Performing the Hajj is a dream for every Muslim to fulfill the 5th Pillar of Islam. To be able to realize this dream, it takes careful planning and preparation. The first step that needs to be taken is to register to get the Hajj Portion and departure schedule and start saving the required costs.

Tabungan Haji iB

Bank OCBC Syariah Tabungan Haji iB is a savings account specifically designated as an intermediary zccount to get the Hajj Portion. Customer can deposit funds to save repayment but cannot withdraw funds unless the Tabungan Haji iB is closed due to a cancellation from the customer.

Requirements for Opening Tabungan Haji iB Account and Printing BPIH (Hajj Travel Expenses) at Bank OCBC Syariah

- KTP/KIA (Child Identity Card), applicants must be at least 12 (twelve) years old at the time of registration.

- Family Card/Birth Certificate/Marriage Book.

- IDR 10,000 stamp duty.

- Complete the iB Hajj Savings account opening form.

- Fill out the Wakalah & SPCH Akad in full (a statement of the truth of Hajj registration identity) (2 copies).

Benefits of being a customer of Tabungan Haji iB OCBC Syariah:

- Connected with Siskohat (Integrated Hajj Information and Computerized System).

- Free monthly administration fee.

- Free of charge below the minimum balance.

- Customers can save the cost of paying off the Hajj at any time.

FEATURES OF iB HAJJ SAVINGS

- Initial deposit: IDR 100 thousand and IDR 25.1 million to get the Hajj portion.

- Administrative costs: None.

- Mutase: Passbook.

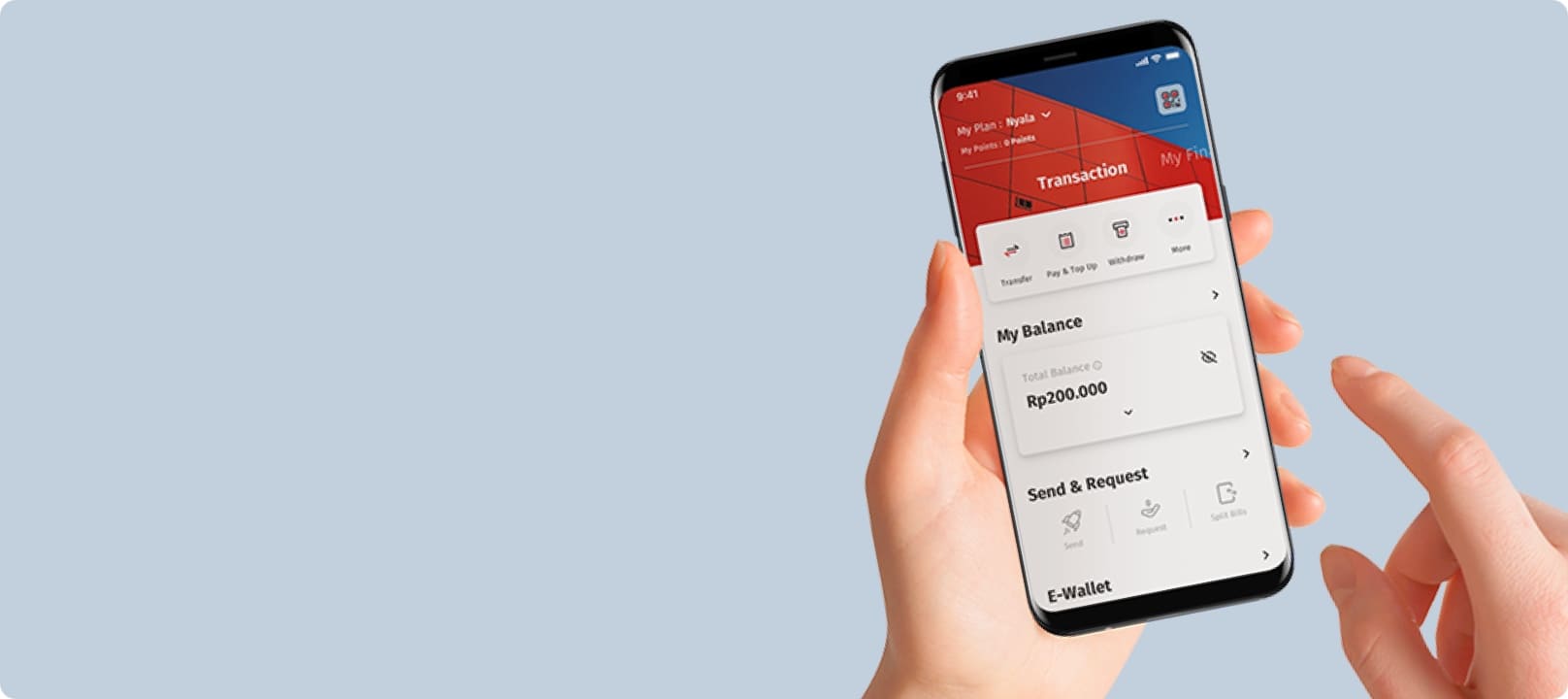

- E-channel: OCBC mobile/OCBC Internet Banking (for checking balances), ATM cards are not provided.