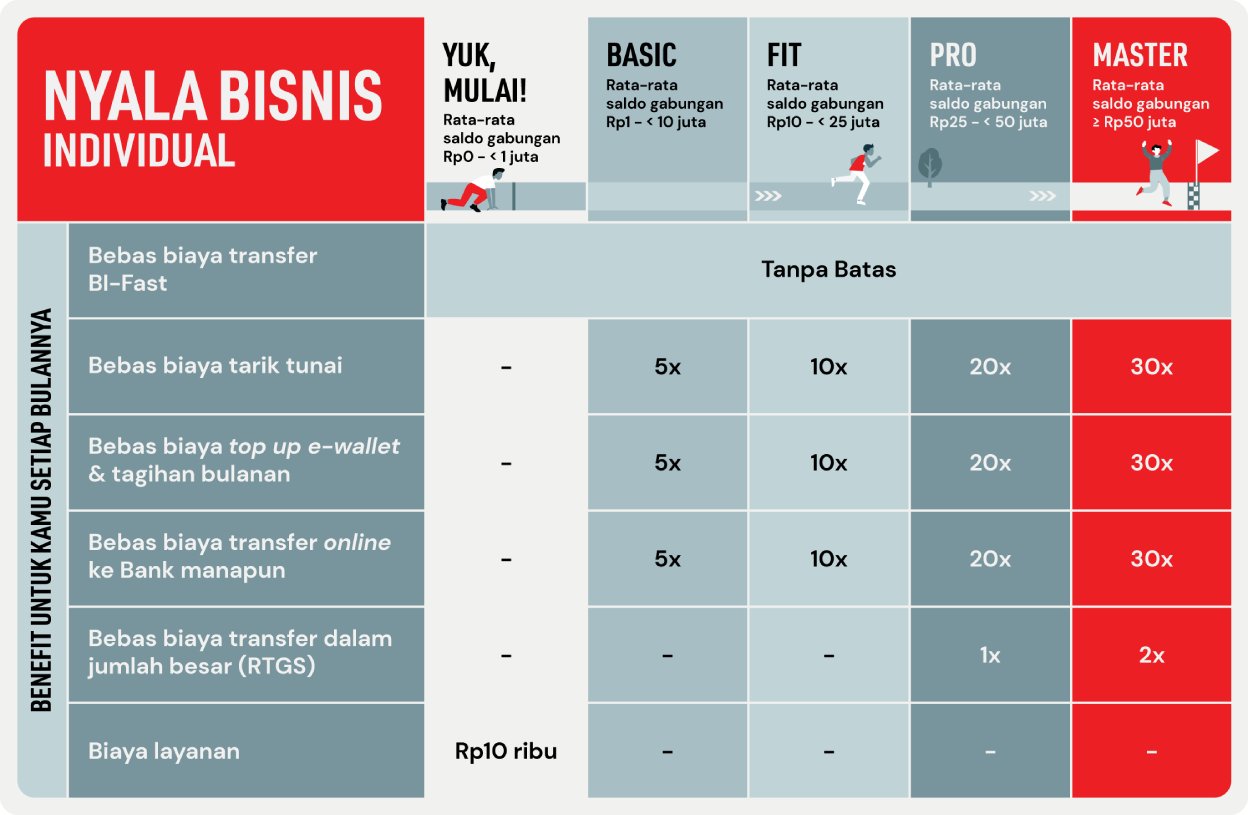

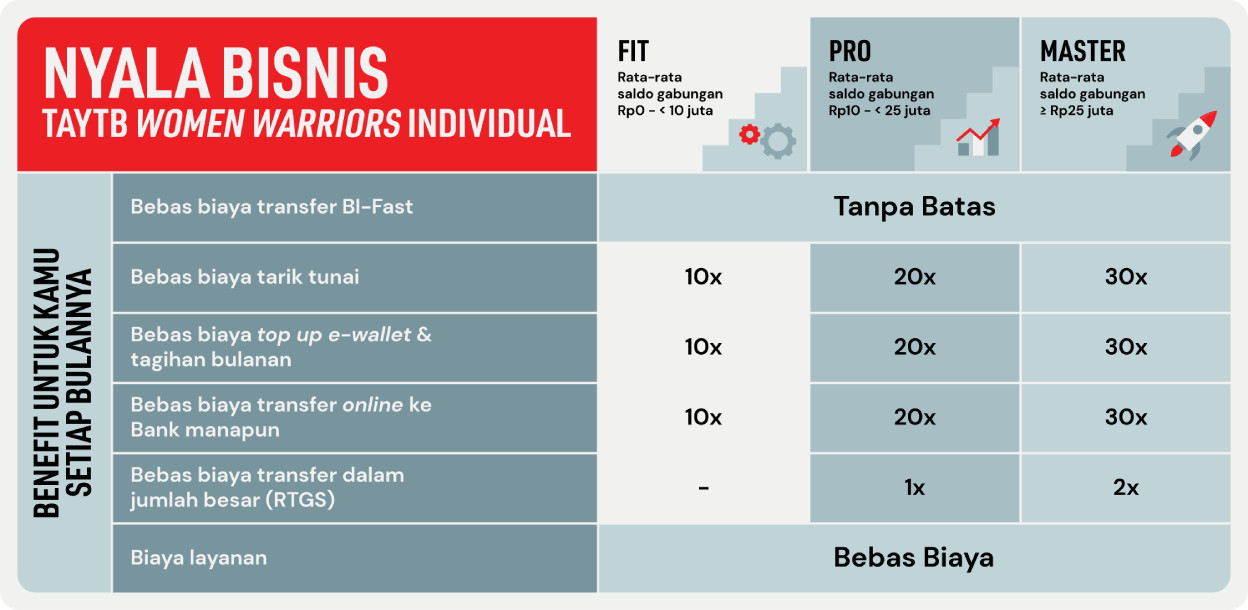

Free admin, cash withdrawal, and interbank transfer fees with a combined balance of IDR 25 million

Special offers for various digital solution to grow your business

Manage Personal and Business Finance in one solution

Benefit of Free Transactions Fee

QRIS MDR Fee Cashback

Incoming Transaction Rewards

KTA Cashbiz

Business Loan

OCBC mobile

OCBC Business web

OCBC Business mobile

Business Digitization Services

Business Fitness Solution

-Loan’s limit start from IDR 25 millions up to IDR 200 millions

-Loan payment period of 12, 24, and 36 months

-Interest rate start from 1.59% flat per month for loan period of 36 months

NYALA Bisnis is a banking service for the ease of managing your personal and business finances. Special banking services for personal needs from OCBC that provide the best benefits based on the combined balance of the various products you have in OCBC (savings, time deposits, current accounts, time savings, investment products). Nyala Bisnis is equipped with 2 accounts, namely Business Smart Giro for business transaction needs and Tanda 360 Plus for personal transactions. By having a total combined balance of an average of Rp. 25 million per month, you can get many benefits like free account administration fees, free cash withdrawals at ATM Prima, Bersama and OCBC Singapore as much as 50x / month, and free purchase payment fees. via ONe Mobile as much as 50x "(the fee will be returned 1 day after the transaction) and also extra facilities to help you focus on growing your business.

For customers who own Joint Account, only primary customer will be eligible for benefits in the joint account. Secondary (non-primary) customer is not eligible for Nyala benefits in the joint account.

Correspondence address or other address and/or electronic address on this Consolidated Statement is system generated. If you find any suspicious information in this Consolidated Statement, or if there is a change of your data or correspondence address or email address, please contact your Relationship Manager or Tanya OCBC at 1500-999 or 62-21-26506300 from overseas not later than 30 calendar days since the issuance date of this Consolidated Statement.

If PT. Bank OCBC NISP, Tbk (“OCBC”) does not receive any objection to the Consolidated Statement within 30 calendar days of the date of its issuance, you will be deemed to have accepted, acknowledged and agreed to all information in this Consolidated Statement. Any risks arising from, including but not limited to all claims, losses and liabilities in relation to your failure or delay in providing OCBC with any necessary confirmation shall be your own risks/responsibility, and OCBC is held harmless against any and all risks and liabilities of any kind.

This Consolidated Statement has been prepared by OCBC to update you on your portfolio value of your deposits, investments, and loans at OCBC, consisting of both Bank Products and Non-Bank Products that are partners with OCBC, namely insurance products and / or capital market products (“Non-Bank Products”).

The Non-Bank Products specified in this Consolidated Statement are not the products of OCBC, and thus such Non-Bank Products are not covered by the government blanket guarantee program or the Deposit Insurance Agency (LPS).

Therefore, OCBC shall not be liable in any way for all consequences and risks connected with such Non-Bank Products because OCBC in this matter is only acting as either a selling agent or a referral agent.

The Non-Bank Product portfolio provided in this Consolidated Statement is not intended to replace the statement and/or confirmation to be provided by the relevant Investment Manager and/or Custodian Bank and/or Insurance Company and/or Securities Company that are partners with OCBC (“Confirmation Letter”).

If there is any discrepancy between the Confirmation Letter and the Consolidated Statement, the Confirmation Letter shall prevail.

OCBC shall not be liable for the Confirmation Letter, so that any issues arising from the Confirmation Letter will be managed by the relevant Investment Manager and/or Custodian Bank and/or Insurance Company and/or Securities Company that are partners with OCBC.

Non-Bank Product Information that is not displayed in this Consolidated Statement is not an OCBC Bank Partner Non-Bank Product.

All references to the terms "Portfolio" and "Account" as used in this Consolidated Statement must be construed as general references only and do not refer to your specific deposits, investments, and loans.

Your portfolio details in the Consolidated Statement may not include executed transactions that are still pending settlement. They will be shown in a subsequent composite statement once the transaction has been settled.

This Consolidated Statement reflects positions as of the transaction date and such positions may differ from those of the respective statement of deposit, investment and loan accounts, which reflect positions as of the settlement date.

The value of your deposits and investments as well as loans in this Consolidated Statement is the result of rounding that is adjusted to the position on the date of the transaction process and may differ from the statements of savings, investment or loan accounts on the date of completion of the transaction.

The equivalent IDR (Rupiah) balance shown in this Consolidated Statement represents an equivalent IDR amount as a result of currency exchange using Bank Indonesia Middle Rate for Balance Value or Amount or Indicated Market Value or Loans.

All information related to Non-Bank Products, such as: insurance and capital market product is provided by Insurance Company, Custodian Bank, Investment Manager and Securities Company and may lag by 2 (two) or 3 (three) business days. If there is any discrepancy on insurance and capital market product data provided by OCBC with insurance and capital market product data provided by the Insurance Company, Custodian Bank, Investment Manager and Securities Company, you are encouraged to refer to data from the Insurance Company, Custodian Bank, Investment Manager and Securities Company.

OCBC shall not be liable for any information provided by third parties. The official confirmation of your portfolio administered and managed by such third party and any issues arising from the relevant information shall be provided and dealt with directly by such third party.

The Information in this Consolidated Statement is not intended as primary supporting data and therefore must not be relied upon or should not serve as the sole reference in calculating used for tax purposes. Customer is encouraged to always check the attached information and before reporting tax data to the relevant institution.

Your personal deposits, investments and loans will not be actively monitored by OCBC.

OCBC does not undertake, and is not obliged to observe, manage, or monitor or otherwise attend to your deposits, investments, and loans.

This Consolidated Statement does not constitute proof of your ownership of Bank Products nor Non-Bank Products.

You are bound by the Terms and Conditions of Use of this Consolidated Statement. OCBC will update this Consolidated Statement from time to time. It is advisable that you regularly read the applicable Terms and Conditions.

Deposit. Interest is calculated on the average daily balance at the end of the month and credited to your account in OCBC on the last day (except Sunday and Public Holiday).

Any terms and conditions as well as product features and interest rates that have been agreed by You are subject to periodic review and may be changed or altered by OCBC at its sole discretion with notice through media deemed properly by the OCBC and subject to the prevailing laws and regulations.

Investment and Bancassurance. Market values are indicative and may not be the price when the sale transaction is executed. Please contact Your Relationship Manager to get the latest pricing.

Bancassurance. The nominal value shown in the “Indicative Market Value” column for non-unit-linked Life Insurance (not linked to investment) represents: 1) the cash value, in respect of products with a cash value. 2) the amount of premium and fees (if any) that has been paid, in respect of products with no cash value.

Information on Life Insurance products and other insurance products offered through Telemarketing is not shown in this Consolidated Statement.

If transactions made on the last business day of the month are not included in this Consolidated Statement then the data will be available in the following month Consolidated Statement. For more information on Insurance products, please refer to the statements on such products issued and directly sent by the relevant Insurance Company.

Bond. The Indicative Market Value does not include accrued interest, income tax and deposit tax, investment or accrued loans, and custodian fee (if any).

Loan.

You must pay all outstanding obligations including the principal, interest, and any other fees incurred in connection with your Loan and Credit Card Accounts in a timely manner. All bills and payments are made in IDR currency (Rupiah), and so are cash withdrawals in a foreign currency.

The exchange rate applicable to you is determined by the principal and the exchange rate applicable at OCBC. Any risks or losses arising from the difference in exchange rates in the repayment and/or cancellation of transactions in a foreign currency shall be your own risk and responsibility.

Sharia. All references to the terms “revenue sharing or bonus” as used in this Consolidated Statement is not displayed. Further information please contact OCBC Sharia Branch Office or Sharia Service Office.

Channelling or Loan Distribution from a Third Party (Fintech or Multi-finance). Any information on loan value and other matters related to channelling activities in fintech or multi-finance is not displayed in this Consolidated Statement.

This Consolidated Statement is made in Indonesian and English language versions. Both language versions have the same legal force, but the parties agree if there is a discrepancy in this Consolidated Statement, the Indonesian version shall prevail.

OCBC NYALA, NYALA BISNIS, NYALA INDIVIDU As a Nyala / Nyala Bisnis / Nyala Individu customer, you are privileged to enjoy our services such as deposit accounts, wealth management, loan facilities, and other benefits, including a Relationship Manager dedicated to assisting you with our Nyala / Nyala Bisnis / Nyala Individu Services. Thank you for your trust in OCBC banking services. For further information, please contact OCBC Call Center at 1500-999 or +62-21-26506300 from overseas. You can also visit our website at www.ocbc.id.

As a customer, you are eligible to get Poinseru from various Bank Products with points as reward. The information about Poinseru in this Consolidated Statement is not in real time with the printed date. You can access your Poinseru detail in real time at Loyalty OCBC website, https://raih.id, in “Activity” page.

Correspondence address or other address and/or electronic address on this SPT Statement Supporting Data is system generated. If you find any suspicious information in this SPT Statement Supporting Data, or if there is a change of your data or correspondence address or email address, please contact our Branch Executive or OCBC Call Center at 1500-999 (Client Service press 9th Menu for Business Banking Customer) or 62-21-26506300 from overseas not later than 30 calendar days of the date of this SPT Statement Supporting Data.

If PT. Bank OCBC NISP, Tbk (“OCBC”) does not receive any objection to the SPT Statement Supporting Data within 30 calendar days of the date of its issuance, you will be deemed to have accepted, acknowledged and agreed to all the information contained in this SPT Statement Supporting Data. Any risks arising from, including but not limited to all claims, losses and liabilities in relation to your failure or delay in providing OCBC with any necessary confirmation shall be your own risks/responsibility, and OCBC is held harmless against any and all risks and liabilities of any kind.

The SPT Statement Supporting Data has been prepared by OCBC to update you on your portfolio value of your deposits, investments, (if any) income and taxes, as well as your loan at OCBC, consisting of both Bank Products and Non-Bank Products that are partners with OCBC, namely insurance products and / or capital market products (“Non-Bank Products”).

The Non-Bank Products specified in this SPT Statement Supporting Data are not the products of OCBC, and thus such Non-Bank Products are not covered by the government blanket guarantee program or the Deposit Insurance Agency (LPS).

Therefore, OCBC shall not be liable in any way for all consequences and risks connected with such Non-Bank Products because OCBC in this matter is only acting as either a selling agent or a referral agent.

The Non-Bank Product portfolio provided in this SPT Statement Supporting Data is not intended to replace the statement and/or confirmation to be provided by the relevant Investment Manager and/or Custodian Bank and/or Insurance Company that are partners with OCBC (“Confirmation Letter”).

If there are any discrepancies between the Confirmation Letter and the SPT Statement Supporting Data, the Confirmation Letter shall prevail.

OCBC shall not be liable for the Confirmation Letter, so that any issues arising from the Confirmation Letter will be managed by the relevant Investment Manager and/or Custodian Bank and/or Insurance Company and/or Securities Company that are partners with OCBC.

Non-Bank Product Information that is not displayed in this Consolidated Statement is not an OCBC Bank Partner Non-Bank Product.

All references to the terms "Summary”, “Account", “Income”, “Tax” as used in this SPT Statement Supporting Data must be construed as general references only and do not refer to your specific deposits and investments (if any) income and taxes or loans.

Your portfolio details in the SPT Statement Supporting Data may not include executed transactions that are still pending settlement. They will be shown in a subsequent composite statement once the transaction has been settled.

This SPT Statement Supporting Data reflects positions as of the transaction date and such positions may differ from those of the respective statement of deposit, investment (if any) income and tax or loan accounts, which reflect positions as of the settlement date.

The value of your deposits and investments (if any) income and tax as well as loans in this SPT Statement Supporting Data is the result of rounding that is adjusted to the position on the date of the transaction process and may differ from the statements of savings, investment or loan accounts on the date of completion of the transaction.

The equivalent IDR (Rupiah) balance shown in this SPT Statement Supporting Data represents an equivalent IDR amount as a result of currency exchange using Bank Indonesia Middle Rate for Balance Value or Amount or Indicated Market Value or Loans, and Tax Rate for Income or Return and Tax Value which reflect positions as of the settlement date.

All information related to Non-Bank Products, such as: insurance and capital market product is provided by Insurance Company, Custodian Bank, Investment Manager and Securities Company and may lag by 2 (two) or 3 (three) business days. If there is any discrepancy on insurance and capital market product data provided by OCBC with insurance and capital market product data provided by the Insurance Company, Custodian Bank, Investment Manager and Securities Company, you are encouraged to refer to data from the Insurance Company, Custodian Bank, Investment Manager and Securities Company.

OCBC shall not be liable for any information provided by third parties. The official confirmation of your portfolio administered and managed by such third party and any issues arising from the relevant information shall be provided and dealt with directly by such third party.

The Information in this SPT Statement Supporting Data is not intended as primary supporting data and therefore must not be relied upon or should not serve as the sole reference in calculating used for tax purposes. Customer is encouraged to always check the attached information and before reporting tax data to the relevant institution.

Your personal deposits, investments, (if any) income and taxes, as well as loans will not be actively monitored by OCBC.

OCBC does not undertake, and is not obliged to, observe, manage, or monitor or otherwise attend to your deposits, investments, and loans.

This SPT Statement Supporting Data does not constitute evidence of your ownership of Bank Products nor Non-Bank Products.

You are bound by the Terms and Conditions of Use of this SPT Statement Supporting Data. OCBC will update this SPT Statement Supporting Data from time to time. It is advisable that you regularly read the applicable Terms and Conditions.

Deposit. Interest is calculated on the average daily balance at the end of the month and credited to your account in OCBC on the last day of the relevant month (except Sunday and Public Holiday).

Any terms and conditions as well as product features and interest rates that have been agreed by You are subject to periodic review and may be changed or altered by OCBC at its sole discretion with notice through media deemed properly by the OCBC and subject to the prevailing laws and regulations.

Investment and Bancassurance. OCBC only provides tax information, income or investment returns (if any) for Bank Products and Non-Bank Products that are partners with OCBC in IDR currency (Rupiah).

Market values are indicative and may not be the price when the sale transaction is executed. Please contact Your Relationship Manager to get the latest pricing.

Bancassurance. The nominal value shown in the “Indicative Market Value” column for non-unit-linked Life Insurance (not linked to investment) represents:

Information on Life Insurance products and other insurance products offered through Telemarketing is not shown in this SPT Statement Supporting Data.

If transactions made on the last business day of the month are not included in this SPT Statement Supporting Data then the data will be available in the following month Consolidated Statement. For more information on Insurance products, please refer to the statements on such products issued and directly sent by the relevant Insurance Company.

Bond. The Indicative Market Value does not include accrued interest, income tax and deposit tax, investment or accrued loans, and custodian fee (if any). The calculation and reporting of taxes for investment in bond products denominated in US Dollars shall be conducted independently (self-assessment) or not tax deductible in accordance with the provisions of the Ministry of Finance.

Structured Products. Investment in structured products are subject to a 20% tax deduction for income earned on deposits and premiums.

Loan.

Loans with collateral and Credit Card. You must pay in a timely manner all obligations owed. Delay in payment can result in penalties, interest arrears, principal arrears, and other costs related to the credit facility that is owed from You to OCBC based on the Credit Agreement and can be blocked on your OCBC Credit Card (if any).

The terms and conditions as well as product features and interest rates agreed upon by You may be reviewed periodically and can be changed at any time at the discretion of OCBC.

Loans with no collateral and Credit Card. Your Loan Account and Credit Card Account (if any) will be linked to each other. Any late payment of your obligation may result in your OCBC Credit Card being blocked.

You must pay all outstanding obligations including the principal, interest, and any other fees incurred in connection with your Loan and Credit Card Accounts in a timely manner. All bills and payments are made in IDR currency (Rupiah), and so are cash withdrawals in a foreign currency. The exchange rate applicable to you is determined by the principal and the exchange rate applicable at OCBC. Any risks or losses arising from the difference in exchange rates in the repayment and/or cancellation of transactions in a foreign currency shall be your own risk and responsibility.

Sharia. All references to the terms "revenue sharing or bonus" as used in this SPT Statement Supporting Data is not displayed. Further information please contact OCBC Sharia Branch Office or Sharia Service Office.

Channelling or Loan Distribution from a Third Party (Fintech or Multi-finance). Any information on loan value and other matters related to channelling activities in fintech or multi-finance is not displayed in this SPT Statement Supporting Data.

This SPT Statement Supporting Data is made in Indonesian and English language versions. Both language versions have the same legal force, but the parties agree if there is a discrepancy in this SPT Statement Supporting Data, the Indonesian version shall prevail.

This SPT Statement Supporting Data is system generated report, therefore no signature required.

Did not find what you're looking for?

See FAQ