Help to ensure your convenience, secure and comfort to do banking transactions at Private Center

Provides insight and strategies to meet financial needs according to your profile

Provides insight, prioritizes convenience and strategy in each of your forex transaction decisions

A consolidated report will be sent to Private Banking customers every month as a source of information related to the total customer relationship with OCBC bank in the form of Bank and Non Bank financial product accounts.

The contents of the consolidation reports include the following:

To facilitate customer transactions, especially for Foreign Exchange Products, in all OCBC Private Centers we provide Phone Recording facilities. Through this facility, you can make Foreign Exchange Product transactions by telephone, without having to come to a branch.

This facility can be provided by customers if they have completed the required documents in accordance with applicable regulations.

The event is only for OCBC Privates Bank customers with special prices from various merchants.

Private Bank customers get special fees and charges from Bank OCBC

Private Bank customers get special fees and charges from Bank OCBC consisting of:

*Terms and conditions applied

Adjustment of Special Transaction Fees for Private Bank Customers effective per 3rd of November 2023 as follows:

| Private Bank with an average minimum average monthly combined balance IDR 1,000,000,000 | ||

|---|---|---|

| Type | Channel | Quota |

| Free BI Fast transfer fee | Branch, IBMB, ATM, OCBC Business | Unlimited |

| Free cash withdrawal fee | ATM | Unlimited |

| Free of online transfer charge | IBMB, ATM, OCBC Business | Unlimited |

| Free of payment/purchase fee | IBMB, ATM, OCBC Business (including auto debit) | Unlimited |

| Free of RTGS transfer fee | Branch | 10x per month |

| Free of RTGS transfer fee | IBMB, OCBC Business | 10x per month |

| Free of TT fee | One Mobile | 1x per month (only swift/ telex charges) |

| Free of checking balances charge | Network’s ATM | Unlimited |

| Free of SKN LLG transfer fee | Branch, IBMB, OCBC Business | Unlimited |

| Free clearing fee | Branch | Unlimited |

| Free of charge fee | Branch | Unlimited |

Notes:

Special facilities that we provide for those of you who are busy but still want to check your health

The Medical Check Up package that we provide:

| Special Package (Asset Under Management IDR 1 Billion - < IDR 10 Billion) |

Advance Package (Asset Under Management ≥ IDR 10 Billion) |

|---|---|

| Complete Hematology | Complete Hematology |

| Liver Function: SGOT, SGPT | Vitamin D |

| Kidney Function: Ureum, Creatinine, Uric Acid | Liver Function: SGOT, SGPT |

| Lipid Profile: Total Cholesterol, Triglyceride | Kidney Function: Ureum, Creatinine, Uric Acid |

| Diabetes Melitus Profile: Fasting Glucose | Lipid Profile: Total Cholesterol, Triglyceride |

| Urine Test | Diabetes Melitus Profile: Fasting Glucose, Hba1C |

| Urine Test | |

| EKG |

This facility is given once a year (running) to OCBC Private Bank customers.

Our Partner Clinical Laboratories:Customers no need to pay for this facility. And if the customer wants to provide this facility for the customer's family members, then a fee will be charged according to the applicable rate.

Pick up facility from the airport to your destination. Available in Indonesia, namely, Jakarta (Soekarno – Hatta International Airport / Halim Perdanakusuma), Surabaya (Juanda International Airport) and Singapore (Changi International Airport).

Enjoy pick up facilities from the airport with a fleet of Toyota Alphard, Mercedes-Benz or Toyota Innova that we provide, in collaboration with our superior partners especially for you.

| Description/Facility | Last 3 (three) months average Asset Under Management (eq.IDR) | ||

|---|---|---|---|

| 2 Bio -< 5 Bio | 5 Bio -< 10 Bio | >= 10 Bio | |

| Airport Pickup (Jakarta - Surabaya) | 8 times a year with Armada Toyota Innova | 12 times a year with Armada Toyota Alphard / Mercedes | 20x a year with Armada Toyota Alphard / Mercedes |

| Airport Pickup (Singapura) | – | ||

Special Fees and Charges:

*Placement of funds (Assets Under Management AUM) on the product such as Savings, Current Accounts, Time Deposits including Wealth Management products. For example, bonds, Bancassurance, Mutual funds, Treasury and other investment products, both in Rupiah and Foreign currencies

The event is only for OCBC Private Bank customers with special prices from various merchants.

See Detail*Global Debit feature is the new name for Global Wallet feature

Withdraw and shop abroad without currency conversion, directly debit foreign currencies at Tanda 360 Plus

*Global Debit feature is the new name for Global Wallet feature

Enjoy various attractive promos for various banking needs specifically for OCBC Private Bank customers.

Lihat PromoSpecial fee for renting a Safe Deposit Box to make it easier for you to store valuables safely.

|

Minimum Fund Placement

|

Safe Deposit Box Sizes

|

||

|---|---|---|---|

|

(AUM Rupiah)

|

Small**

|

Medium **

|

Large **

|

| ≥ IDR 500 Million - < 2 Billion | Free | 50% discount | 50% discount |

| ≥ IDR 2 Billion - < 5 Billion | Free | Free | 50% discount |

| ≥ IDR 5 Billion | Free | Free | Free |

*) Choose one of the followings

**) Subject to availability

Wealth Management Head

OCBC Indonesia

Head of Investment Strategy

Bank of Singapore

Senior Investment Strategy

OCBC Bank

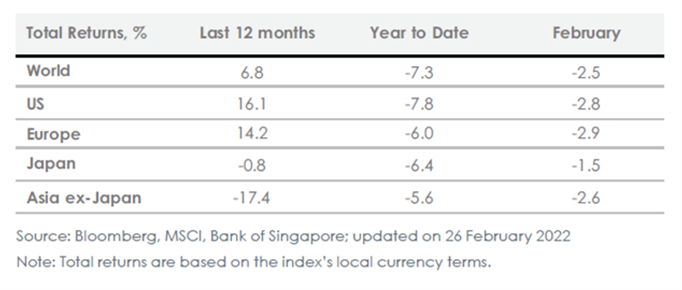

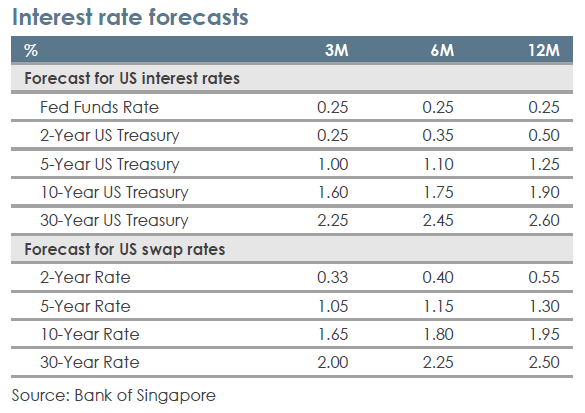

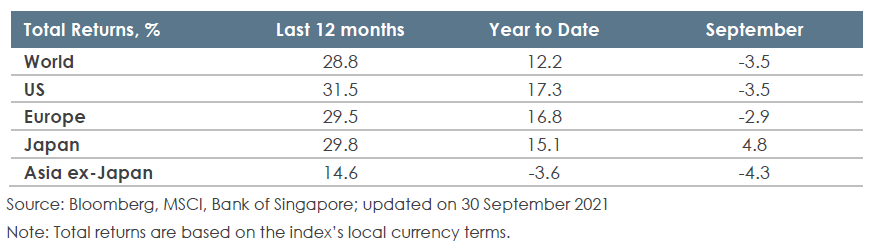

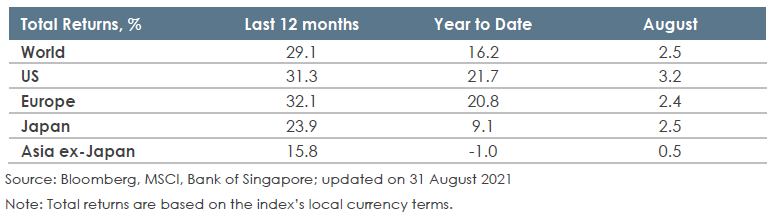

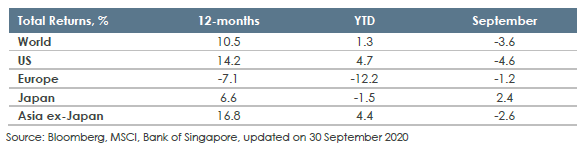

Strong Start to the Year

The global indices rallied significantly in February. The Dow Jones, S&P 500, and Nasdaq indices each were up by +5.2%, +5.1%, and +6.1% respectively. The 4th quarter earnings season also showed positive results. Based on Factset data at the end of February, more than 90% of companies have reported their performance, and 73% recorded better results than expected. NVIDIA’s financial report became the main sentiment anticipated by investors, as the “market leader” chip manufacturer for artificial intelligence (AI) technology. Nvidia reported a 126% increase in profits in 2023 or US$60.9 billion, along with the high demand for AI chips. Thus, the semiconductor sector became one of the supports for the rise of the S&P 500 index throughout February.

However, in contrast to the stock market, the bond market experienced an increase US Treasury 10Y yield from 3.91% to 4.25% in February, indicating a significant decline in the bond price. The hawkish tone from major Fed officials, regarding the direction of interest rate policy, weighed on the bond market performance, along with the higher than expectation of January inflation figures.

Meanwhile, Eurozone also saw rally in its major indices. The Eurostoxx 600 index strengthened by 1.84% in February and booked a new record high. Positive sentiment from the technology sector also supported the increase. In addition, investors optimism also improved following the higher-than-expected manufacturing sector growth at 48.9, enhancing the narrative that the slowdown occurring in the European Zone is nearing its peak.

Carrying similar sentiment as its western counterparts, Asian stock indices also strengthened. MSCI Asia Pacific ex-Japan rallied +4.33% in February, supported by tech sector. Pro-growth economic policies issued by the Chinese government also boosted optimism. The People’s Bank of China (PBoC) has cut the 5-year prime lending rate and tightened “short selling” rules for stocks to maintain the market stability. Meanwhile, Japan closed on the brink of recession. Yet, the news has not become major headwind for the equity market. Weaker JPY had contributed to the stock performance.

Domestically, Bank Indonesia (BI), as expected kept the benchmark interest rate unchanged at 6.00%. This decision is in line with the central bank commitment to stabilize the inflation rate within range of 2.5 ± 1%. Macro backdrop also remained resilient; trade balance recorded surplus of USD 2.01 billion. While FX reserve was steady at USD 145 billion, equivalent to import financing and debt payments for six months, far above the international adequacy standard of 3 months. Likewise, the consumer confidence level was reported at 125.0, up from the previous month at 123.8. Meanwhile, the manufacturing sector growth remained at the expansion level of 52.9.

Several multinational institutions have projected Indonesia’s economic growth this year to be at 4.9% according to the World Bank, 5% according to the ADB and IMF, and 5.2% from the OECD. Meanwhile, the Indonesian Government has set the target for Indonesia’s economic growth also at 5.2% in 2024.

Equity

The Jakarta Composite Index (JCI) saw an increase of +1.50% in February. Stocks in the infrastructure and non-cyclical consumer sectors led the increment, each by +5.03% and +1.26% respectively. The JCI rally in February was supported by the euphoria of the general election, which historically often drives the performance of risky assets. Next, the month of March will mark the fasting month and soon Eid celebration, which may boost household consumption, thus supporting the real economic sector. Analysts have estimated that earnings growth will be in the range from 8-9% in 2024.

Bonds

The domestic bond market was less optimistic in February, with the 10-year government bond yield increased 0.38% to 6.6%, signalling a decrease in the bond price. The increase in the bond yield was also pushed by the increase in the US Treasury yield and weaker Rupiah.

Rising price in the food commodity, such as rice, which was caused by prolonged El-Nino weather, has pushed February inflation rate above the expectation and drained the government rice reserve. However, government estimates that inflation will remain stable at a range of 2.5 ± 1% in 2024. The 2024 State Budget sets the target for debt issuance in 2024 to be at IDR 666 trillion, with an estimated fiscal deficit at 2.29%. However, at the start of the year, government estimated that there may be possibility for this fiscal gap to widen to 2.8% due to the addition of the social aid budget, fertilizer subsidies for farmers, and fuel subsidies which are expected to rise due to rising global oil price. On the basic macro assumptions of the 2024 State Budget, the range of 10-year government bond yields is set at 6.7%.

Currency

The Rupiah currency weakened by nearly 5% in February to IDR 15,719 per US Dollar. The US Dollar Index (DXY) that measure US Dollar against a basket of major currencies increased by 2.02% to a level of 104.15 in February, as Fed officials remained hawkish on the interest rate policy.

Going forward, Rupiah may remain volatile as the heightened global uncertainty caused by Fed rhetoric. However, Bank Indonesia pledged to maintain the stability of the currency through several macro-prudential policies and payment systems, such as the Domestic Non-Deliverable Forward (DNDF) policy, the SRBI (Bank Indonesia Rupiah Securities) policy, and the SVBI (Bank Indonesia Foreign Currency Securities) policy to support the monetary operation, to ensure the efficacy of the monetary policy.

Juky Mariska, Wealth Management Head, OCBC Indonesia

GLOBAL OUTLOOK

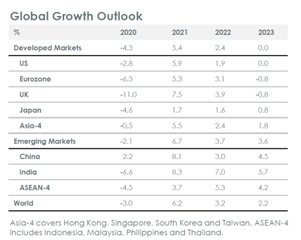

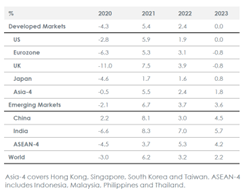

The economic outlook is set to be more favourable for financial markets this year compared to 2023. – Eli Lee

Financial markets have begun 2024 strongly. Enthusiasm for AI, potential rate cuts in the US and Europe, reflation in Japan, stimulus hopes in China and strong growth in India have pushed the S&P 500, Eurostoxx 600, Nikkei 225 and SENSEX equity indices to record highs. But risks remain to the outlook. The UK, Germany and Japan are in a recession. Inflation is preventing early interest rate cuts. The wars in Ukraine and the Middle East may broaden and the US election may see sharp shifts in financial markets.

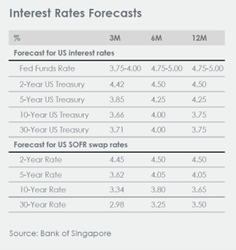

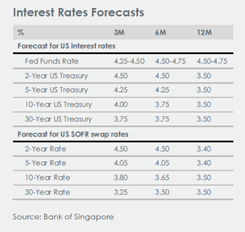

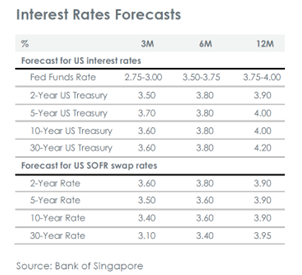

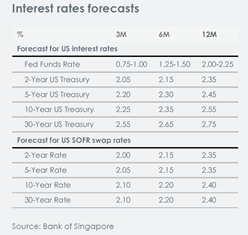

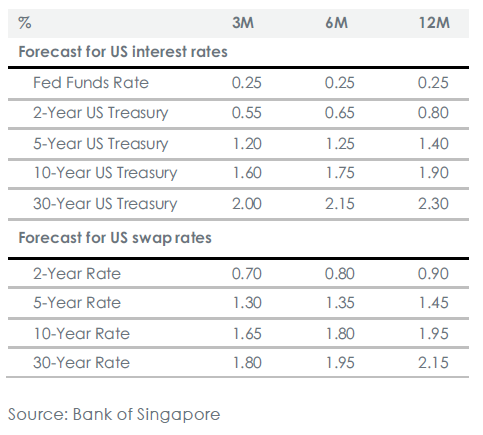

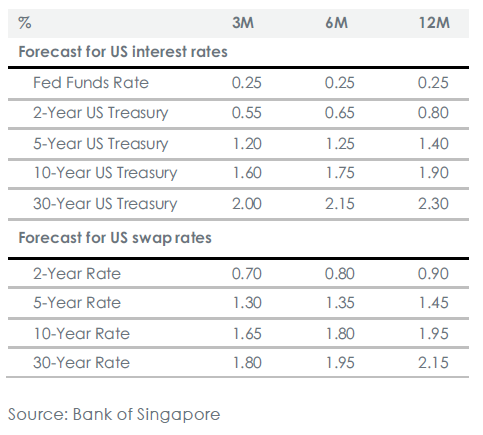

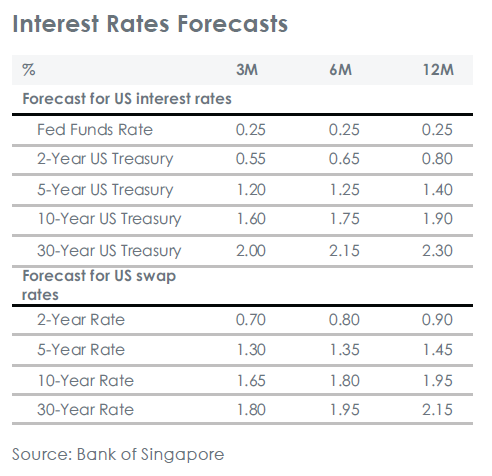

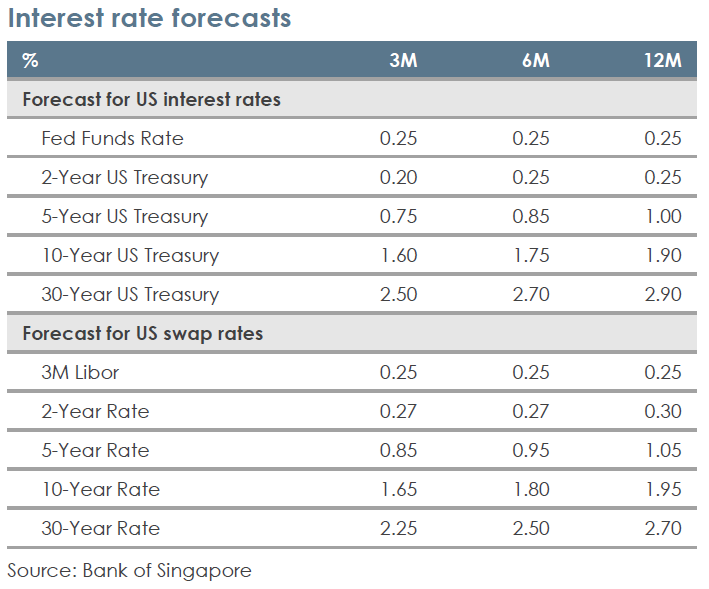

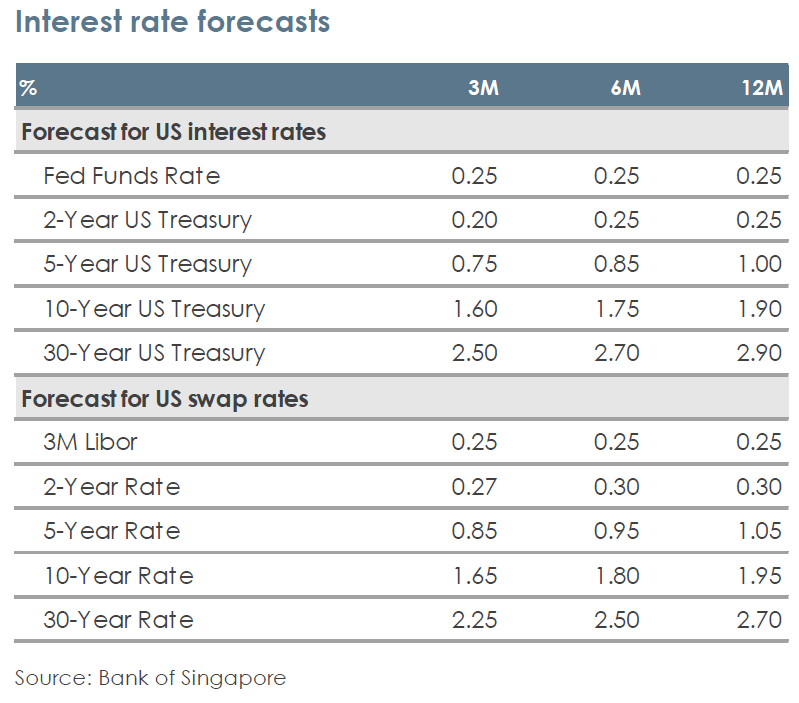

In the US, we expect the Federal Reserve (Fed) will cut interest rates from June. Since the start of 2024, market expectations have fallen from six Fed rate cuts this year towards our view of three. This has caused 10Y US Treasury (UST) yields to retrace from 3.75% at the end of 2023 to around 4.25% now. But with the Fed intent on lowering rates from the summer, we think fixed income assets will rally again.

We thus recommend staying Overweight USTs and Developed Markets Investment Grade bonds. We forecast 10Y UST yields will fall back to last year’s lows of 3.25% and prefer high quality bonds to hedge against recession risks.

In Europe, we maintain a Neutral stance. Growth should start to recover this year. But the European Central Bank (ECB) and Bank of England (BoE) are unlikely to ease while inflation stays well above their 2% goals.

In China, we also maintain a Neutral stance. Economic growth is likely to remain subdued around 5% this year in the absence of major fiscal stimulus, property market stabilisation and better relations with the US. But valuations have become very undemanding across domestic markets.

Last, we recommend staying Overweight Japan’s equities. The return of inflation makes it likely the Bank of Japan (BoJ) end negative interest rates.

US – Fed and elections are key

The two key US macro themes this year are the Fed’s interest rate decisions and the outcome of November’s election.

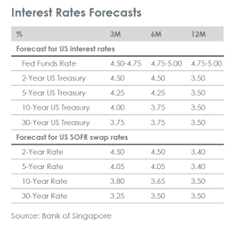

We expect the central bank will make three cuts to its fed funds rate from 5.25-5.50% to 4.50-4.75% this year as the forecast table shows. Core consumer price index (CPI) inflation has fallen from a peak of 6.6% in 2021 as the US reopened from the pandemic to 3.9% in January after the Fed’s aggressive interest rate hikes in 2022 and 2023. The decline opens the way for the Fed to pivot towards interest rate cuts in 2024 as inflation falls further towards its 2% target with 25bps moves likely in June, September and December.

Fed rate cuts would benefit financial markets this year. We see 10Y UST yields falling back to 3.25%. We also expect Fed easing would support risk assets even if the US economy suffers a mild recession which remains our base case for 2024.

The main risk to our view here is if core inflation gets stuck around 3-4%, preventing the Fed from cutting interest rates in 2024. While goods inflation has plunged as supply disruptions have eased after the pandemic, services inflation remains high. But the slowing economy is likely to lower inflation enough this year to let the Fed start reducing interest rates from the summer.

The other key theme will be the US election. If President Biden is behind in the polls in the second half of 2024, then financial markets may react sharply to the risk of former president Trump returning to the White House.

First, the Republican candidate is proposing a 10% tariff for all imports into the US and 60% tariffs from China. This would spark inflation, stop the Fed cutting rates and make the USD surge.

Second, equities may be buoyed by the prospects of Trump reducing corporate taxes again. But the US fiscal deficit is 7-8% of GDP so unfunded tax cuts may cause UST yields to spike.

Third, risks to the Fed’s independence would unsettle markets and, lastly, uncertainty about the rule of law and global politics under Trump may result in gold prices surging. Investors are thus set to keep watching the polls closely this year.

China – More easing required

China’s economic activity remains subdued. January’s consumer price index (CPI) showed inflation was below zero for the fourth month in a row at -0.8%. The last time consumer prices fell at the same pace was in the aftermath of the 2008 global financial crisis.

China’s growth has been lacklustre for two years now. GDP only expanded by 3.0% in 2022 and 5.2% last year owing to the shocks of 2020-2022: strict lockdowns, regulatory hits, property weakness, recessions abroad and rising geopolitical tensions. Consumers are cautious after three years of lockdowns, higher unemployment and falling property prices. Investment is being held back by subdued confidence. Exports are limited by recessions in major economies like Germany and Japan and officials are wary of incurring more debt to finance fresh, large-scale government spending.

This year, we expect GDP growth to stay moderate at 5.0%, far below its 9% annual average rate recorded in the 2000s and 2010s. Policymakers have stepped up efforts to aid growth including cutting 5Y loan prime rates by 25bps in February to 3.95%, the largest decline on record, to support China’s weak property sector.

But officials will need to announce more steps including further fiscal borrowing and additional property easing measures given the current weak levels of confidence in the economy.

Europe – Sticky inflation to delay rate cuts until summer

The latest 4Q23 data shows both Germany and UK suffered recessions in the second half of last year. Germany’s economy, the largest in the Eurozone, contracted 0.3% during 2023 while the UK only grew 0.1% last year owing to high inflation, the energy shock from the war in Ukraine and rapid increases in interest rates by the ECB to a record high of 4.00% and the BOE to 5.25%.

This year, economic activity has started to pick up across Europe as the latest purchasing managers’ indices (PMI) numbers improve. But sticky inflation in both the Eurozone and UK are likely to keep the ECB and BoE from cutting interest rates to support economic recovery until June and August respectively. We thus expect GDP growth for 2024 to remain weak at just 0.4-0.5% for the UK and the Eurozone.

Japan – First interest rate hike since 2007 likely in April

The return of inflation after three decades in Japan prompted the BoJ to end negative interest rates.

In January, headline inflation fell from 2.6% to 2.2% but stayed above the BoJ’s 2% target while core inflation - excluding fresh food and energy - only dipped from 3.7% to 3.5%. Thus, core inflation remains close to four-decade highs.

Japan’s upcoming annual spring wage talks is set to show firm salary growth for the second year in a row. The BoJ is therefore likely to feel confident that inflation will settle around its 2% target and increase interest rates.

EQUITIES

Fabulous February

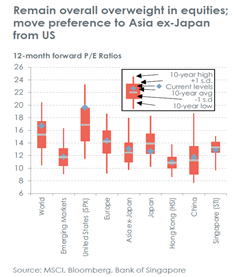

Despite the rally in Japanese equities, valuations are not excessive, and we maintain our Overweight stance for Japan. – Eli Lee

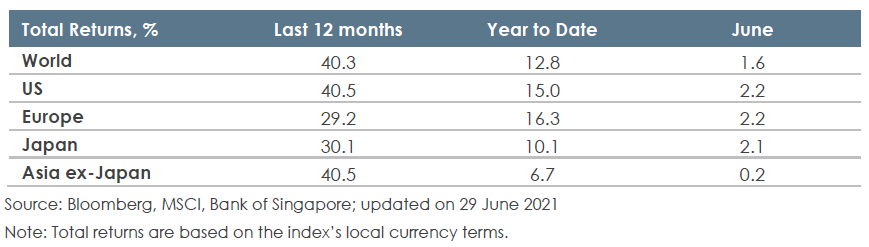

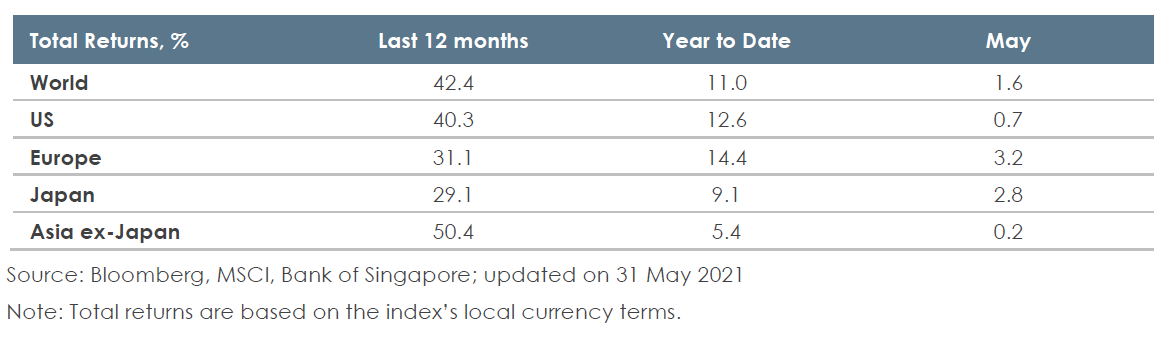

After a strong start to the year, Japanese equities continued to power on, with the MSCI Japan Index clocking a 14% rise YTD, as of the close of 28 February, significantly outperforming other regions in local currency terms. Despite the sharp rally, valuations are not excessive due to an attractive expected earnings growth trajectory amidst improving fundamentals, ongoing corporate reforms and other idiosyncratic factors. We maintain our Overweight stance for Japan, which supports our moderately Overweight position for equities globally.

February was also a good month for Chinese equities, as markets rallied after the start of the Dragon Year, and A-shares reversed all YTD losses. Policymakers continue to make proactive moves to shore-up market sentiment, such as the announcement of the largest-ever 5Y Loan Prime Rate (LPR) cut by China’s central bank. We keep our positive watch on Chinese and Hong Kong equity markets for now as we look out for signs of a sustained recovery.

As for US and European equities, where we continue to hold a Neutral stance.

US – Strong report card

The 4Q23 reporting season in the US saw corporates in the S&P 500 Index largely delivering scorecards that are above expectations. 4Q23 earnings per share (EPS) is tracking at 7% YoY growth, surpassing the street’s expectations of 3% YoY at the start of the season. The key highlight of this reporting season has certainly been the strong performance of the Magnificent Seven collectively, on the back of an improving advertising outlook, continued traction in artificial intelligence (AI) and nascent signs of recovery in cloud demand.

Incoming US macro data has been robust, across payrolls, consumer confidence data and ISM manufacturing numbers. As our macro team has increased US GDP for 2024 from 0.9% to 1.5%, we have also revised our 2024 EPS forecast up accordingly from 5% to 7.5%.

We continue to remain Neutral on the US at this juncture.

Europe – Lowered earnings growth expectations

It has been a weak reporting season for Europe thus far. Only about 50% of the reporting companies beat expectations, lower than the historical average of 57%, while earnings continue to be revised downwards. What is more encouraging, however, is the improvement in the Euro area composite flash purchasing managers’ index (PMI) to 48.9 in February, though it remains in contractionary territory. What has been supportive was services, which stopped contracting, but manufacturing PMI fell by 0.5 points to 46.6 due to Germany, which saw a deterioration in factory conditions.

Ahead of major elections, Europe is also seeing widespread protests by farmers with rising signs of “greenlashing”. Should there be a swing to the political right, it would suggest an increasingly polarised EU that is going to be Eurosceptic, which increases investor uncertainty.

Japan – Continues to shine

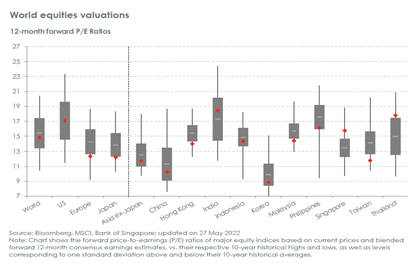

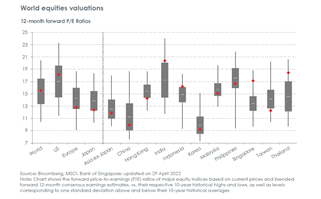

The Japanese equity markets continued to make positive headline news, with the Nikkei 225 hitting fresh all-time highs set 34 years ago. For valuations, the MSCI Japan Index is now trading at consensus 12-month forward P/E multiple of 16.5x, which is 1 standard deviation (s.d.) above its 10Y average of 14.7x, while the forward price-to-book (P/B) multiple of 1.46x is 2.1 s.d. above the 10Y mean of 1.24x. Although valuations look more stretched now, idiosyncratic drivers are still at play and Japanese equities remain under-owned by foreign investors. Furthermore, although price levels are similar to the previous peak in 1989, valuations are significantly different. The MSCI Japan Index traded at a forward P/E of 46x and P/B of 4.8x then.

Asia ex-Japan – Some green shoots but more policy support from China needed

The MSCI Asia ex-Japan Index has recovered some ground, and is now flat YTD (as at 27 February 2024), after being down as much as 7.3% at one point. However, the 4Q23 earnings season has been slightly disappointing so far, with more companies reporting misses than beats. Out of the 57% of MSCI Asia ex-Japan Index’s market cap which have reported results, overall 4Q23 net profit growth came in at +24% YoY but -7% for 2023.

Looking ahead, the street is projecting EPS growth of 19% in 2024, which we believe is still too bullish and we thus see downside risks to earnings forecasts. While there has been more policy support from the Chinese government, such as the material 25bps cut to the 5Y loan prime rate (LPR) by the People’s Bank of China (PBOC), we believe more easing measures are needed, and high frequency data suggests that the property market remains subdued. We maintain a Neutral rating on Asia ex-Japan but are positive on South Korea and Singapore. We now upgrade Indonesia to Overweight. This is premised on expectations of policy continuity post-elections, a supportive macro backdrop, moderate earnings growth and attractive valuations.

China/HK – More efforts to support the economy and markets

China’s equity markets rallied after the start of the Dragon Year, with A-shares reversing all YTD losses. This turnaround coincided with the announcement of the largest-ever 5Y LPR cut by the PBoC. There was also an air of optimism with regards to the appointment of Wu Qing, the new Chairman of the Securities Regulatory Commission, following a series of seminars and discussions with investors. These engagements fostered hopes among market participants that the new leadership may usher in positive changes and reforms.

We continue to advocate focusing on three key investment themes: i) the proliferation of generative AI, ii) identifying quality growth and market leaders amid a bumpy recovery, and iii) yield plays to cushion market volatility. We look forward to more policy directives from the Government.

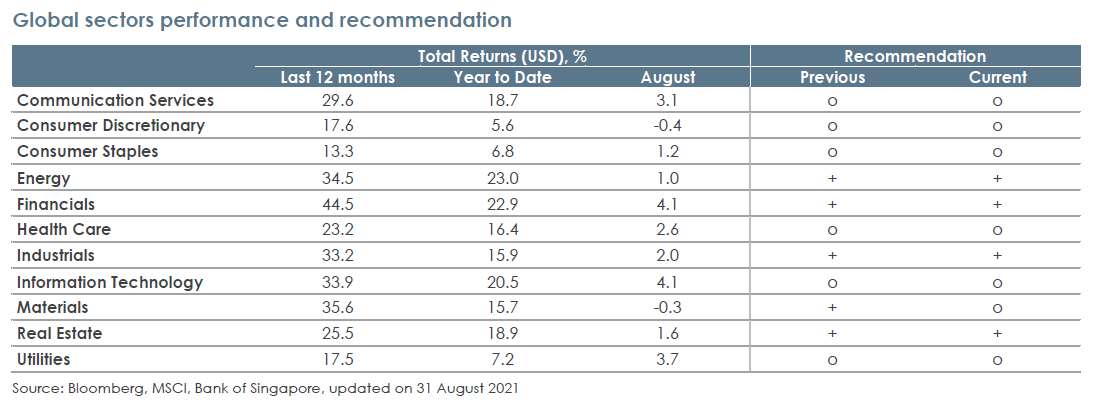

Global Sectors - Tech rally continues unabated

A solid reporting season has helped to propel the global tech complex higher last month. Nvidia’s results and management commentary provided further fuel to the rally, especially as indications point towards a solid transition from training to inference hardware, which could help to catalyse a proliferation of AI applications.

In China, we remain selective on the internet space. E-commerce remains highly challenging in the near-term, and we prefer names leveraged to online gaming and outbound travel at this stage.

Over in China, the consumer sector was in the spotlight as consumption data during the Chinese New Year holiday came in better than feared. Overall, travel momentum was decent, but consumption downgrading was still widely seen as reflected by lower per capita spending.

Meantime, to boost investment and consumption, it was also announced during the fourth meeting of the Central Commission for Financial and Economic Affairs on 23 February 2024 that China will advance a new round of renewals of large-scale equipment and trade-ins of consumer goods. We believe this could stimulate home appliances demand, and firms in the large home appliances segment are likely to be beneficiaries of this policy.

BONDS

Holding out for a rate cut

With their higher duration, US Investment Grade bonds and US Treasuries should be best placed to benefit from falling Treasury yields in 2024, and we reiterate our Overweight on these asset classes. – Vasu Menon

The overall trajectory of the Federal Reserve’s (Fed) rate policy has been the primary driver of fixed income markets in recent months, and we expect this trend to continue in the near term. Developed Markets (DM) Investment Grade (IG) bonds and US Treasuries (USTs) should be positioned to achieve solid returns in anticipation of this year’s declining interest rate environment.

However, a Fed pivot and the resulting declining interest rate environment should be beneficial for fixed income broadly. Hence, we are Neutral DM High Yield (HY), Emerging Markets (EM) IG and EM HY as well.

Rates

While Fed rate cuts are on the radar, the key question remains about the pace and timing of rate cuts. The market has also pared back sharply the odds of the first rate cut at the March meeting which stood at 90% in late December. Despite that, the current pricing still looks excessive against our expectations for 75 basis points (bps) of rate cuts for this year, with the first reduction in June.

Developed markets

The current pause in anticipation of Fed policy easing in mid-2024 drives our Overweight recommendation on DM IG. With tight spreads near post-GFC levels, rates are now the primary driver of returns for DM IG. Given our expectations of demonstrably lower UST yields by the end of 2024, DM IG should be well-placed to benefit given that they possess the highest duration of the credit classes.

Emerging markets

We maintain a Neutral rating on EM HY and EM IG with a preference for the former. Favourable top-down factors including declining rates and a waning USD should underpin performance. Additionally, after two years of elevated defaults, we expect 2024 to return to levels that are more indicative of long-term averages with lower distressed levels validating this trend.

Asia

We maintain a Neutral rating on Asia IG and HY and continue to monitor China’s economy for any sign of bottoming. The property sector has seen stronger stimulus such as the 5Y loan prime rate cut and the channelling of funding to stalled projects including those of defaulted developers. On the other hand, the sector continues to be marred by weak sales and risks of liquidation for defaulted developers, with Country Garden being the latest to face a winding up petition.

FX & COMMODITIES

Gold poised to shine

Gold is set to benefit from Fed easing, potential US election-related uncertainties and Emerging Markets central banks buying. – Vasu Menon

Oil

Red Sea vessel diversions, temporary supply outages in the US due to extreme weather conditions and increased travel activity during the Lunar New Year holidays in China kept Brent supported between USD80-85/barrel since early February. Risks to oil trade flows caused by Red Sea vessel diversions are showing up in an increasing price backwardation.

But, at the same time, oil price volatility has fallen close to pre-Covid lows, with OPEC’s elevated spare capacity limiting upside price risk, while OPEC’s willingness to prop up prices through supply cuts limiting downside risk. We still expect OPEC+ to extend cuts through 2Q24. We continue to see Brent supported around the USD80/barrel level but expect prices to soften to the mid-70s by end-2024. Ample non-OPEC supply – especially from the US, Canada, and Guyana – points to a looser oil market ahead. We expect non-OPEC oil production to moderate from a very rapid pace in 2023 but supply growth is likely to remain solid. The US will probably still be the largest source of additional production.

Gold

Gold has been on the defensive since the start of the year. The scaling back of Fed rate cut expectations lifted the greenback and US yields, which weighed on gold. Gold could stay muted for now. But the bulk of the gold price pullback may be done as Fed rate cut bets are now more realistic.

We view gold as a reliable portfolio diversifier. We still expect gold prices to hit a new nominal high of USD2,200/oz by end-2024. The appeal of gold as a zero-yield long duration asset should increase once the Fed cuts rates, which we expect will start in June. A much weaker gold price would need the conversation to change from when the Fed will cut rates to whether rate cuts will be possible at all. We do not see the conversation changing for now. Second, the US elections in November is becoming a growing focus for the market as Trump’s lead in the polls expand. The market is starting to worry that if Trump takes the White House, the potential trade and foreign policy shifts as well as threats to Fed independence from his win could lead to higher uncertainty. It makes sense to have some gold as a hedge against such uncertainties. Third, gold should be supported by robust buying activity by central banks in Emerging Markets. Large US fiscal deficits and rising debt levels as well as concerns of American political dysfunction have driven more central banks away from the USD to gold.

Currency

Rhetoric from the US Federal Reserve (Fed) remains largely focused on patience, with no hurry to cut rates given the risk of sticky inflation and a still resilient labour market. The disinflation trend remains intact (although bumpy) as labour market tightness and economic activity are already showing signs of softening. With disinflation, the higher real rates can be overly restrictive on the economy and poses the risk of a hard landing down the road. Our view remains for the Fed to embark on a rate cut cycle around mid-year. The gradual reduction of nominal rates from high levels does not imply outright monetary accommodation, but only means a less restrictive environment.

The US Dollar (USD) should eventually ease lower. However, the greenback is not a one-way trade. It remains a safe-haven proxy and has yield appeal. Scenarios where global and China growth momentum sputters, global risk-off takes place in the investment markets or geopolitical tension escalates - could all help the USD to find intermittent support on dips.

A more favourable outlook in 2024

2024 is widely anticipated to be better than 2023 and suffice to say is off to a pretty good start. Rate cut expectations were still the main driving force for the move higher by risk assets last month, as can be seen by Wall Street which continued its move up after a monster rally in December last year. All three main bourses notched gains, with the Dow Jones up 1.22%, the S&P500 for 1.59%, and the tech-heavy Nasdaq Composite moderately at 1.02%. While risk assets appreciated, the bond market was relatively calm considering the current headwinds markets are facing; the 10Y US Treasury was trading stably at 3.9% for the whole of last month. With inflation expected to drop significantly in January, risk appetite remains strong amongst investors even though equity indices are currently at historically high levels. However, Jerome Powell had reiterated that rate cuts may not come as soon as the market expects it to initially, sounding hawkish enough to push rate cut expectations from March to May or June. From a growth perspective, developed economies are expected to experience slower growth this year.

In Europe, the European Central Bank (ECB) and the Bank of England (BoE) is expected to begin easing in the end of second quarter or early third. Inflation is still higher here than in the US but is on the right track according to their government and central banks. On the geopolitical side, the ongoing war between Russia – Ukraine and Israel – Palestine remain a dampening sentiment for financial markets, although now have significantly lower impact in terms of market movement. However, if dragged too long, may spark new geopolitical tensions such as the proposed sanctions by the EU on several Chinese companies accused of helping and enabling Russia on its war efforts against Ukraine.

Moving East, China recorded its 4th quarter 2023 GDP at 5.2%, up from 4.9% but still a bit lower than market expectation of 5.3%. The subdued growth, although pretty much in line with the government’s target, was driven by several factors such as the nation’s deflationary issue, weak consumer confidence, as well as the property sector ongoing crisis. More monetary stimulus and fiscal easing will be needed to revive the economy this year. In Japan, The Nikkei 225 index currently hovers in its highest since 1989, above the psychological handle of 35,000. Japanese Yen weakness has supported risk assets adamantly while the BOJ has yet to declare anything concrete in regard to their monetary tightening schedule.

Looking inward, domestic fundamentals remain strong. The recently released GDP numbers for Q4 2023 has surpassed market expectation, climbing from 4.94% to 5.04% in the last quarter of last year mainly driven by solid to robust consumption – with the central bank rate nudging higher last October until now at 6.00%, which last seen in mid-2019. From an inflation perspective, headline CPI slightly dropped from 2.61% to 2.57%, just slightly above the 2.53% estimate; still well in range with the government’s desired target. PMI Manufacturing for the month of January also went up from 52.2 to 52.9, confirming the business sector’s optimism as elections are just around the corner.

Equity

The JCI slightly declined in the first month of 2024, recording a drop of 0.89%. The move down comes after the bourse was able to notch a new all-time high record of 7,359.8 on the 4th of January. From a sectoral point-of-view, the move down was led by the Technology and Healthcare sectors which dropped 6.93% and 4.33% respectively. The majority of local investors sought to exit from risk assets after the significant rally in the previous month. On the other side, foreign investors recorded quite a significant inflow – USD$534.2 million in just the first month of 2024. Domestic stocks are favoured as it is fairly more attractive compared to other EM risk assets. From a valuation perspective, the JCI currently sits at 15.4x P/E ratio and is considered quite a fair value given where the index currently trades at.

The early outcome of the recently held general election was cherished by markets as the number 02 candidate pair - Prabowo Subianto and Gibran Rakabuming Raka, eldest son of current President Joko Widodo dominated votes with a quick count result in most surveys at the range of 57 – 59%. With that achievement, the pair will be able to win the general election in just one round. Historically, quick count result has only little deviation with the real count result, prompting victory speeches and declarations by the candidates. For the equity market, this introduced a new kind of optimism as political uncertainty starts to fade. But what’s more important is that this victory means that there will be policy continuation – such as the capital city migration from Jakarta to Nusantara and focus on the down streaming industry. Foreign Direct Investment (FDI) is expected to increase in coming months which will help propel economic growth in the coming years.

Bond

Similarly, fixed income assets were also under pressure last month. At the start of the year, the 10-year government bond yield quickly jumped to around 6.72% before gradually going down, and finally closed the last trading day of January up 10bps from where it started at 6.58%. Nonetheless, volatility remains high as global central banks, including Bank Indonesia are starting about to start a new rate cycle down from where it currently is. However, it seems unlikely for Bank Indonesia to take a pre-emptive move to cut rates before The Fed – keeping in mind the pressure Rupiah has been facing these last few weeks due the Fed’s somewhat hawkishness. Foreign investors did neither collect nor sold domestic bonds significantly last month, netting only an outflow of USD$0.7 million. Even though Real Yields remain a big incentive for our fixed income assets, rising yields globally and a stronger dollar seem to be a challenge. Nonetheless, bond yields are still on a positive trajectory and is currently well positioned for new and existing investors who wish to add on to their fixed income portfolio as monetary easing is expected to start in a couple of months.

Currency

The Rupiah depreciated against the USD last month, with the currency pair USD/IDR trading at Rp15,783 by month-end. The greenback gained as much as 2% against the Rupiah in January as hawkish comments by The Fed officials keep investors’ rate cut expectations at bay. Markets are currently pricing in the first 25bps rate cut to happen either in May or June. Should The Fed feel the same way, Bank Indonesia would most likely follow in their footsteps in the third quarter of this year.

Juky Mariska, Wealth Management Head, OCBC Indonesia

GLOBAL OUTLOOK

A More Favourable Outlook in 2024

The economic outlook is set to be more favourable for financial markets this year compared to 2023. – Eli Lee

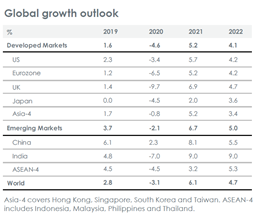

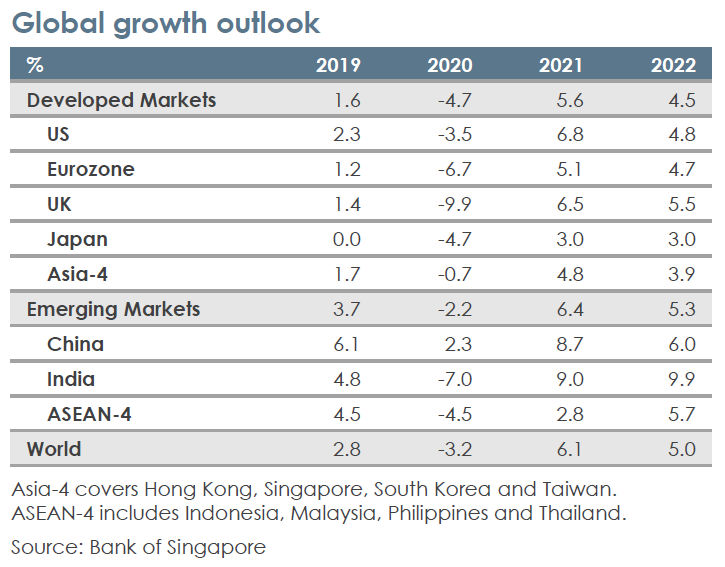

The economic outlook is set to be more favourable for financial markets in 2024.

First, inflation is falling fast. The global surge in goods prices during the pandemic has eased as supply disruptions have diminished. Similarly, the reopening boom in services is abating after central banks hiked interest rates rapidly in 2022 and 2023.

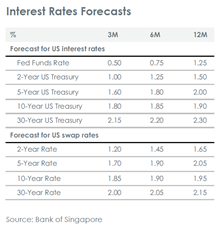

Second, the Fed and its peers are preparing to reduce interest rates as inflation falls back to their 2% targets. We expect the Fed will start cutting its fed funds rate from 23-year highs of 5.25-5.50% in June. We also expect the European Central Bank (ECB) and the Bank of England (BoE) to begin easing from the summer. The People’s Bank of China (PBOC) has already lowered banks’ reserve requirements in January. And, while the Bank of Japan (BOJ) is set to lift rates for the first time in nearly two decades, dovish officials are only likely to raise the BOJ’s deposit rate from -0.10% to 0% this year.

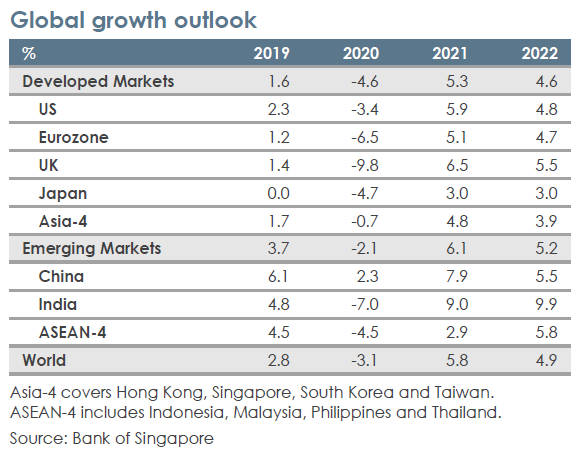

Third, easing inflation and interest rate cuts will support the outlook for bonds. We forecast 10Y US Treasury (UST) yields to fall back to last year’s lows of 3.25%. But faster declines in inflation will allow fixed income assets to provide positive real returns still.

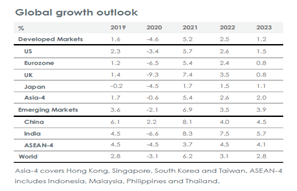

Last, we expect the expansion of artificial intelligence (AI), and the prospects of more rapid productivity growth to buoy equity markets in 2024.

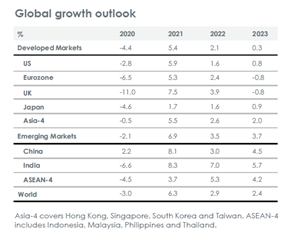

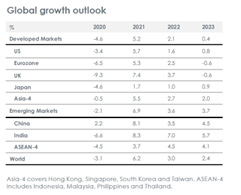

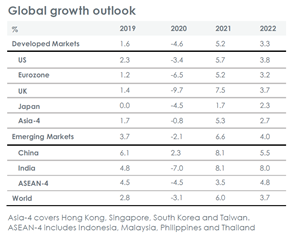

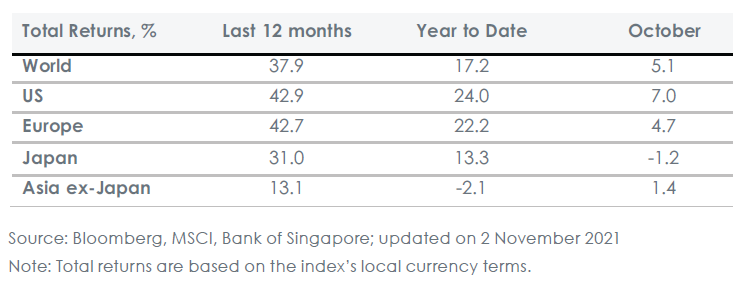

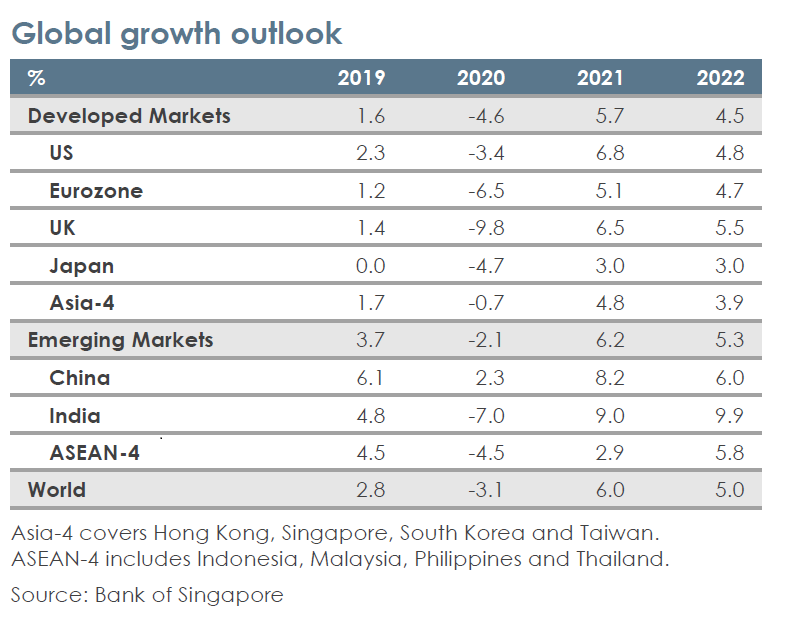

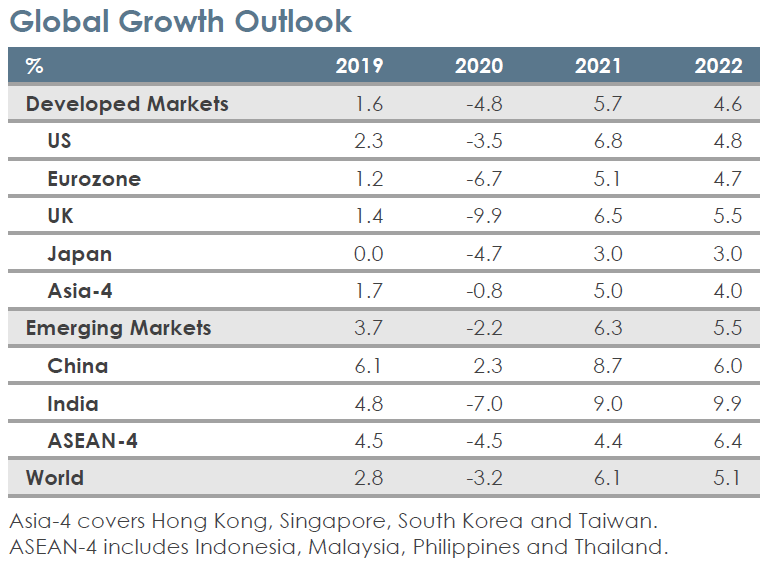

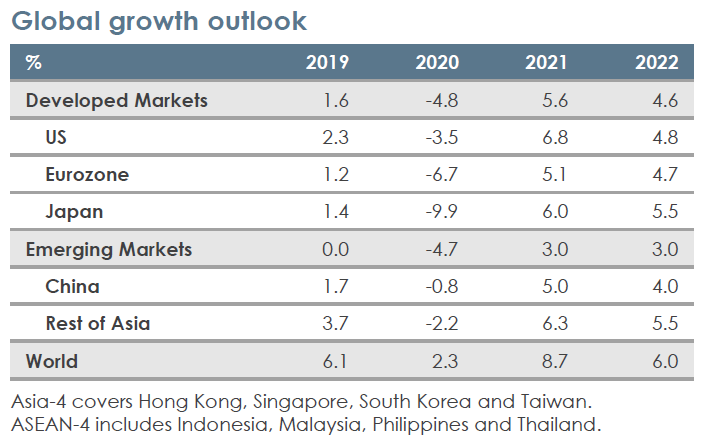

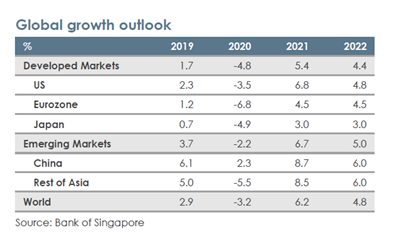

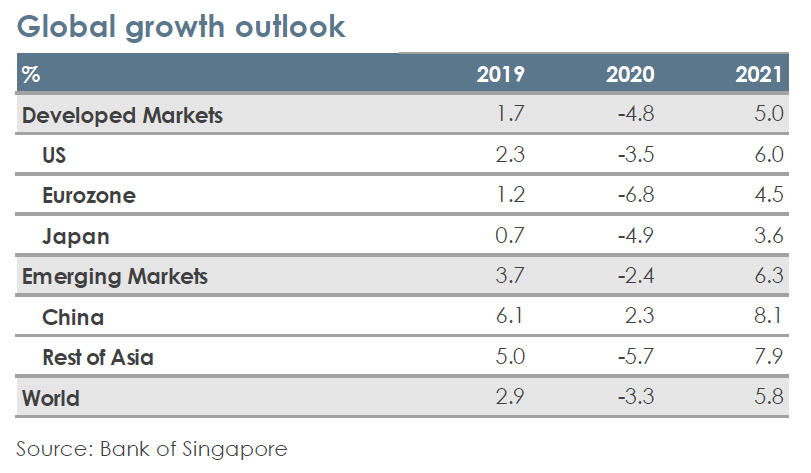

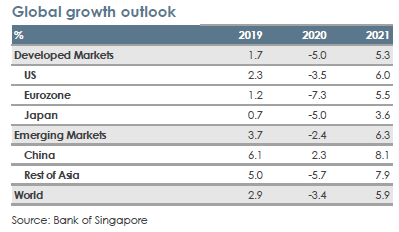

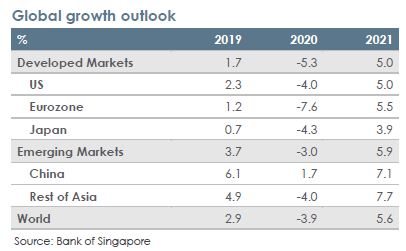

There are still risks to the outlook this year. The US, UK, Eurozone, China and Japan are all likely to suffer slower growth or even recession – as our table of GDP forecasts shows – as reopening tailwinds fade and interest rate hikes from 2022-2023 curb activity. The elections in 2024, above all else in the US, will also increase uncertainty. But falling inflation, central bank rate cuts, positive real returns for fixed income assets and enthusiasm about AI in equity markets are all likely to outweigh such concerns.

Investors should thus start 2024 with a moderate Overweight stance towards risk assets.

AS - Fed to dominate 1H2024, election in 2H2024

The Fed’s interest rate decisions are set to dominate the outlook for financial markets in the first half of the year, before attention turns to the November presidential election in the second half.

The Fed is almost certain to start reducing its fed funds rate from 23-year highs of 5.25-5.50% sometime in the coming months as inflation is falling fast back towards its 2% target. The central bank’s target measure of inflation – changes in core personal consumption expenditure (PCE) prices – has declined from four-decade highs of 5.6% in 2022 to 2.9% now after the Fed’s aggressive interest rate rises over the last two years.

Despite the decline in inflation, we think that Fed officials will be more cautious and wait for further evidence that inflationary pressures are fully abating before starting to gradually lower the fed funds rate from June by 25bps and again in September and December. We thus forecast the fed funds rate to fall to 4.50-4.75% by the end of 2024.

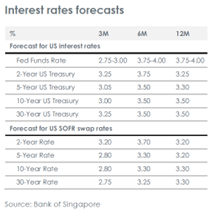

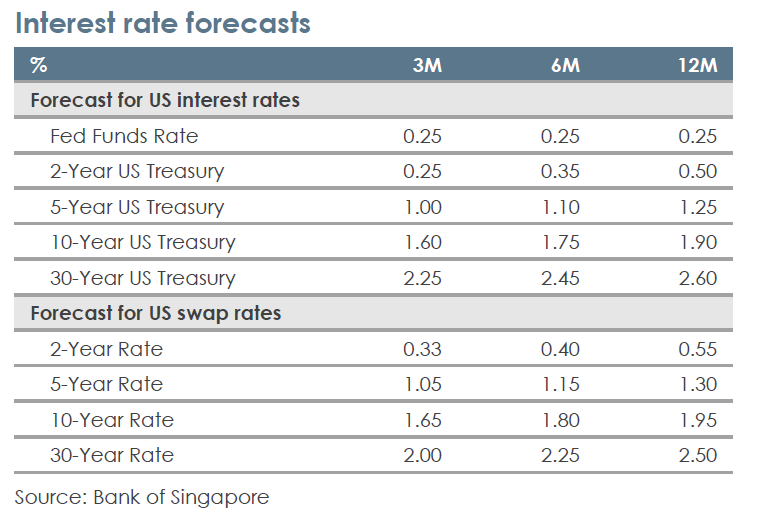

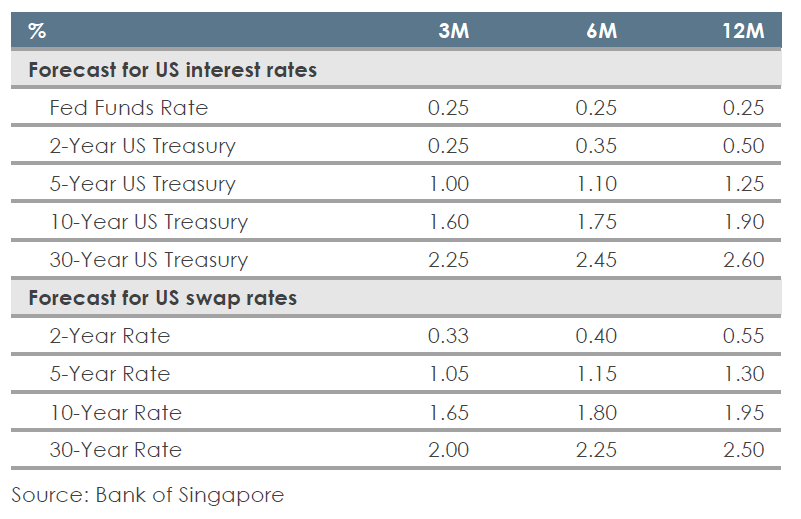

The decline in the Fed’s key interest rates is likely to benefit financial markets this year. We see 10Y US Treasury yields falling back to 3.25% as the table of forecasts shows. We also expect the Fed’s easing will support risk assets even if the US economy suffers a mild recession which remains our base case for 2024.

The outlook in the first half of this year is thus likely to be buoyed by the Fed.

In the second half, however, financial markets may be adversely affected if the polls show that former President Donald Trump is well ahead of President Joe Biden. We see four key risks here.

First, Trump is considering a 10% tariff for all goods imports. This would spark inflation, stop the Fed cutting rates and make the US Dollar surge. Second, a replay of his first term’s corporate tax cuts may spur equities but a larger budget deficit and spiking US Treasury yields could be a worse risk. Third, Fed independence may be threatened and, finally, uncertainty about the rule of law – if Trump targets opponents at home – and the global order if the US pulls out of NATO, may also hurt risk assets. Investors are thus likely to track US politics closely as November’s election draws closer.

China - Subdued growth

China’s growth continues to be subdued. The latest data shows the economy expanded by 5.2% in 2023. This was up from 3.0% in 2022 when lockdowns were still enforced. But even with last year’s tailwinds from reopening, GDP growth was still well below its 6.0% rate in 2019 before the pandemic emerged in 2020.

China’s outlook remains challenging after the shocks of 2020-2022: strict lockdowns, regulatory hits, property weakness, recessions abroad and geopolitical risks. Of the economy’s four engines for growth, consumers are cautious after three years of lockdowns, higher unemployment and falling property prices; investment is also being held back as business sentiment continues to be lacklustre; exports are constrained by weak demand abroad and government leaders are wary of taking on more debt.

This year, we forecast GDP growth to stay subdued at 5.0%. Officials have stepped up efforts to aid growth in recent months including more government spending, easier liquidity conditions from the PBOC and support for loans to property developers. But given the weakness of consumer confidence and real estate, fresh monetary and fiscal easing will be needed to stop growth sliding further and to revive the economy’s “animal spirits” this year.

Europe – Only slowly emerging from recession

Both the Eurozone and the UK suffered weak growth of only 0.5% last year. This year, we expect GDP to just expand by the same modest rates again. The energy shock from the war in Ukraine and the rapid increases in interest rates by the ECB to a record high of 4.00% last year and the BOE to 5.25%, caused Europe’s two largest economies to come close to a recession in 2023. This year, we expect the ECB and the BOE to start cutting interest rates from June and August respectively, providing support to financial markets. But with unemployment still very low after the pandemic and wage growth strong, we expect both central banks will only reduce interest rates in 25bps steps this year.

Japan – Dovish official bolster the outlook

Japanese stocks rallied in January 2024 as the return of inflation after three “lost decades”, corporate governance reforms and the weak Yen pushed the Nikkei 225 Index closer to its all-time high from 1989.

Financial markets are likely to stay supported by the BOJ. In January, the dovish BOJ left its deposit rate at -0.10% as widely expected. Following the shocks of the pandemic and the war in Ukraine, inflation has reached four-decade highs with core inflation around 4%. But the BOJ is keeping interest rates negative until it feels confident inflation will settle at its 2% target.

If Japan’s upcoming annual spring wage round is firm, we expect the BOJ to increase its deposit rate back to 0% from April. But officials are unlikely to make any further rate hikes this year while they wait to see if inflation will be able to stay around its 2% target in future. Thus, the BOJ is set to remain dovish throughout 2024 and keep supporting Japan’s financial markets despite it being the only major central bank likely to raise interest rates this year.

Source: Bank of Singapore

EQUITIES

Japan’s January

Valuations in Japan remain undemanding due to an attractive expected earnings profile, and we maintain our Overweight stance for Japan. – Eli Lee

US – Goldilocks expectations fuelling bullish investor sentiment

Prior to the latest reports from the US earnings season, consensus expectations were for earnings per share (EPS) growth of 3% YoY for the S&P 500 Index in 4Q23 - marking the first quarter of growth expectations since 3Q22. Like our observations in prior quarters, share prices of companies that disappoint on EPS appear to be more severely punished than those that have outperformed.

The outlook for US banks remains mixed as earnings growth could continue to be lacklustre this year amidst soft net interest income (NII) and loans growth in 1H24, although non-interest income could see a more meaningful recovery. Consumption still appears to be relatively resilient, as evidenced by comments from consumer-facing companies such as Visa and American Express. Within Technology, there have been several notable disappointments within the semiconductor space, although the sector could remain largely buoyant on the generative artificial intelligence (AI) narrative.

We continue to hold a Neutral weight position in the US at this juncture.

Europe – Hoping for an alleviation in Red Sea tensions

Since the Russian invasion of Ukraine in February 2022, equity fund flows into Europe have been negative, with domestic investors selling equities and allocating more to cash and bonds. But for every stock sold, there must be a buyer, so who has been buying? In net terms, the large buyer of European stocks was the corporate sector via buybacks.

But for equity flows to improve, economic performance and expectations are key. We are forecasting subdued economic growth of 0.5% for the Eurozone this year, while consensus EPS growth expectations of 5.3% looks vulnerable should Red Sea tensions result in a longer-than expected and more severe disruption in supply chains. On a more positive note, the European Central Bank (ECB) may start cutting rates around the middle of this year which would support valuations. We maintain Neutral on European equities.

Japan – Ready, set, go!

The Japanese equity market has had a bright start to 2024, with the MSCI Japan Index up 6.1% year to date (YTD) as of 26 January 2024 in Yen (JPY) terms, although returns were more muted at +1.0% in US Dollar (USD) terms given the depreciation of the JPY back to about the 150 level. Currency volatility is set to continue, but our house view on the USDJPY remains at 130 over a 12-month horizon. The decent performance of the MSCI Japan Index was likely underpinned by the weakening of the JPY and potentially higher retail participation in stock markets following improved tax incentives that came into effect on 1 January 2024 under the Nippon Individual Savings Account (NISA) scheme. Looking ahead, attention will be focused on the earnings season and commentaries during the Monetary Policy Meetings by the Bank of Japan.

Asia ex-Japan – Upgrading South Korea to Overweight

The MSCI Asia ex-Japan Index started 2024 on a sour note, declining as much as 7.3% YTD in mid-January before recovering some ground due to more policy easing measures announced by the Chinese government and media. We remain Neutral on Asia ex-Japan but we are monitoring developments emanating from China closely. Within the Index constituents, we are upgrading MSCI Korea by one notch to Overweight, while downgrading MSCI Philippines to Neutral at the same time.

China/HK – Balancing between growth and risk containment

The People’s Bank of China (PBOC) announced a 50 basis points (bps) reserve ratio requirement (RRR) cut and a 25bps cut for relending and rediscounting rates after the recent State Council meeting. The timing and the magnitude of the RRR cut were modest positive surprises. Also, it has been reported that a stabilisation package is under consideration, which could amount to CNY2.3t. If confirmed, it could help to boost market sentiment and liquidity in the near term. While the rate cuts alone may not be sufficient to address fundamental issues (e.g., the real estate downcycle, debt restructuring), it is an encouraging starting point, nonetheless. Follow-on measures involving a coordinated and comprehensive package would be needed to address these structural issues and support a sustainable re-rating of equities.

We are still of the view that consensus earnings estimates for the MSCI China Index looks optimistic and are likely to be vulnerable to a downward revision, especially going into the corporate reporting season in March 2024.

With China in transition and the US heading into a rate cut cycle, we advocate focusing on three key investment themes:

Global Sectors - Information Technology and Communication Services lead the pack

The global sectors that have outperformed markets YTD are the Information Technology, Communication Services and Healthcare sectors, while the Materials, Real Estate and Utilities sectors have lagged. In Materials, after a December rally in the stock prices of mining companies, January saw a correction with the pull back in iron ore prices amidst a softer outlook due to Chinese demand. European chemical companies are also sounding caution on potential supply chain woes due to the Red Sea tensions. We believe the above factors are likely to continue to weigh on the broader Materials sector for now.

On the other hand, we remain constructive on US Tech as encouraging advertising trends.

BONDS

Fed policy to drive bond markets

The timing and trajectory of the Federal Reserve’s rate policy will continue to be the primary driver of fixed income performance in 2024. – Vasu Menon

We expect the timing and trajectory of the Federal Reserve (Fed) rate policy to be the primary driver of fixed income performance in 2024. Given their higher duration (interest rate sensitivity), Developed Markets (DM) Investment Grade bonds (IG) and US Treasuries should be well positioned to achieve solid returns in this year’s anticipated declining interest rate environment, and we therefore accord these asset classes Overweight recommendations. However, a Fed pivot and a resulting declining interest rate environment should be broadly beneficial for fixed income securities. Hence, we are Neutral on DM High Yield bonds (HY), Emerging Markets (EM) IG and EM HY.

Rates

While Fed rate cuts are on the radar, the key question remains about the pace and timing of rate cuts. From pricing in sharp 165bps of rate cuts in mid-January, the market has scaled back expectations. In addition, the market has also pared back sharply the odds of the first rate cut at the March meeting which stood at 90% in late December.

Developed markets

The current pause and anticipation of Fed policy easing in mid-2024 drives our Overweight recommendation for DM IG. With historically tight credit spreads, rates are now the primary driver of returns for DM IG. Given our expectations for lower US Treasury yields by the end of 2024, DM IG should be well placed to benefit given that the sub-asset class possess the highest duration amongst the credit classes under our coverage.

Emerging markets

We maintain a Neutral rating on EM HY and EM IG with a preference for the former. Favourable top-down factors including declining rates and a waning US Dollar should underpin performance. After two years of elevated defaults, we expect 2024 to return to levels that are more indicative of long-term averages. Finally, the EM HY space has also become more geographically diversified over the past several years, which should mute volatility going forward.

Asia

We maintain our recommendation of Asia IG and Asia HY at Neutral. Within IG, most issuers have relatively stable credit fundamentals and would continue to benefit from government ownership and implicit support. Within Asia HY, China HY Property outperformed YTD on supportive measures from the government, but the sector is still marred by mishaps i.e., Evergrande’s liquidation proceedings and the lack of sales recovery. Overall, higher carry of Asia HY and lower year-on-year (YoY) default expectations should support returns in 2024.

FX & COMMODITIES

Ample supply

While simmering geopolitical tensions could support prices for now, ample non-OPEC+ supply, especially from the US, Canada, Brazil and Guyana, point to a looser oil market ahead. – Vasu Menon

Gold

Gold prices have been range bound since the start of 2024 at just over USD2,000/oz, held back by a moderation in exuberant Federal Reserve (Fed) easing expectations.

Despite the choppy price action year-to-date, an eventual Fed easing, heightened geopolitical risks and strong central bank buying should benefit gold prices in 2024. While there is much uncertainty on the timing and extent of Fed rate cuts, the bigger picture is that the Fed looks set to ease monetary policy and US interest rates are likely to head lower in 2024. This is bullish for gold. Heightened geopolitical risks also supports the case for gold as a portfolio diversifier.

We expect central bank buying to continue, given economic risks and the prospects for a weaker US Dollar in 2024. The safe haven status of US debt has been brought into question by the recent credit downgrades. While gold exchange traded funds (ETF) continued to liquidate holdings of the precious metal in 2023, investors are expected to rebuild their gold allocations this year which should eventually manifest in a renewed increase in ETF inflows into gold.

Oil

Oil prices moved backed up over the past month on the back of elevated tensions in the Middle East. The Red Sea disruptions resulted in a rerouting of ships and tankers, which by themselves would not affect oil supply very much. But that changed after Houthi forces hit a fuel tanker carrying Russian refined oil products. The risk of the US getting dragged into the conflict is also rising following the drone strike on US forces at a military base in Jordan.

While simmering geopolitical tensions could support prices for now, ample non-OPEC+ supply – especially from the US, Canada, Brazil and Guyana - points to a looser oil market ahead. US oil production was aided by a strong increase in well productivity, despite limited growth in drilling activity. We reduce our 12-month Brent forecast to USD75/barrel from USD85/barrel previously. Supply management by the OPEC+ alliance, strategic restocking by China and the US, and a mild recession risk should limit the downside risk to oil prices. OPEC+ appears determined to prop up prices through supply cuts, and we expect supply discipline to stay in place throughout 2024.

Currency

The US Dollar (USD) traded in a holding pattern during the second half of January, following the rally seen in first half of the month. Markets were unwinding some of their aggressive bets on rate cuts by the Federal Reserve (Fed). The key message out of the recent Federal Open Market Committee (FOMC) policy meeting on 31 January was that the Fed endorses a pivot but at the same time, signalled that it is in no hurry to cut rates. Data-dependence remains key and should continue to drive USD volatility.

By the March FOMC, the Fed would have two more Consumer Price Index (CPI) readings to assess if they have greater confidence that inflation is moving towards its target. Overall, the Fed’s latest comments suggested that a May cut could be the base case, similar to what markets expect. Markets are pricing in about six rate cuts of 25 basis points (bps) each at every Fed policy meeting, starting in May till the end of year. We are still in favour of a weaker USD as the Fed is done tightening and should embark on rate cut cycle soon. Softer core PCE inflation data for December 2023 (2.9% y-o-y) and easing tightness in the US labour market reinforces how entrenched the US disinflation trend is. If the disinflation trend persists and labour market tightness eases further, this could cause the USD to trade on a backfoot. That said, the USD is not a one-way trade. It remains a safe-haven proxy. If the Global/China growth momentum sputters and geopolitical tensions escalate, we could still see the USD finding intermittent support on dips. Our bias is to sell the USD on rallies.

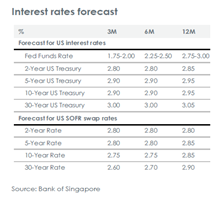

Better prospect in 2024

US equity rallied in November, responding to Fed’s decision to keep interest rate at 5.25 to 5.5%. During his speech, Fed Chairman, Jerome Powell quoted that current interest rate is slightly below neutral. This statement not only spurred the equity performance but managed to push the US Treasury 10Y yield lower to 4.3% at the end of the month. US inflation was released steady at 3.1% y-o-y. The dovish tone has pushed the rate cut expectation to come earlier in 2024, as US economy moves toward soft landing. During December FOMC, Fed pencilled at least three interest rate cuts in 2024, anticipating 1.5% in reductions in 2024.

Moreover, interest rate policy would not be the only supportive sentiment for US equity next year. US Presidential race, which will be held in November 2024, has been historically evidenced as positive catalyst for equity market. This euphoria would normally start few months prior to the electoral vote.

Moving to the other western counterpart, Eurozone is also seen to almost reaching end of the hike cycle. Equities rallied despite soft economic data. October inflation was stable at 2.9% y-o-y, unemployment rate was also steady at 6.5%. ZEW Economic Sentiment, which projects economic confidence index for the next 6 months, increased to 12.8 in December, compared to previous 9.8. The zone economy is projected to grow at 0.5% in 2024, slightly increased from 2023 estimate at 0.4%.

From the eastern part of the globe, rating agency, Moody’s cut outlook on China’s sovereign debt from stable to negative, while keeping the current rating at A1 level. Moody’s expected China annual GDP growth to slow to 4% in 2024 and 2025 and average 3.8% from 2026 to 2030. During this year alone, the government has introduced a number of targeted policies to support the property sector and propel the equity market. However, the effort has not been able to support sustainably. Fundamentally, manufacturing activity started to expand at 50.7, followed by improving retail sales at 7.6%.

Meanwhile from the domestic economy, Indonesia November inflation was released at 2.86% y-o-y. The stable inflation and Fed dovish tone have prompted the central bank to keep current benchmark rate of 7-day reverse repo rate at 6 percent. According to recent survey of Bloomberg analysts, Bank Indonesia will start lowering the interest rate in Q3- 2024.

Equity

Jakarta Composite Index, rallied 4.87% in November, led by technology and infrastructure sector by 20.51% and 19.52% respectively. The Organisation for Economic Cooperation and Development (OECD) estimated that the Indonesian economy would grow 5.2% in 2024 and would remain stable the following years. The positive outlook was seen as a continued result from this year improvement. Furthermore, starting at the end of 2023, all eyes are moving toward the presidential election, which will be held on Feb 14th, 2024. Historically, election period has been seen as positive catalyst for the equity market.

Bond

Following the developed market trend, the domestic bond market also improved in November, where US Treasury yield had moved lower. 10Y ID government bond yield declined from 7.1% to 6.62% at the end of November. Foreign investors booked net buy of IDR 23.5 trillion in the government bond market. The decline in oil price has also supported rally in the bond price.

Moving forward, government aimed bond issuance will reach IDR 666.4 trillion in 2024. The figure increased compared to 2023 at IDR 362.93 trillion. Maturing debt refinancing climbed marginally from IDR 482 trillion in 2023, to IDR 565 trillion in 2024. Fundamentally, investing in bond still offers attractive yield, that receives continued support from stable domestic inflation, potential rate cut in 2024, and the narrow deficit gap.

Currency

Rupiah moved stronger against the greenback by 2.36% in November, to IDR 15,510 per US Dollar. The US Dollar Index or DXY was down 2.47% to 103.49 in November. Coming into 2024, the dovish Fed will remain as sustenance for Rupiah against the US Dollar.

Juky Mariska, Wealth Management Head, OCBC Indonesia

A pivotal year

In our base case scenario, as the lagged effects of higher rates continue to drag on US growth with fiscal policy turning less stimulatory, the US labour market and consumer confidence will further weaken. In this scenario, the US economy experiences a mild recession for two quarters in mid-2024 while core inflation eases below 3%. – Eli Lee

After a challenging 2023, the economic outlook will be more favourable for financial markets next year. Falling inflation and fears of recession are likely to make central banks pivot from rapid interest rate hikes to measured rate cuts in 2024. Risk assets are thus set to benefit from policymakers seeking to reflate their economies rather than aiming for further disinflation.

We think next year’s shift by central banks from tightening to easing is likely to be the key driver for financial markets, overcoming concerns of a recession and falling growth across the major economies.

United States

In 2024, we expect a slowdown in US activity and for core inflation to fall below 3% after the Fed’s rapid interest rate hikes over 2022 and 2023. The central bank will thus be able to start cutting its fed funds rate from June. The economy is likely to suffer a mild recession, contracting for two quarters in 2024.

Our base case for the Fed pivoting to rate cuts next year is supported by the following factors:

Core inflation as measured by personal consumption expenditure (PCE) prices has fallen from 5.5% in 2022 to 3.5% now. Once core PCE inflation falls below 3% in 2024, we expect the Fed will pivot from rate hikes to cuts, lowering its fed funds rate by 25bps in June, September and December.

We expect the US economy will still suffer a mild recession despite the Fed’s rate cuts so the combination of weaker growth and easier monetary policy is likely to lead to US Treasury (UST) yields falling substantially over the next 12 months as our forecasts in the table below show. We think our base case of quarterly rate cuts from June and a mild recession has a 50% probability.

We also think there is a 30% chance of a more market-friendly soft landing where the US avoids recession while core inflation falls below 3%, and a 20% probability of a hard landing where core inflation stays above 3%, preventing the Fed from easing and thus causing a deeper downturn in 2024.

Similarly, we expect the other major economies will also slow or suffer sluggish growth next year.

Eurozone / UK

Both are at risk of contracting in the second half of 2023 - under the impact of higher interest rates and energy costs from the war in Ukraine - and are only likely to slowly emerge from recession next year.

Falling inflation should allow the European Central Bank (ECB) to start cutting interest rates from its current record level of 4.00% from June 2024 and the Bank of England (BoE) from 5.25% in the second half of next year.

But we forecast GDP growth will still be only around 0.5% in 2023 and 2024 for both economies.

China

In 2023, China’s recovery been challenging, and we anticipate China’s uneven reopening from the pandemic to slow further in 2024.

Looser fiscal policy will help, and we maintain our forecast for GDP to rise solidly by 5.4% in 2023. GDP may expand slowly by 5.0% in 2024 with more fiscal, monetary and property easing measures still needed to keep growth supported.

But confidence remains low especially around the weak property sector. Exports are also likely face headwinds from falling global growth.

Japan

We think Japan’s economy will also slow in 2024 as this year’s tailwinds from reopening ebb. We also anticipate the Bank of Japan (BoJ) will finally exit its long period of negative interest rates in 2023 as inflation becomes entrenched in Japan.

Summary

Global growth overall may slow for the third year in a row in 2024 but with the Fed, ECB and Bank of England (BoE) pivoting to rate cuts, the economic outlook is set to turn more favourable for financial markets next year.

We recommend a modestly Overweight stance towards risk assets as 2024 starts, with a preference for high quality Treasury and corporate bonds in fixed income – as hedge against recession risks – and a modestly Overweight stance in equities as upcoming rate cuts support investor sentiment.

Outlook largely favourable

In equities, we upgrade our overall stance from Underweight to modestly Overweight. We upgrade Europe from Underweight to Neutral, remain Neutral on US and Asia ex-Japan, and Overweight on Japan. We favour quality growth sectors, including Technology, and defensive value sectors, including Healthcare, Consumer Staples, and Utilities. – Eli Lee

US

We see cyclical pressures increasingly setting in from the delayed impact of prior rate hikes, declining household excess savings and tighter bank lending standards. On the other hand, robust operating metrics for large-cap tech firms looks set to continue, while generative artificial intelligence (AI) continues to be accretive to selected tech beneficiaries.

The presidential election could be a source of market volatility, though likely more pronounced only in 2H2024. We remain Neutral on the US at this juncture.

Europe

The European Central Bank (ECB) may finally cut rates in 2H2024, which would support risk assets. including European equities.

However, earnings growth is still expected to be muted, along with downside risks of a recession. Europe itself is also navigating a tricky geopolitical balancing act between China and the US.

Japan

We have an Overweight position in Japan as several drivers for outperformance remain: continued corporate reforms leading to increased dividends and share buybacks; an acceleration of cross-shareholding unwinding; higher retail participation given changes to the Nippon Individual Savings Account (NISA) scheme; and wage growth which could drive consumption and support higher prices, thus alleviating potential margin pressure.

We prefer companies with higher exposure to domestic consumption over exporters, and would also relook at the mega-cap Japanese banks and life insurance companies on share price pullbacks.

Asia ex-Japan

We maintain our Neutral rating on the MSCI Asia ex-Japan Index. The recent dips in the 10Y UST yield and oil prices, coupled with more aggressive policy easing measures by the Chinese government could provide some near-term support to share prices. However, rising risks of a recession in the US, uncertainties arising from elections in the region (Taiwan, Indonesia and India) and structural challenges in China are potential offsetting factors for 2024.

China/ HK

Despite recent macro data being mixed, the expectation of peaking US rates and therefore the stabilisation of US-China yield spread would help bring the focus back to companies’ fundamentals and support a trading rebound in the near term.

However, consensus earnings estimates for offshore Chinese equities appear to be optimistic and vulnerable to downward revision. We believe a sustainable re-rating would hinge on further coordinated policy support, a recovery in the real estate market and corporate earnings outlook.

With light positioning and undemanding valuations, risk-return could become more favourable if these concerns subside.

Global sectors

We advocate a mix of quality growth sectors (with names in the Communication Services, Information Technology sectors) and defensive value sectors (such as Healthcare, Utilities and Consumer Staples).

We favour companies with sustainable dividends and free cashflow yields especially going into 2024 where macroeconomic uncertainty is still prevalent.

As such, we are upgrading the Global Information Technology and Communication Services sectors from Neutral to Overweight. 10Y UST yields trending towards our target of 3.25% in 12 months without a deep recession in the US should be a constructive backdrop for Technology and long-duration risk assets.

Within Developed Markets (DM), we continue to be selective as valuations are not cheap given the

recent broad rally.

We are also upgrading the Global Real Estate sector from Underweight to Neutral on expectations that the Fed rate hike cycle is likely behind us, coupled with extreme negative positioning.

Finally, we are downgrading the Global Financials sector from Neutral to Underweight. Although we acknowledge that forward P/E for the sector is low, the cyclical nature of the sector typically leads to share price underperformance during recessions. Headwinds from more stringent regulatory capital requirements and thus higher capital buffers, muted loans growth, credit quality concerns and uncertain recovery prospects of capital market activities keep us on the sidelines.

Waiting for policy easing

In fixed income, we remain Overweight on Developed Market Investment Grade bonds and upgrade our Underweight position in Developed Market High Yield bonds to Neutral. – Vasu Menon

With the Federal Reserve expected to pivot to rate cuts by June 2024, US Treasury (UST) yields would rally significantly and be poised for returns of up to 12% in 2024. Although we see the risk of near-term volatility, we expect 10Y UST yields to settle lower at 3.25% over the next 12 months. We thus recommend extending duration, favouring maturities in the 8-15Y bucket.

Developed Markets Investment Grade

We maintain our Overweight recommendation on the back of a mild US recession and a 12-month forecast of 3.25% for the 10Y UST yields. As the credit asset class with the highest duration, it should be the major beneficiary once Fed policy easing commences, likely in the 2H2024. Furthermore, as yields are still attractive on a historical basis, it should benefit from a rotation out of cash-like assets during the policy easing cycle.

Developed Markets High Yield

We are upgrading our recommendation to Neutral and expect returns of 8-9% for the next 12 months. While we expect defaults to increase, and spreads to widen modestly, starting yields above 8% should provide a significant buffer. Finally, maturities for 2024 remain modest, which should provide a positive technical backdrop for the asset class.

Emerging Markets

We maintain a Neutral rating on EM HY and EM IG with a preference for the former. The EM HY space has also become more geographically diversified over the past several years, which should mute volatility.

Asia

Demand from the onshore Chinese market and attractive all-in yields are market technicals that should support the Asian bond market. We revise our recommendation of Asia IG and Asia HY to Neutral from Underweight. Within IG, most issuers in the segment should have relatively stable credit fundamentals and would continue to benefit from government ownership and implicit support.

Summary

Policy easing is likely to begin in the 2H24. Hence, we maintain our Overweight call on Developed Markets (DM) Investment Grade (IG) and US Treasuries (UST), which should be major beneficiaries of a more dovish Fed policy. We upgrade our call on DM High Yield (HY) to Neutral and maintain our Neutral calls on Emerging Markets (EM) HY and EM IG. We remain cautious of China HY property on concerns over the sector’s long-term fundamentals.

A gradual descent

A more entrenched disinflation trend and further easing of labour market tightness and activity data in the US in 2024 could weigh on the greenback. – Vasu Menon

Gold

Gold’s respectable performance is likely to extend into 2024. Being a long duration zero coupon asset, investment demand for gold will benefit from a weaker US Dollar environment and lower US Treasury (UST) yields as the Federal Reserve (Fed) starts its easing cycle in mid-2024.

Declining US real interest rates are set to push gold prices to a new nominal high of US$2,200/oz by end-2024. Gold should be supported by robust central bank buying activity.

Gold also looks compelling as a reliable diversifier against a potential increase in geopolitical risk and a crowded global elections calendar in 2024. Many of these elections will be relatively routine affairs but there can be surprises. The US presidential election in November, and Taiwan’s election in January are among the key ones to watch.

Oil

Our Brent oil price assumptions remain at US$85/bbl for end-2024. The recent decline in prices is driven by concerns over: (i) slowing global economic growth, and thus oil demand, as the sharp rise in interest rates bite and (ii) stronger than expected non-OPEC+ production.

However geopolitical factors, such as the Israel-Hamas and Russia-Ukraine conflicts, and OPEC+ discipline are set to help place a floor under crude oil.

OPEC+ agreed to make 2.2mb/d of supply cuts recently. Incremental voluntary cuts add up to 900kb/d, of which 200kb/d from lower oil products exports from Russia and 700kb/d spread between six OPEC+ members. The cuts will be in place through 1Q2024, when global oil demand is seasonally the weakest. OPEC+’s move again underlines determination to defend an oil price floor around USD80/bbl.

Currency

The US Dollar (USD) index fell by 3% in November. The USD narrative is starting to shift, led by softer US data.

We remain biased to adopt a “sell-on-rally” for the USD. The extent of USD decline is highly dependent on: (i) how much markets expect the Fed to cut rates by; and (ii) the timing of the first rate cut. That said, even with US Treasury yields easing, the USD still retains some degree of yield advantage and is a safe haven proxy to some extent.

The Euro (EUR) appreciated by 3.2% (versus the USD) in November, riding on the USD’s pullback and the ECB’s hawkish rhetoric. Over a broader time-horizon, we still see room for the EUR to recover as the USD adjusts lower on the shifting USD narrative.

The Pound (GBP) rose sharply (4% versus the USD) in November on a combination of drivers, including hawkish BOE rhetoric and not-as-bad-as-feared UK data and government finances. We are mildly constructive on the GBP’s outlook with UK demand growth proving resilient. Potential BOE-Fed policy divergence would be supportive of the GBP.

Troubling Times

Global risk assets were under quite heavy pressure in the month of October. In the US, the Dow Jones, S&P500, and NASDAQ each recorded decline of -1.36%, -2.20%, and -2.78% respectively. The FOMC Meeting held in September echoed higher for longer interest rate environment, also putting pressure on fixed income assets. The US Treasury was briefly seen hovering at 5.018% on the last trading day of last month. However, the narrative had changed during November FOMC Meeting held at the beginning of the month, in which The Fed decided to maintain its Federal Funds Rate at 5.25% - 5.50% as widely anticipated by market participants. The move was supported by several economic indicators that had shown signs of softening, such as the unemployment rate which climbed to 3.9% while inflation remain relatively high.

Moreover, the ongoing geopolitical conflict between Israel and Hamas also weighed on global equities, especially in the US. The first attack, launched on the 7th of October have ignited a war that is very much still ongoing right now with both sides launching retaliatory attacks. However, this conflict should not prompt significant increase in the oil price, since both countries are not major oil producers, therefore oil was seen trading at US$82.11/ barrel at the end of October.