Jakarta, March 10th 2021 - Bank OCBC NISP held a Market Outlook meeting to share insights related to economic and investment trend throughout 2021 for its Private and Premier Banking Customers. Program Management Office Coordinator of the Committee for Handling COVID-19 and National Economic Recovery (KPCPEN) Arya Sinulingga was attended to give a disclosure as the event’s keynote speech. Aviliani, Senior Researcher and Commissioner of the Institute for Development of Economics and Finance (INDEF) also attended and shared some economy insight.

On this “Balancing Recovery and Growth Momentum in 2021” talk show, Deputy Chairman of the Indonesian Chamber of Commerce and Industry for International Relations Shinta Kamdani, Economist of OCBC Bank Wellian Wiranto, and Associate Director of Ashmore Asset Management Indonesia Steven Yudha were attend as speakers. Also attending were President Director of Bank OCBC NISP Parwati Surjaudaja and Director of Bank OCBC NISP Johannes Husin to reaffirm Bank's commitment as a trusted partner in assisting customers to maintain and develop their assets in order to realize their financial aspirations, both individually and corporately.

“A year since pandemic has presented major challenges and implications for all sectors, including banking and all elements of society, as well as business actors and customers of Bank OCBC NISP. We are completely understood the necessity on the requirement to adjust business strategies and personal investments that customers need to perform. Thus, align to our vision to be the trusted partner to enrich quality of life, Bank OCBC NISP will continue to always be side by side with customer to assist them in deciding the best choices thus they could achieve their aspiration. This is a manifestation of our commitment to carry out responsible banking, which is more than just supporting financial solutions but also empowering the public by sharing knowledge through the implementation of a Market Outlook for private and premier banking customers today,” stated Johannes Husin – Director of Bank OCBC NISP.

After contraction occur on last year, all parties are now longing for economic recovery in 2021. Various fiscal and monetary policies, as well as vaccinations that have been running, are expected to be catalysts that will drive recovery. The optimism that happens were also become the limelight in the International Monetary Fund (IMF) report conveyed by Bank Indonesia, which Indonesia’s policy synergy in facing pandemic is able to sustain economic recovery.

To support the economic recovery, the Government has provided a stimulus that is expected to encourage public consumption, particularly the upper middle class, including reduced down payments for motor vehicle loans and housing loans, as well as a reduction in the BI 7-Day Reverse Repo Rate or the benchmark interest rate. As a result, several economic indicators appear to have started to recover, such as the manufacturing PMI which expanded by 52.2 and foreign exchange reserves which managed to record an all-time high of USD 138 billion. These indicators indicate that Indonesia's fundamentals are in a good category in the midst of the vaccination process and this is expected to be a positive catalyst for economic recovery.

“Bank OCBC NISP saw this economic recovery indications needs to be a consideration for customers in determining the next financial decision and we are ready to be our traveling companions by providing integrated financial solutions," Johannes added.

Bank OCBC NISP provides a various investment alternative product that can be accessed both offline and online via ONe Mobile. In addition, the OCBC NISP Wealth Panel also regularly provides economic and investment insights through the ONe Wealth series on the YouTube channel of Bank OCBC NISP, monthly outlook and wealth daily on the ONe Mobile application. This can be used by premier and private customers to maximize their financial management.

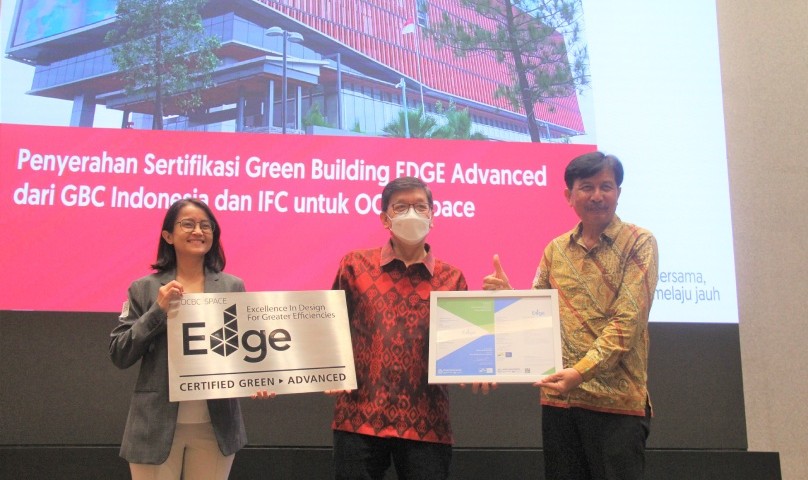

Johannes continued that with a strong capitalization and sustainable performance, Bank OCBC NISP will spur itself to continue #GoFarBeyond and turning challenges into opportunities. In addition to its commitment as a Responsible Banking Activities, Bank OCBC NISP is also committed to Maintain Positive Performance thus Customers could Feel Secure and of course Providing a Positive Impact on Social and Environmental Life in order to continue to accompany customer progress, through the provision of banking services in accordance with the stages customer business to achieve further growth.

Sekilas Tentang Bank OCBC NISP

Bank OCBC NISP was established in Bandung in 1941 under the name Nederlandsch Indische Spaar en Bank Deposit. As per December 31st, 2020, Bank OCBC NISP serves its customers through 236 office networks in 57 cities in Indonesia, equipped with 592 Bank OCBC NISP ATM units, accesible in more than 102,000 ATM networks in Indonesia, as well as connected with more than 650 OCBC Groups ATM networks in Singapore and Malaysia. Bank OCBC NISP also serves its customers through digital channels, including mobile banking and internet banking, both for individual and corporate. Bank OCBC NISP is one of the banks with the highest credit ratings in Indonesia, with idAAA (stable) rating from PT Pemeringkat Efek Indonesia (PEFINDO) and AAA(idn)/stable from PT Fitch Ratings Indonesia.

Bank OCBC NISP

Corporate Communication Division

OCBC NISP Tower, Jl Prof Dr Satrio Kav 25, Jakarta 12940

Tel: 021- 25533888; Fax: 021-57944000

corporate.communication@ocbcnisp.com

Website : www.ocbcnisp.com

|

Aleta Hanafi Division Head aleta.hanafi@ocbcnisp.com, Mobile: 62-8119860068 |

Duhita Rahma Mahatmi (Gandis) Public Relations & CSR duhita.mahatmi@ocbcnisp.com Mobile: 62-8111071069 |

Masniar Hutajulu Public Relations masniar.hutajulu@ocbcnisp.com Mobile: 62- 85218211636 |

Achievement - 29 Feb 2024

Achievement - 14 Nov 2023