Effective from 1 March 2023, there are changes in features, service, benefit, and fees with details as follows:

| No. | Product Name | |

|---|---|---|

| Valid until 28 February 2023 | Effective from 1 March 2023 | |

| 1. | Tanda 360 | Tanda 360 |

| 2. | Tanda Silver | |

| 3. | Tabungan Harian | |

| 4. | Tabungan Bisnis | |

| 5. | Tanda Senior | |

| 6. | Tanda Co Branding | |

| 7. | Tanda Wulan | |

| 8. | Tanda Gold | |

| 9. | Tanda Reguler | |

| 10. | Tabungan Tanda | |

| 11. | Tabungan Bundling (IDR) | |

| 12. | E-One Saving | |

| 13. | Tanda Bundling Valas (IDR) | |

| 14. | Tanda 360 Komunitas* | |

| Interest Rate (% p.a) | |

|---|---|

| < IDR 10 mio | 0,00% |

| IDR 10 mio - < IDR 50 mio | 0,05% |

| IDR 50 mio - < IDR 1 bil | 0,10% |

| ≥ IDR 1 bil | 0,50% |

| Conditions | TANDA 360 | |

|---|---|---|

| Currency | IDR | |

| Account Statement | Passbook/ E-Statement/ Statement | |

| Initial Deposit | IDR 200.000 | |

| Admin Fee (monthly) | Passbook | IDR 5.000 |

| E-Statement/ Statement | Free | |

| Minimum Average Balance (monthly) | IDR 10.000.000 | |

| S/C for below minimum average balance (monthly) | IDR 12.500 | |

| Closing Fee | IDR 100.000 | |

| Dormant Fee | IDR 15.000/month | |

| Printed Statement Fee | IDR 20.000/month | |

| Benefit | |

|---|---|

| Free of change cash withdrawals at ATM OCBC | Gratis |

| Free Transfer Fees between banks via ATM OCBC/ ATM Prima Network/ATM Bersama and through internet & Mobile Banking OCBC (Only valid Online and LLG) | 30 X Transaction/ month Balance after transaction ≥ IDR10 Mio |

| Free of change cash withdrawals at ATM other than OCBC (ATM Jaringan Prima, Bersama and OCBC Singapore) | |

| Free shopping fees/debit (Jaringan VISA/Mastercard dan Debit BCA/Prima/GPN) | Free |

| No. | Product Name | |

|---|---|---|

| Valid until 28 February 2023 | Effective from 1 March 2023 | |

| 1. | Tanda 7 | Tanda Premium |

Effective from 1 March 2023, Tanda 7 product will be adjusted to Tanda Premium product. More details click here

| No. | Product Name | |

|---|---|---|

| Valid until 28 February 2023 | Effective from 1 March 2023 | |

| 1. | E-One Transaction | Tanda 360 Plus |

| 2. | Tanda 360 @ Work | |

Effective from 1 March 2023, E-One Transaction and Tanda 360 @Work product will be adjusted to Tanda 360 Plus. More details click here

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| Untuk Rekening Rupiah | Free | Free | Free | Free | Free |

| Untuk Rekening Valas USD & non USD/td> | Kurs Jual TT | Kurs Jual TT | Kurs Jual TT | Kurs Jual TT | Kurs Jual TT |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| Pindah buku dengan mata uang yang sama | Free | Free | Free | Free | Free |

| Pindah buku dengan mata uang berbeda | Kurs Jual TT | Kurs Jual TT | Kurs Jual TT | Kurs Jual TT | Kurs Jual TT |

a. Biaya Kliring dan Intercity

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| Biaya Setoran warkat kliring | 2,000 / warkat | 2,000 / warkat | 2,000 / warkat | 2,000 / warkat | Free 50x per bulan |

| Biaya Setoran warkat kliring + Intercity | 2000 + 0 | 2000 + 0 | 2000 + 0 | 2000 + 0 | 2000 + 0 |

| Biaya tolakan kliring | 125.000 | 125.000 | 125.000 | 125.000 | 125.000 |

| Biaya pemrosesan warkat dengan nominal diatas Rp.500juta (dibebankan kepada nasabah penerbit warkat) termasuk biaya RTGS ke bank penerima / penagih warkat | 125.000 | 125.000 | 125.000 | 125.000 | 125.000 |

b. Setoran warkat Inkaso

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| Biaya Setoran warkat inkaso Ke luar kota yang terdapat Cabang OCBC NISP + biaya kliring | 10.000,-/ warkat + IDR 2.000,-/warkat | 10.000,-/ warkat + IDR 2.000,-/warkat | 10.000,-/ warkat + IDR 2.000,-/warkat | 10.000,-/ warkat + IDR 2.000,-/warkat | F10.000,-/ warkat + IDR 2.000,-/warkat |

| Biaya Setoran warkat inkaso Ke luar kota yang tidak terdapat Cabang OCBC NISP + biaya kliring + biaya Bank Perantara | 10.000,-/ warkat + IDR 2.000/ warkat + Biaya Bank Perantara / warkat | 10.000,-/ warkat + IDR 2.000/ warkat + Biaya Bank Perantara / warkat | 10.000,-/ warkat + IDR 2.000/ warkat + Biaya Bank Perantara / warkat | 10.000,-/ warkat + IDR 2.000/ warkat + Biaya Bank Perantara / warkat | 10.000,-/ warkat + IDR 2.000/ warkat + Biaya Bank Perantara / warkat |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis | |

|---|---|---|---|---|---|---|

| Untuk Rekening Rupiah | Kurs Beli TT | Kurs Beli TT | Kurs Beli TT | Kurs Beli TT | Kurs Beli TT | |

| Untuk Rekening Valas dengan mata uang : USD,SGD, EUR, AUD, GBP, JPY, CNH, HKD | setara USD 50.000 per hari per rekening | Free | Free | Free | Free | Free |

| Di atas batas harian | Free | Free | Free | Free | Free | |

| Setoran Bank Notes Denominasi | USD ≤ 50 | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya |

| SGD ≤ 20 | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | Provisi 1% dari total nominal pecahan yang dikenakan biaya | |

| Setoran Uang Kertas Asing USD CAP | Provisi 1% dari total nominal | Provisi 1% dari total nominal | Provisi 1% dari total nominal | Provisi 1% dari total nominal | Provisi 1% dari total nominal | |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| Pindah buku dengan mata uang yang sama | Bebas | Bebas | Bebas | Bebas | Bebas |

| Pindah buku dengan mata uang berbeda | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT |

| Pindah buku antar mata uang yang berbeda dalam rekening Multicurrency | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT | Kurs Beli dan Jual TT |

| Transaction Type | Normal Fee Rate | Fee for Premier Customer | Fee for Nyala | Fee for Nyala Individu | Fee for Nyala Business |

|---|---|---|---|---|---|

| Equivalent USD 2,500 per month per account | Free | Free | Free | Free | Free |

| Above the month limit | Provisi 0.5% | Provisi 0.5% | Provisi 0.5% | Provisi 0.5% | Provisi 0.5% |

| Transaction Type | Normal Fee Rate | Fee Rate for Nyala Customer /Nyala Business | Fee for Premier Customer | Fee for Private Customer |

|---|---|---|---|---|

| Equivalent USD 2,500 per day or Equivalent USD 25,000/month | Free | Free | Free | Free |

| Equivalent USD 5,000 per day or Equivalent 50,000/month | Provisi 0,50% | Provisi 0,50% | Free | Free |

| Equivalent USD 10,000 per day or Equivalent 100,000/month | Provisi 0,50% | Provisi 0,50% | Provisi 0,50% |

Free |

| Above nominal | Provisi 0,50% |

Provisi 0,50% | Provisi 0,50% | Provisi 0,50% |

| Branch Office | Region |

|---|---|

| OCBC NISP Tower Branch | Area Jabodetabek |

| ONSpace Branch | Area Jabodetabek |

| Menara Kelapa Gading Branch | Area Jabodetabek |

| Pantai Indah Kapuk Branch | Area Jabodetabek |

| Bandung Asia Afrika Branch | Area Jawa Barat |

| Semarang Katamso Branch | Area Jawa Tengah |

| Surabaya – HR Muhammad Branch | Area Jawa Timur |

| Medan Polonia Branch | Area Sumatera |

| Makasar Ahmad Yani Branch | Area IBT |

| Bali Sunset Road Branch | Area IBT |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| Nominal Penarikan < Rp. 5 Juta* | 10.000 | 10.000 | 10.000 | 10.000 | 10.000 |

| Nominal Penarikan > Rp. 5 Juta | Free | Free | Free | Free | Free |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis |

|---|---|---|---|---|---|

| LLG/SKN | 2.900 | Free | 2.900 | 2.900 | 2.900 |

| RTGS | 30.000 | Free 10x Per bulan gabungan transaksi melalui IBMB / Cabang | 30.000 | 30.000 | 30.000 |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Individu | Biaya Nyala Bisnis | |

|---|---|---|---|---|---|---|

| Biaya TELEX/SWIFT | Giro Umum | 50.000 | 50.000 | 50.000 | 50.000 | 50.000 |

| Tabungan | 50.000 | Free 1x Per bulan (Tabungan dan Tabungan Multicurrency | 50.000 | 50.000 | 50.000 | |

| Multicurrency | 100.000 | 100.000 | 100.000 | 100.000 | 100.000 | |

| Biaya Provisi | Giro Umum tidak melibatkan Valas | 0.125% (min USD 10 – maks USD 150) atau setara | 0.125% (min USD 10 – maks USD 150) atau setara | 0.125% (min USD 10 – maks USD 150) atau setara | 0.125% (min USD 10 – maks USD 150) atau setara | 0.125% (min USD 10 – maks USD 150) atau setara |

| Tabungan tidak melibatkan Valas | 0.125% (min USD 10 – maks USD 150) atau setara | Free 1x Per bulan (Tabungan dan Tabungan Multicurrency) *berlaku hanya untuk transaksi melalui One Mobile, 1x per bulan. |

0.125% (min USD 10 – maks USD 150) atau setara | 0.125% (min USD 10 – maks USD 150) atau setara | 0.125% (min USD 10 – maks USD 150) atau setara | |

| Giro Umum dan Tabungan melibatkan Valas | Free | Free | Free | Free | Free | |

| Multicurrency | Free | Free | Free | Free | Free | |

| Biaya Full Amount sampai dengan Bank Koresponden Penerima*) | USD | 25 | 25 | 25 | 25 | 25 |

| EUR | 20 | 20 | 20 | 20 | 20 | |

| AUD | 30 | 30 | 30 | 30 | 30 | |

| GBP | 15 | 15 | 15 | 15 | 15 | |

| HKD | 300 | 300 | 300 | 300 | 300 | |

| SGD | 25 | 25 | 25 | 25 | 25 | |

| CNY | 200 | 200 | 200 | 200 | 200 | |

| CAD | 25 | 25 | 25 | 25 | 25 | |

| CHF | 15 | 15 | 15 | 15 | 15 | |

| NZD | 45 | 45 | 45 | 45 | 45 | |

| JPY |

|

|

|

|

|

|

| Transfer dana ≤ JPY 40 mio | 4.500 | 4.500 | 4.500 | 4.500 | 4.500 | |

| Transfer dana > JPY 40 mio | 4.500,- (sampai nominal transfer JPY 40 mio) + 0,05% dari sisa nominal transfer (0,05% x (nominal transfer – JPY 40 mio) | 4.500,- (sampai nominal transfer JPY 40 mio) + 0,05% dari sisa nominal transfer (0,05% x (nominal transfer – JPY 40 mio) | 4.500,- (sampai nominal transfer JPY 40 mio) + 0,05% dari sisa nominal transfer (0,05% x (nominal transfer – JPY 40 mio) | 4.500,- (sampai nominal transfer JPY 40 mio) + 0,05% dari sisa nominal transfer (0,05% x (nominal transfer – JPY 40 mio) | 4.500,- (sampai nominal transfer JPY 40 mio) + 0,05% dari sisa nominal transfer (0,05% x (nominal transfer – JPY 40 mio) | |

| Biaya Incoming Transfer | Full Amount/OUR | Free | Free | Free | Free | Free |

| Beneficiary (BEN)/Sharing (SHA) | ||||||

| USD | USD 5 | USD 5 | USD 5 | USD 5 | USD 5 | |

| EUR | EUR 3,5 | EUR 3,5 | EUR 3,5 | EUR 3,5 | EUR 3,5 | |

| AUD | AUD 6 | AUD 6 | AUD 6 | AUD 6 | AUD 6 | |

| GBP | GBP 2,5 | GBP 2,5 | GBP 2,5 | GBP 2,5 | GBP 2,5 | |

| HKD | HKD 35 | HKD 35 | HKD 35 | HKD 35 | HKD 35 | |

| SGD | SGD 7,5 | SGD 7,5 | SGD 7,5 | SGD 7,5 | SGD 7,5 | |

| CNY | CNY 32 | CNY 32 | CNY 32 | CNY 32 | CNY 32 | |

| CAD | CAD 6 | CAD 6 | CAD 6 | CAD 6 | CAD 6 | |

| CHF | CHF 6 | CHF 6 | CHF 6 | CHF 6 | CHF 6 | |

| NZD | NZD 9 | NZD 9 | NZD 9 | NZD 9 | NZD 9 | |

| Jenis Transaksi | Biaya Tarif Normal | Biaya Nasabah Premier | Biaya Nyala | Biaya Nyala Bisnis | |

|---|---|---|---|---|---|

| Pembuatan kartu ATM baru dengan menggunakan nama |

|

Free | Free | Free | Free |

| Penggantian Kartu ATM karena Hilang atau Rusak |

|

40.000 | 40.000 | 40.000 | 40.000 |

| Pengantian Buku Tabungan karena Hilang, Habis / Rusak |

|

40.000 | 40.000 | 40.000 | 40.000 |

| Pembelian Buku Cek / Bilyet Giro |

|

100.000 | 100.000 | 100.000 | 100.000 |

| Permintaan Copy Bukti Transaksi | <= 3 bulan | 5.000 | 5.000 | 5.000 | 5.000 |

| > 3 bulan | 10.000 | 10.000 | 10.000 | 10.000 | |

| Permintaan Rekening Koran di luar Rekening Koran bulanan | <= 6 bulan | 5.000 | 5.000 | 5.000 | 5.000 |

| > 6 – 12 bulan | 15.000 | 15.000 | 15.000 | 15.000 | |

| > 12 bulan | 25.000 | 25.000 | 25.000 | 25.000 | |

| Penerbitan Surat Dukungan Bank |

|

150.000 | 150.000 | 150.000 | 150.000 |

| Penerbitan Surat Konfirmasi Audit |

|

100.000 | 100.000 | 100.000 | 100.000 |

| Penerbitan Surat Referensi Bank |

|

50.000 | 50.000 | 50.000 | 50.000 |

| Biaya Sewa Safe Deposit Box / Tahun | Tipe Besar | 1,500,000 + PPN 11% | 1,500,000 + PPN 11% | 1,500,000 + PPN 11% | 1,500,000 + PPN 11% |

| Tipe Sedang | 1,000,000 + PPN 11% | 1,000,000 + PPN 11% | 1,000,000 + PPN 11% | 1,000,000 + PPN 11% | |

| Tipe Kecil | 600,000 + PPN 11% | 600,000 + PPN 11% | 600,000 + PPN 11% | 600,000 + PPN 11% | |

| Jaminan Kunci | 1.000.000 | 1.000.000 | 1.000.000 | 1.000.000 | |

| Token Internet Banking | Pembelian Token Baru / Token Hilang | 200.000 | 200.000 | 200.000 | 200.000 |

| Token rusak dan habis baterai | Free | Free | Free | Free | |

| Biaya Layanan |

|

N/A | N/A | 20.000 | 50.000 |

|

Type

|

Description

|

|---|---|

|

Provision

|

Tenure ≤ 10 years: 1% loan plafond

Tenure > 10 years: 1.5% loan plafond |

|

Administration Fee

|

Tenure < 10 years: 0.1% loan plafond or min. Rp 250.000

Tenure ≥ 10 years: 0.1% loan plafond or min. Rp 500.000 |

|

Insurance Premium

|

Subject to charges imposed by OCBC NISP insurance partners

|

|

Notary

|

Subject to charges imposed by OCBC NISP notary partners

|

|

Taxation

|

Rp 750.000 or subject to charges imposed by KJPP

|

|

Legal Documents

|

Imposed when legal documents are prepared by Bank OCBC NISP

|

|

Late Charges

|

0.1% per day of delayed payments

|

|

Penalty

|

3% of unscheduled payments

|

|

Deposit Fee of Unclaimed Collateral Documents

|

Smallest Safe Deposit Box (SDB) fee will be charged, when collateral documents are unclaimed 30 days after a loan paid off

|

|

Interest rate

|

In accordance with the Rate Promo

|

|

Type

|

Description

|

|---|---|

|

Provision

|

Tenure ≤ 10 years: 1% loan plafond

Tenure > 10 years: 1.5% loan plafond |

|

Administration Fee

|

Tenure < 10 years: 0.1% loan plafond or min. Rp 250.000

Tenure ≥ 10 years: 0.1% loan plafond or min. Rp 500.000 |

|

Insurance Premium

|

Subject to charges imposed by OCBC NISP insurance partners

|

|

Notary

|

Subject to charges imposed by OCBC NISP notary partners

|

|

Taxation

|

Rp 750.000 or subject to charges imposed by KJPP

|

|

Legal Documents

|

Imposed when legal documents are prepared by Bank OCBC NISP

|

|

Late Charges

|

0.1% per day of delayed payments

|

|

Penalty

|

3% of unscheduled payments

|

|

Deposit Fee of Unclaimed Collateral Documents

|

Smallest Safe Deposit Box (SDB) fee will be charged, when collateral documents are unclaimed 30 days after a loan paid off

|

|

Interest rate

|

In accordance with the Rate Promo

|

|

Type

|

Description

|

|---|---|

|

Provision

|

Tenure ≤ 10 years: 1% loan plafond

Tenure > 10 years: 1.5% loan plafond |

|

Administration Fee

|

Tenure < 10 years: 0.1% loan plafond or min. Rp 250.000

Tenure ≥ 10 years: 0.1% loan plafond or min. Rp 500.000 |

|

Insurance Premium

|

Subject to charges imposed by OCBC NISP insurance partners

|

|

Notary

|

Subject to charges imposed by OCBC NISP notary partners

|

|

Taxation

|

Rp 750.000 or subject to charges imposed by KJPP

|

|

Legal Documents

|

Imposed when legal documents are prepared by Bank OCBC NISP

|

|

Late Charges

|

0.1% per day of delayed payments

|

|

Penalty

|

3% of unscheduled payments

|

|

Deposit Fee of Unclaimed Collateral Documents

|

Smallest Safe Deposit Box (SDB) fee will be charged, when collateral documents are unclaimed 30 days after a loan paid off

|

|

Interest rate

|

In accordance with the Rate Promo

|

|

Type

|

Description

|

|---|---|

|

Provision

|

Tenure ≤ 10 years: 1% loan plafond

Tenure > 10 years: 1.5% loan plafond |

|

Administration Fee

|

Tenure < 10 years: 0.1% loan plafond or min. Rp 250.000

Tenure ≥ 10 years: 0.1% loan plafond or min. Rp 500.000 |

|

Insurance Premium

|

Subject to charges imposed by OCBC NISP insurance partners

|

|

Notary

|

Subject to charges imposed by OCBC NISP notary partners

|

|

Taxation

|

Rp 750.000 or subject to charges imposed by KJPP

|

|

Legal Documents

|

Imposed when legal documents are prepared by Bank OCBC NISP

|

|

Late Charges

|

0.1% per day of delayed payments

|

|

Penalty

|

3% of unscheduled payments

|

|

Deposit Fee of Unclaimed Collateral Documents

|

Smallest Safe Deposit Box (SDB) fee will be charged, when collateral documents are unclaimed 30 days after a loan paid off

|

|

Interest rate

|

In accordance with the Rate Promo

|

| No | Service | Fee | |

|---|---|---|---|

| 1 | Disbursement Fee | IDR 25.000 | |

| 2 | Provision Fee | starting from 3% of loan principal amount/minimum of IDR 150.000 | |

| 3 | Late Payment Fee | 5% from total installement (minimum IDR 150.000 and maksimum IDR 750.000) | |

| 4 | Early Paid Off Fee | 8% of the remaining loan principal | |

| 5 | Copies of Monthly Bills Fee | IDR 12.500/month | |

| 6 | Monthly Bill Fee | Mail/Courier | |

| no charge | IDR 12.500/month | ||

| 7 | Insurance Premium | 1,5% of loan principal amount | |

| 8 | Stamp Duty |

Payment < IDR 250.000 = 0 Payment ≥ IDR 250.000 - Rp 1.000.000 = IDR 3.000 Payment > IDR 1.000.000 = IDR 6.000 |

|

Interest and Fees

| Annual fee (free of the first year fee) | Main Card IDR 600,000 per year, Supplementary Card IDR 300,000 per year |

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR 50,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100,000 and a maximum of IDR 250,000 |

| Lost/Damage Card Replacement Fee | IDR 250,000 |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30,000, and Declined Check / Giro Fee IDR 25,000 |

| Duty Stamp Charged for Payments with Certain Amount | Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10,000 |

| Installment Request Fee |

Through OCBC mobile Application or other channels IDR 15,000 per transaction Through Contact Center – Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer fee | IDR 10,000 to OCBC account IDR 25 thousand to another bank account |

|

E-Statement via Email Fee Request Increase Limit Fee Notification Charges |

IDR 5,000 per bill per month IDR 50,000 per request IDR10,000 per bill per month |

| Important Information |

|

Interest Calculation for Shopping Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total new bill, or pays after the Due Date. Interest for Shopping Transactions is calculated based on the Posting Date (Posting Date) of the transactions made. The interest rates that apply to purchase transactions are listed on the Billing Sheet. Unpaid costs, penalties, or interest are not included in the interest calculation component. Interest will be charged on the next billing sheet. For a complete interest calculation can be seen in the illustration of credit card interest calculations.

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Date of Cash Advance until the date of full payment of the Cash Advance transaction. The interest rates that apply to Cash Withdrawal transactions are listed on the Billing Sheet. Unpaid costs, penalties, or interest are not included in the interest calculation component. For a complete interest calculation can be seen in the illustration of the Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

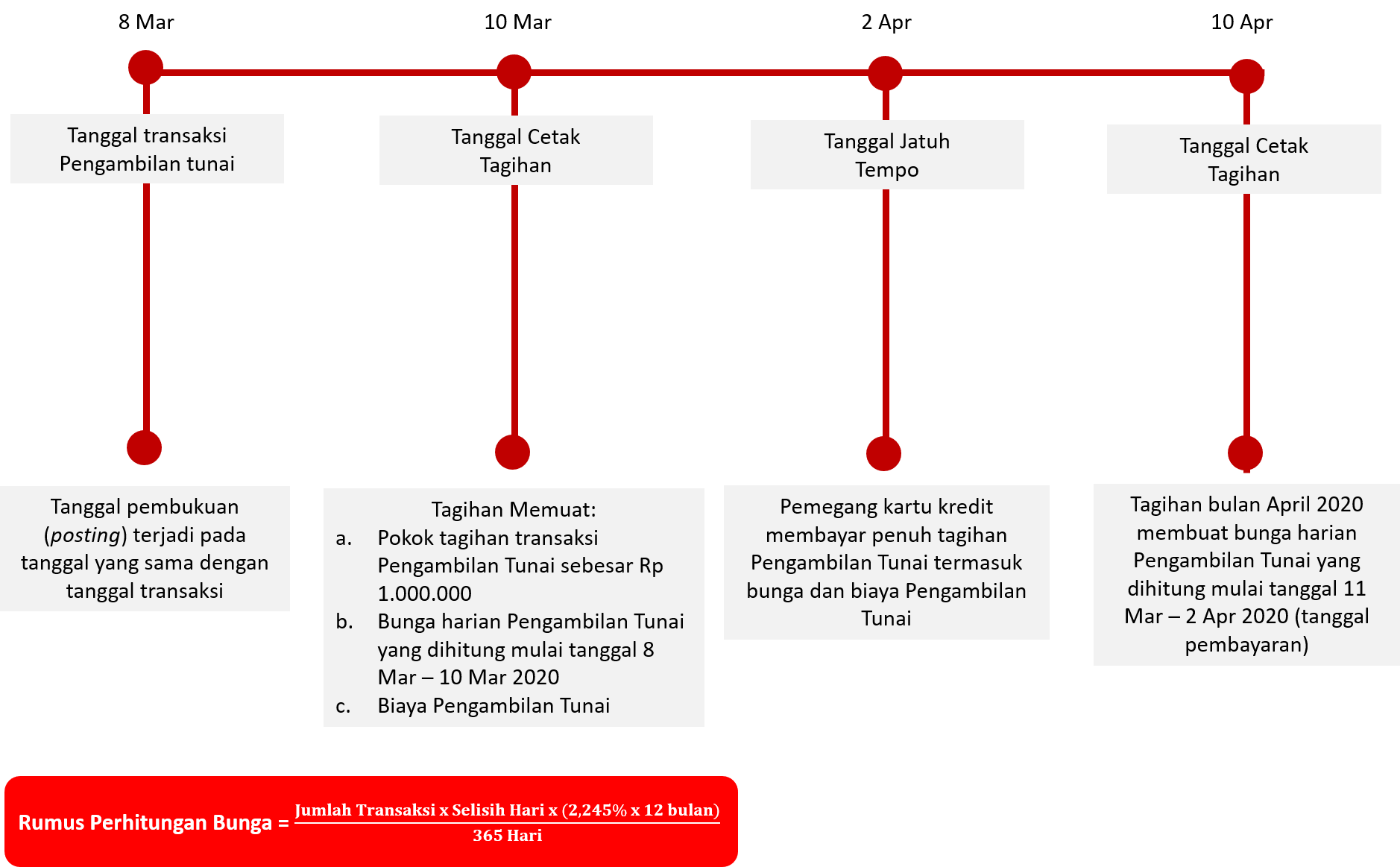

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 2,215 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Difference of days = (10 - 8) + 1 = 3, Interest = IDR 1,000,000 x 3 x (2,245% x 12 months) / 365 = IDR 2,215

Interest and Fees

| Annual Fee (free of the first year fee) |

Main Card IDR 300,000 per year,

Supplementary Card IDR 100,000 per year |

| Annual fee | Main Card IDR 600 thousand per year, Supplementary Card: IDR 300 thousand per year |

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR 50,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (Until 31 Dcember 2023 or always binding with Bank Indonesia regulations) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100.000 and a maximum of IDR 250.000 |

| Lost/Damage Card Replacement Fee | IDR 100 thousand |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30.000, and Declined Check / Giro Fee IDR 25.000 |

| Duty Stamp Charged for Payments with Certain Amount |

Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10 thousand |

| Installment Request Fee |

Through OCBC (ID) Application or other channels IDR 15,000 per transaction Through Contact Center – Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer Fee | IDR 10,000 to OCBC account IDR 25,000 to another bank account |

|

E-Statement via Email Fee Request Increase Limit Fee Notification Charges |

IDR 5,000 per bill per month IDR 50,000 per request IDR10,000 per bill per month |

| Important Information |

|

Interest Calculation for Purchasing Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total new bill, or pays after the Due Date. Interest for Shopping Transactions is calculated based on the Posting Date of the transactions made. The interest rates that apply to spending transactions are listed on the Billing Statement. Unpaid fees, penalties, or interest are not included in the interest calculation component. Interest will be charged on the next billing statement. For a complete interest calculation, see the illustration of credit card interest calculation.

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Cash Advance Date until the date of full payment of the Cash Advance transaction. The interest rates that apply to cash withdrawal transactions are listed on the Billing Sheet. Unpaid fees, penalties, or interest are not included in the interest calculation component. For complete interest calculation, please see the illustration of Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 2,215 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Difference of days = (10 - 8) + 1 = 3, Interest = IDR 1,000,000 x 3 x (2,245% x 12 months) / 365 = IDR 2,215

Interest and Fees

| Annual fee | Private Banking Customer: Free annual fee for primary and supplementary cardholders as long as the primary cardholder are a valid Private Banking customer Premier Banking Customer :

|

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR 50,000 (until 31 December 2023) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (until 31 December 2023) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100.000 and a maximum of IDR 250.000 |

| Lost/Damage Card Replacement Fee | IDR 100 thousand |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30.000, and Declined Check / Giro Fee IDR 25.000 |

| Duty Stamp Charged for Payments with Certain Amount |

Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10 thousand |

| Installment Request Fee |

Through OCBC mobile Application or other channels IDR 15,000 per transaction Through Contact Center – Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer Fee | IDR 10,000 to OCBC account IDR 25,000 to another bank account |

|

E-Statement via Email fee Increase Limit Fee Notification Charges Voyage Miles Redemption Fee |

IDR 5,000 per month IDR 50,000 per request IDR 10,000 per bill per month IDR 10,000 for every request |

| Important Information |

|

Interest Calculation for Purchasing Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total new bill, or pays after the Due Date. Interest for Shopping Transactions is calculated based on the Posting Date of the transactions made. The interest rates that apply to spending transactions are listed on the Billing Statement. Unpaid fees, penalties, or interest are not included in the interest calculation component. Interest will be charged on the next billing statement. For a complete interest calculation, see the illustration of credit card interest calculation.

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Cash Advance Date until the date of full payment of the Cash Advance transaction. The interest rates that apply to cash withdrawal transactions are listed on the Billing Sheet. Unpaid fees, penalties, or interest are not included in the interest calculation component. For complete interest calculation, please see the illustration of Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 2,215 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Difference of days = (10 - 8) + 1 = 3, Interest = IDR 1,000,000 x 3 x (2,245% x 12 months) / 365 = IDR 2,215

Interest and Fees

| Annual fee (free of the first year fee) | Primary Card IDR 1,000,000 per year, Supplementary Card: IDR 500,000 per year |

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR 50,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100,000 and a maximum of IDR 250,000 |

| Lost/Damage Card Replacement Fee | IDR 100,000 |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30,000, and Declined Check / Giro Fee IDR 25,000 |

| Duty Stamp Charged for Payments with Certain Amount | Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10,000 |

| Installment Request Fee |

Through ONe Mobile Application or other channels IDR 15,000 per transaction Through Contact Center – Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer fee | - IDR 10,000 to OCBC account - IDR 25,000 to another bank account |

|

E-Statement via Email Fee Request Increase Limit Fee Notification Charges |

IDR 5,000 per bill per month IDR 50,000 per request IDR10,000 per bill per month |

| Important Information |

|

Interest Calculation for Shopping Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total of the new bills, or pays after the Due Date. Interest on Purchase Transactions is calculated based on the Posting Date of the transaction made. The interest rates that apply to purchase transactions are listed on the billing statement. Unpaid fees, penalties, or interest are not included into the interest calculation component. Interest will be charged on the next billing statement. For a complete interest calculation can be seen in the credit card interest calculations illustration.

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Cash Advance Date until the full payment date of the Cash Advance transaction. The interest rates that apply to Cash Advance transactions are listed on the Billing Sheet. Unpaid fees, penalties, or interest are not included in the interest calculation component. For a complete interest calculation can be seen in the illustration of the Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 1,726 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Interest = IDR 1,000,000 x 3 x (1,75% x 12 months) / 365 = IDR 1,726

Interest and Fees

| Annual fee (free of the first year fee) | Main Card IDR 600,000 per year, Supplementary Card IDR 300,000 per year |

| Retail Interest | 1.75% per month, 21% per year |

| Cash Advance Interest | 1.75% per month, 21% per year |

| Minimum Payment | 5% of the bill or a minimum of IDR50,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Cash Advance Fee | 6% or a minimum of IDR 100,000 (whichever is greater) |

| Late Payment Fee (Late Charge) | 1% of the total bill, minimum IDR 50,000 and maximum IDR 100,000 (Until 31 December 2023 or always binding with Bank Indonesia regulations) |

| Over-limit Fee | 6% of the excess limit, a minimum of IDR 100,000 and a maximum of IDR 250,000 |

| Lost/Damage Card Replacement Fee | IDR 100,000 |

| Billing Statement Delivery Charge | IDR 12,500 per billing |

| Transaction Copy Request Fee | Transaction Note IDR 50,000 , Monthly Bill IDR 30,000, and Declined Check / Giro Fee IDR 25,000 |

| Duty Stamp Charged for Payments with Certain Amount | Payment amounted above IDR 5,000,000 will be charge Duty Stamp IDR 10,000 |

| Credit Card Payment Costs through Teller at OCBC Branch | IDR 10,000 |

| Installment Request Fee |

Through OCBC mobile Application or other channels IDR 15,000 per transaction Through Contact Center – Tanya OCBC IDR 20,000 per transaction |

| Installment Payment Cancellation/Acceleration Fee | IDR 200,000 per transaction |

| Transfer fee | IDR 10,000 to OCBC account IDR 25 thousand to another bank account |

|

E-Statement via Email Fee Request Increase Limit Fee Notification Charges |

IDR 5,000 per bill per month IDR 50,000 per request IDR10,000 per bill per month |

| Important Information |

|

Interest Calculation for Shopping Transactions (Retail):

Interest will be charged if the Cardholder pays less than the total new bill, or pays after the Due Date. Interest for Shopping Transactions is calculated based on the Posting Date (Posting Date) of the transactions made. The interest rates that apply to purchase transactions are listed on the Billing Sheet. Unpaid costs, penalties, or interest are not included in the interest calculation component. Interest will be charged on the next billing sheet. For a complete interest calculation can be seen in the illustration of credit card interest calculations.

Interest Calculation for Cash Advance Transactions:

Interest for Cash Advance is charged and calculated from the Date of Cash Advance until the date of full payment of the Cash Advance transaction. The interest rates that apply to Cash Withdrawal transactions are listed on the Billing Sheet. Unpaid costs, penalties, or interest are not included in the interest calculation component. For a complete interest calculation can be seen in the illustration of the Credit Card Interest Calculation.

* This illustration uses the Platinum Credit Card due date

Note:

Illustration of interest calculation can give different results caused by:

The example of calculation of interest on Cash Advance transactions:

The Cash Advance transaction of IDR 1,000,000 is made and recorded on March 8, 2020. The Billing Statement print date is March 10, 2020. The Due Date is April 2, 2020.

The Cash Advance transaction interest that printed on the Billing Statement sheet for April 2020 is IDR 2,215 (*** see calculation method below).

Image of interest day calculation for Cash Advance transactions

** This illustration uses the calculation of the Titanium Credit Card due date

*** The interest calculation for the Cash Advance transaction was billed in April 2020 as follows:

Difference of days = (10 - 8) + 1 = 3, Interest = IDR 1,000,000 x 3 x (2,245% x 12 months) / 365 = IDR 2,215