COMPLAIN HANDLING MECANISM

As a realization of the Bank OCBC NISP’s commitment to become a reliable and credible financial institution, the Bank welcomes and appreciates every assessment and input from its Customers.

As the implementation, Bank manages all complaints and feedbacks in accordance with the Financial Services Authority Regulation and internal policies, “Customer Complaints Handling”, that is continually improved.

The mechanism for complaint (verbally or in writing) submission is as follows:

- The bank provides various media for complaints, feedbacks, and compliments to improve our quality of service, as follows:

- 24-Hour service of Tanya OCBC through 1500-999 (Domestic number) or +62-21-26506300 (Overseas number) and/or email at tanya@ocbc.id

- Website www.ocbcnisp.com on menu “Contact Us”

- WhatsApp Tanya OCBC through +62-81-2150-0999

- OCBC mobile application, on menu “Feedback” (on Login page)

- Social media Twitter (@TanyaOCBCNISP and @OCBC_Indonesia), Instagram (@OCBC_Indonesia) and Facebook (Bank OCBC)

- Nearest Branch Office

- Mass media (printed/electronic/online)

For those representing our customers, complaints can only be delivered through our nearest branch with the customer’s power of attorney.

Documents that should be including in accordance to report the complaint are as follows:

- Copy of Customer’s/Non-Customer’s valid ID

- Copy of supporting documents, among others: deposit/withdrawal evidence, proof of transfer, Statement of Account and/or other supporting documents that is related to the lodged complaints.

- If the complaint is submitted by customer’s representatives, the following additional documents are required:

- Copy of Customer’s Representatives ID.

- Power of Attorney from Customer to Customer’s Representatives stating that the Customer gives the authority to the appointed power of attorney (Individual, Institution or Legal Entity) to represent and act on behalf of the Customer.

- If the Customer’s Representatives is in the forms of institiution and/or legal entities, then the aforementioned representatives is also required to enclose documents that signifies its authority.

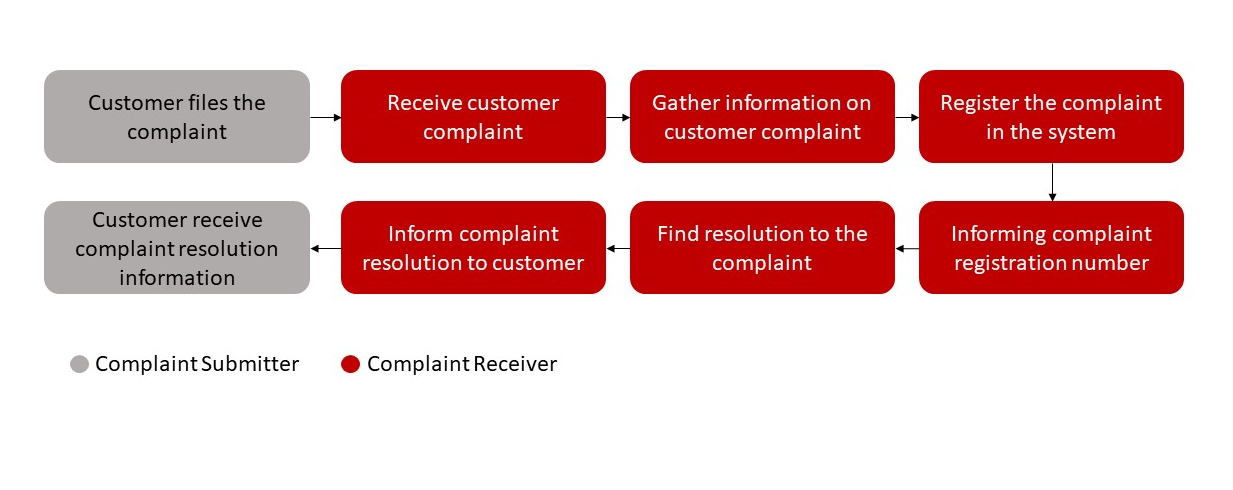

- Bank OCBC Officer will receive the complaint, gather the required information and register the complaint in Customer Handling Management System.

- Customer will receive complaint registration number that can be used to enquiry the progress of the complaint resolution.

- Bank OCBC officer will provide solution to customer’s complaint. If Bank OCBC officer is unable to provide immediate solution, then the complaint will be followed up by relevant units to find the proper solution. The complaint solution will be informed to customer either by telephone, direct meeting and written notification.

- Complaints submitted by the customer will be settled in accordance to the Service Level Agreement (SLA) for each complaint category. The SLA is 5 Business Day for verbally lodged complaint, or it could be handled without furthermore investigation and maximum 20 Business Days for written Complaint. If the settlement requires more than 20 Business Days, then the bank can extend by informing the extension period time to customer.

- Bank OCBC has the obligation to inform the customer for every complaint’s resolution. If the customer accepts the provided solutions, then the complaint will be deemed as closed. If the customer did not accept the provided solutions, Customer could ask Bank OCBC officer to re-escalate the complaints in line with the customer’s objections of the provided solutions.

- If the customer does not accept the provided solution, the customer can utilize complaints settlement via Indonesian Banking Dispute Settlement Alternative Institution (LAPSPI) in which the process and settlement follow the applicable provisions of the regulator.

- If the customer rejects the proposed solution, the customer can file the dispute through the court.