Jakarta, April 30th, 2021 – Bank OCBC NISP strives to support National economic recovery amidst COVID19 pandemic that has lasted more than a year. As Indonesians trusted partner for 80 years, Bank OCBC NISP focuses to advance financial literacy, MSME businesses development, and sustainability.

Disruption caused by the pandemic has accelerated Bank OCBC NISP’s innovations and initiatives in providing financial solutions for the society — both individual customers and small enterprises to corporate customers –.

“Understanding the challenges faced by our customers, we continue to accelerate our capability in serving as intermediary function based on prudent principle, and present various banking solutions that support corporate and individual customers to maintain their financial health. The Bank will continue to strengthen digital solutions to answer various simple and complex needs of our customers. We also continue our commitment to take greater part supporting business sustainability through business financing that has positive impacts towards economy, social and environment,” said Parwati Surjaudaja, President Director of Bank OCBC NISP.

Prudent principle to run intermediary function

During the economic recovery, Bank OCBC NISP is committed to prioritize prudent principle in its intermediary function. In the first quarter of 2021, Bank OCBC NISP was able to post 13% yoy, hence Total Deposits amounted IDR155 T. The Bank’s low-cost funding or CASA composition rose from 42.2% in December 2020 to 45.1% in March 2021. The increase in CASA was also one of the factors that contributed to the Bank’s Net Interest Income, which increased 10% yoy to IDR1.9 Trillion.

As part of its intermediary function, Bank OCBC NISP disbursed loans of IDR114.9 Trillion until the end of March 2021. NPL (non-performing loan) net stood at 0.8% and NPL gross around 2.0%, below the average NPL of banking industry. By implementing prudent principles, the Bank also recorded a sustainable performance of IDR515 Billion Profit After Tax in first quarter 2021.

As one of the efforts to push economic growth, Bank OCBC NISP provides financing solutions, including TAYTB Women Warriors, a loan program with beyond financial solution and competitive rates for womanpreneurs. Furthermore, to cater for MSME business owners, the Bank has also introduced KTA Cash Biz, a loan program up to IDR200 mio which can be applied online. Bank OCBC NISP has also provided a competitive rate of 1.8% p.a. (for first year) through KPR Easy Start to cater for eco-friendly sustainable green housing.

Support for Corporate Customers

To support corporate customers in responding to challenges caused by the pandemic, Bank OCBC NISP provides comprehensive banking solution supported by internet and mobile-based services, Velocity@ocbcnisp. Velocity@ocbcnisp service can be adjusted according to customers business scale, as such it receives positive feedback from corporate customers. This is reflected through transaction value of the channel that rose by 63% in 1st quarter of 2021. On the other hand, transaction frequency also increased by 9% yoy and number of users by 15% yoy.

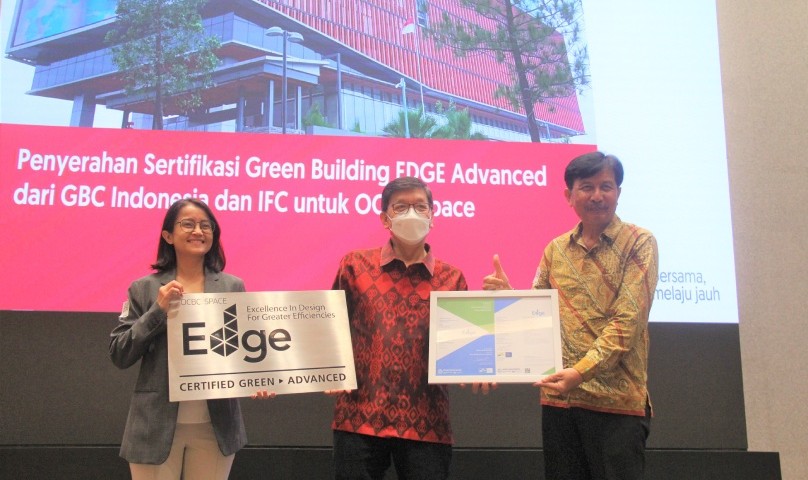

Bank OCBC NISP continues its commitment to present sustainable financial solution that supports customers to #GoFarBeyond by providing positive impact to social, economy, and environment. This commitment has been responded by corporate customers. As per March 31st, 2021, the Bank’s sustainability financing reached 27% of the total credit, while green financing reached 41%. This green financing is used to finance sustainable projects, such as the green buildings, water management, renewable energy, energy efficiency, etc.

Support for Individual Customers

In order to support Indonesians to #MelajuJauh being financially fit, Bank OCBC NISP continues to strengthen ONe Mobile’s capacity as a Comprehensive Money Manager at hand, which not only to fulfill the needs of customers transaction but also to help customers manage their finances and investments, which assist them to reach their financial aspiration. Beyond just the capability to do saving or daily payment transaction needs, ONe Mobile provides comprehensive features such as account portfolios, latest market insights, and investment products’ transaction & evaluations. Moreover, customers can apply housing loan facilities (KPR) through ONe Mobile to own their dream houses or as an investment property.

ONe Mobile utilization continues to increase, as reflected in the number of application downloads, which reached almost 1 mio in 2020. Customer’s convenience in using ONe Mobile also increases, as reflected in transaction frequency and value for ONe Mobile. In 1st quarter of 2021, number of users has grown by 32%, in comparison to same period of previous year.

Individual customer convenience in using ONe Mobile is not limited to only banking transactions. Customers can also enjoy the easiness of investment on the go provided by ONe Mobile. Our digital channel enables them to purchase investment products online, including time deposits and customer deposits. The number of customer deposits opened through digital channels increased by 21% yoy.

Furthermore, Bank OCBC NISP is also committed to continue innovating to bring banking closer to the customers through OCBC NISP OmniChannel Banking Experience. Not only customers receive 24/7 banking services with ONe Mobile, but now customers who need advisory services can utilize Mobile Relationship Manager or visit the Bank’s Branch offices, which was specially designed to enable comfortable discussions for customer’s financial aspirations.

“Moving forward, we believe the needs in sustainable financing or digital services will grow. For us, both initiatives need to be accelerated in order to support sustainable corporate performance as well as national economic recovery. This is our concrete support to position the nation as one of the world’s economic leader,” Parwati ended.

The overview of financial reports and financial ratios as of March 31st , 2021, are available in the attached factsheet.

About Bank OCBC NISP

Bank OCBC NISP was established in Bandung in 1941 under the name Nederlandsch Indische Spaar en Bank Deposit. As per March 31st, 2021, Bank OCBC NISP serves its customers through 235 office networks in 57 cities in Indonesia, equipped with 561 Bank OCBC NISP ATM units, accessible in more than 100,000 ATM networks in Indonesia, as well as

connected with more than 640 OCBC Groups ATM networks in Singapore and Malaysia. Bank OCBC NISP also serves its customers through digital channels, including mobile banking and internet banking, both for individual and corporate. Bank OCBC NISP is one of the banks with the highest credit ratings in Indonesia, with idAAA (stable) rating from PT

Pemeringkat Efek Indonesia (PEFINDO) and AAA(idn)/stable from PT Fitch Ratings Indonesia

Bank OCBC NISP

Corporate Communication Division

OCBC NISP Tower, Jl Prof Dr Satrio Kav 25, Jakarta 12940

Tel: 021- 25533888; Fax: 021-57944000

corporate.communication@ocbcnisp.com

Website : www.ocbcnisp.com

|

Aleta Hanafi Division Head aleta.hanafi@ocbcnisp.com, Mobile: 62-8119860068 |

Duhita Rahma Mahatmi (Gandis) Public Relations & CSR duhita.mahatmi@ocbcnisp.com Mobile: 62-8111071069 |

Masniar Hutajulu Public Relations masniar.hutajulu@ocbcnisp.com Mobile: 62- 85218211636 |

Achievement - 29 Feb 2024

Achievement - 14 Nov 2023