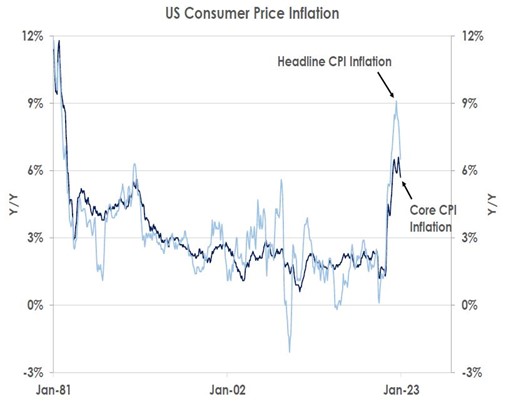

Overnight, the key US consumer price index (CPI) report for December met expectations. Headline inflation again fell from 7.1% to 6.5%. Consumer prices dipped 0.1% last month as energy costs retreated 4.5%. Core inflation also fell from 6.0% to 5.7% but consumer prices excluding food and energy costs still rose 0.3% in December. Significantly, persistent sources of inflation remain firm. Rents rose a further 0.8% last month and have increased by 7.5% now compared to a year ago.

Source: Bank of Singapore, Bloomberg

Inflation remains far above the Federal Reserve’s 2% target. Officials, however, are signalling the Fed may step down the pace of its interest rate hikes from last year’s 50bps and 75bps moves to 25bps rises this year as inflation is now well below its four-decade peak of 9.1% (see chart above).

Source: Bank of Singapore, Bloomberg

Philadelphia Fed President Harker said: “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75bps at a time have surely passed. In my view, hikes of 25bps will be appropriate going forward.” Richmond Fed President Barkin said "the path of rate rises this year may be slower, but longer and potentially higher” and Boston Fed President Collins said “I’d lean at this stage to 25 [bps] … smaller changes give us more flexibility.”

Only St Louis Fed President Bulllard warned against stepping down from December’s 50bps rate hike to 25bps when the Fed next meets on February 1, noting “the front-loading policy has served us well and would continue to serve us well, going forward. I don’t really see any purpose in dragging things out through 2023.”

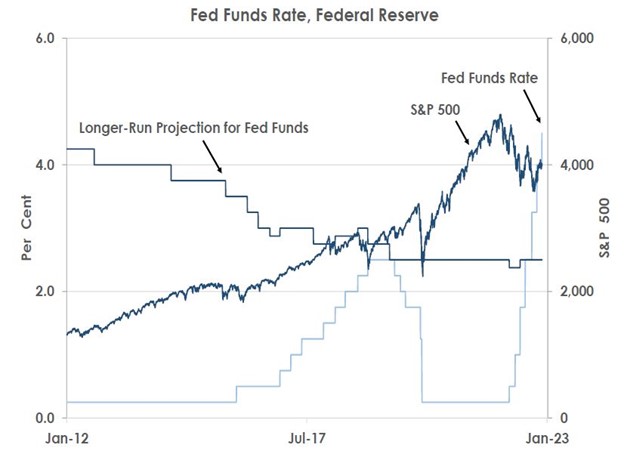

After the CPI data, the S&P 500 finished 0.3% higher, 10Y Treasury yields fell sharply by 10bps to 3.45% and the USD weakened to nine-month lows of 1.08 against the EUR. Investors hope the Fed’s aggressive tightening shown in the second chart is close to its end now as US inflation falls.

We revise our Fed view and now expect only a 25bps hike in February. But we see further 25bps hikes in March and in May too now. We therefore still forecast the fed funds rate to peak at 5.00-5.25% in 2023. We also don’t expect the Fed to cut rates later this year – despite our view of a US recession in 2H23 – given the stickiness of inflation. Thus, our Fed call remains more hawkish than investors’ current optimistic consensus.

This article was first published by Bank of Singapore on January 13, 2023. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.