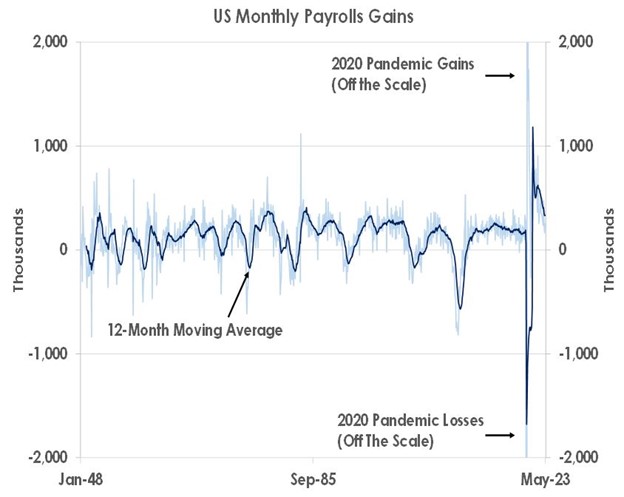

April’s payrolls were stronger-than-expected. Firms added 253,000 new jobs though revisions subtracted 149,000 gains from earlier months. Thus, payrolls are still rising at a much faster pace than before the pandemic.

The rest of April’s jobs data was firm too. The unemployment rate fell back to 53-year lows of 3.4% as the second chart shows. Average hourly earnings rose 0.5%, the fastest pace in a year for wage growth, while the average workweek remained unchanged at 34.4 hours.

The overall trend of payrolls gains is slowing as the first chart shows. But wages are still increasing by 4.4% compared to a year ago given the large rise in average hourly earnings last month.

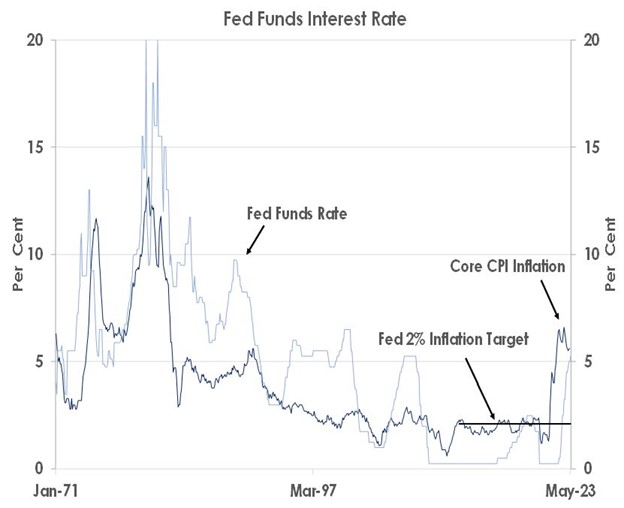

The Federal Reserve will therefore view the labour market as being too tight still to return inflation to its 2% target unless it keeps interest rates elevated for an extended period to slow the economy further.

Source: Bank of Singapore, Bloomberg.

This month, the Fed lifted its fed funds rate for the tenth meeting in a row by 25bps to 5.00-5.25%. The last chart shows the rate is at its highest level now since 2007. But the chart also shows core inflation remains far above the Fed’s 2% target as the tight jobs market keeps wage growth strong.

We think the Fed will thus not cut interest rates later this year - even if the US suffers recession - while inflationary pressures remain firm. The Fed’s stance and its outlook for the rest of 2023 is therefore set to keep challenging risk assets.

This article was first published by Bank of Singapore on May 08, 2023. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.