2022 Annual General Meeting Shareholder of Bank OCBC NISP

Bank OCBC NISP’s positive growth is the result of consistent development and implementation of continuous strategy to provide beyond-banking services supported by digitalization initiatives

Shareholders’ resolution on five meeting agenda

Bank OCBC NISP held the Annual General Meeting of Shareholders (AGMS) on Tuesday, 5 April 2022 and received approval for all of its meeting agenda. The five meeting agenda were as follows:

- The Company’s Annual Report including the Report of the Board of Directors and the Supervision Report of the Board of Commissioners for the financial year of 2021

- (i) The determination of the appropriation of the Company’s net profit of the financial year of 2021 of IDR 2.5 T for:

- 20% or amounted to IDR 504.8 billion or IDR22 per share is determined as cash dividend

- IDR 100,000,000 is set aside for general reserves

- The remaining net profit of IDR 2 T is determined as retained earnings

(ii) Grant authority to the Board of Directors with the substitutions right to set dividend payment of the financial year of 2021 in accordance with the applicable provisions.

- Buyback of Company’s shares at a maximum of 436,000 shares to provide variable remuneration following the prevailing Indonesia’s Financial Services Authority Regulation (POJK) in accordance with the prevailing law and regulation.

- Changes in the Company management’s composition:

- The reappointment of Rama P. Kusumaputra as Independent Commissioner, Andrae Krishnawan W. and Johannes Husin as Directors, effective since the closing of the Meeting until the closing of the Company’s AGMS in 2025.

- The appointment of Na Wu Beng as Commissioner, effective after obtaining OJK’s approval until the closing of the Company’s Annual General Meeting of Shareholders (AGMS) in 2025.

- The resignation of Hardi Juganda as Independent Commissioner as of the effective appointment of Na Wu Beng as Commissioner.

- The delegation of authority and power of attorney to the Board of Commissioners to appoint a Public Accountant and Public Accounting Firm to audit the Company’s Financial Statements for the financial year 2022.

Positive performance as the economic activity improves

- The positive performance throughout 2021 strengthened Bank OCBC NISP's position in contributing and boosting Indonesia's economic recovery. Bank OCBC NISP recorded an increase in net profit of 20% yoy or reached IDR 2.5 trillion which was driven by net interest income’s increase of 7% yoy and accompanied by a decrease in allowance for impairment losses of 7% yoy. On the other hand, other operating income decreased 8% and operating expenses increased 2% yoy.

- Bank OCBC NISP recorded a total deposits growth of 6% YoY at IDR 168 T, of which the low-cost funding or CASA contributes 51% (current account and savings account), and the rest of its 49% are Time Deposits. Bank’s Total Assets are grown at 4% to IDR 214.4 trillion at the end of 2021.

- In line with the banking industry, Bank also succeeded to record its loan disbursement growth of 5% to IDR120.8 trilion which is supported by retail loans. The Bank also fulfilled its intermediary function based on prudent principle, which reflected in its well-maintained NPL ratios below banking industry’s average NPL and regulatory requirement, Bank’s net NPL stood at 0.9% and Bank’s gross NPL stood at 2.4%.

- The Bank is able to keep its Capital Adequacy Ratio - CAR at the end of 2021 at 23.0%, above the regulatory requirement level. The Bank also maintained its efficiency ratios, with Cost-to-Income Ratio at 43.4% and Operating Expenses to Operating Income Ratio (BOPO) at 76.5%.

“Our main focus in 2021 is to support our customers to adapt during the pandemic’s challenges. We continue to accelerate and transform the Bank's capabilities to deliver relevant innovations and initiatives for individual customers in managing and growing their funds as well as our corporate customers in maintaining and growing their business. Our digitalization services that are well received by our customers, contributed positive growth of Bank OCBC NISP's performance. This will be our fundamental assets to realize our (Bank’s) vision ‘To become a trusted partner to enrich the quality of life’,” said the President Director of Bank OCBC NISP, Parwati Surjaudaja.

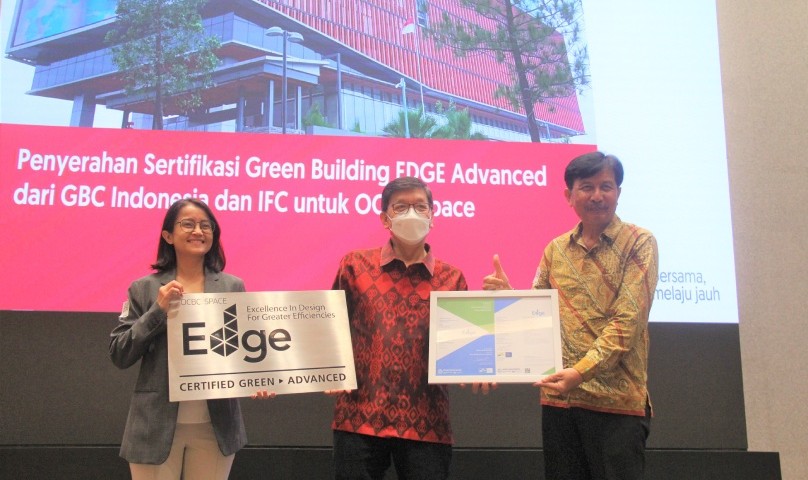

Commitment to sustainable financing

- Bank OCBC NISP sees that green financing is an important part of a smart economy that must be continuously encouraged. As one of the 10 largest banks in Indonesia in terms of assets and part of the Indonesian Sustainable Finance Initiative (IKBI), Bank OCBC NISP is committed to provide sustainable financial solutions for retail and corporate customers to #MelajuJauh (GoFarBeyond), giving positive impact to the environment and society.

- The Bank will continuously explore potential debtors or debtors whose businesses are engaged in sectors that support green financing. As of December 31st, 2021, Bank has already disbursed IDR 30.89 trillion of sustainability financing, and of which 40% are green financing disbursement.

- Bank OCBC NISP’s commitment towards sustainable financing is also reflected in its TAYTB Women Warrior program which disbursed to business players that practice gender equality aspects. Until December 2021, the Bank has disbursed financing to more than 1,000 women Moving forward, the Bank will continuously innovate and assist Indonesian Women to expand their business potentials, which is pivotal in contributing to the economy.

Commitment to shape Indonesia’s #FinanciallyFit society

- Bank OCBC NISP sees the importance of increasing financial literacy and inclusion as the fundamental of the Nation's economic strength. Therefore, the Bank continuously innovates its various financial literacy and inclusion initiatives in effort to build financially fit generation.

- Bank OCBC NISP launched the Financial Fitness solution by NYALA OCBC NISP in 2021 to encourage Young Indonesians to be financially fit; shifting away the mindset of getting rich to be fit with savings, emergency funds, protection, to investments. Furthermore, the Bank also published The Financial Fitness Index survey that shows average young Indonesians has low - financial fitness score. Moreover, Bank introduced Financial Fitness Gym by Nyala OCBC NISP, the first gym-branch office concept in Indonesia to meet the needs of financial literacy and inclusion.

- In the same year, Bank OCBC NISP actively conducts financial literacy programs through Ruang MeNYALA webinars, financial EducatiON classes, and other educational activities. Approximately total of 72,000 participate in the programs. The Bank’s educational content is also available through Bank’s owned digital and social media platform.

- Bank OCBC NISP’s commitment to educate Indonesian towards the importance of financial management also received a positive outcome. It is shown in the increasing interest of customers to grow their funds through investment products. In December 2021, transactions for wealth management products for mutual funds, bancassurance, and securities products experienced an increment in revenue by 15% yoy. Fee-based income from the wealth management business also made a positive contribution, amounting to 25% of the total fee-based income of Bank OCBC NISP.

- Bank OCBC NISP also recorded an increase interest among Young Indonesians especially Generation Z, to get their own house. This was reflected in the 2021 23% YoY mortgage distribution increase. One of the Bank's flagship products is KPR Easy Start, a housing ownership loan with an affordable and step up installment scheme.

Digital capabilities acceleration to assist Customers

- In 2021, Bank OCBC NISP enhanced its ONe Mobile’s banking capabilities to be more convenient, modern, intuitive, and hassle-free. ONe Mobile aimed to help customers to grow and achieve their financial aspiration through financial and investment management features available in the application. In addition, QRIS payment feature is also added in ONe Mobile.

- ONe Mobile capabilities to grow money and fulfill daily transaction have received a positive response from customers. The number of transactions made by customers through ONe Mobile throughout 2021 has increased by 17%, transaction value increased by 20%, and the number of users increased by 19% compared to 2020.

- In addition to digital services for individual customers, Bank OCBC NISP has also advanced the Velocity@ocbcnisp feature for corporate customers to provide flexibility and convenience in doing transactions anytime and anywhere. Bank Guarantee feature was also added in velocity@ocbcnisp to simplify customer access on bank guarantee services.

- Velocity@ocbcnisp’s enhancement received a good response from corporate customers, as reflected in the increase in usage throughout 2021, the value of transactions through velocity@ocbcnisp grew 64%, while total transactions and numbers of users grew 20% and 11% respectively compared to 2020.

“Digital services are now becoming inseparable in our modern life. This motivates us to consistently accelerate our digital capabilities in providing convenience to fulfil our customer financial needs. Digitalization played as an important enabler in realizing our commitment to deliver sustainable innovation,” Parwati added.

Collaboration to empower MSME’s business actors and start-ups

- Bank OCBC NISP understands the challenges faces by business players. This motivates Bank to continue help support MSMEs going beyond than financing. To further revive MSMEs businesses and boost Indonesian economy better, the Bank launched KTA CashBiz solution that allow customers to apply process, and get their loan online, without the need of going to the branch. Bank OCBC NISP also partners with fintech players to support MSMEs further.

- Bank OCBC NISP held the #ONPreneurship MENCARI JAGOAN LOKAL SEHAT, a collaborative ecosystem program to improve the quality and capability of MSMEs. The series of programs range from webinars, networking, and bootcamps aim not only to inspire, but also to provide practical solutions to business challenges in the new normal era, particularly related to digital, marketing, branding, financial, and funding aspects.

- Bank’s commitment to empower MSMEs through #ONPreneurship and W-talks education are consistently conducted. Throughout 2021, Bank OCBC NISP collaborated with partners to organize webinar education classes regularly with total of 5,243 participants.

###

Overview of Bank OCBC NISP

Bank OCBC NISP was established in Bandung in 1941 under the name Nederlandsch Indische Spaar en Deposito Bank. As of December 31, 2021, Bank OCBC NISP served customers through 211 office networks in 54 cities in Indonesia, equipped with 537 Bank OCBC NISP ATM units accessible at more than 100,000 ATM networks in Indonesia, as well as connected to more than 700 OCBC Group ATM networks in Singapore and Malaysia. Bank OCBC NISP also serves customers through various digital channels, including mobile banking and internet banking – both for individuals and corporations. Bank OCBC NISP is one of the banks with highest credit ratings in Indonesia, namely idAAA (stable) from PT Pemeringkat Efek Indonesia (PEFINDO) and AAA (idn)/stable from PT Fitch Ratings Indonesia.

Bank OCBC NISP

Brand & Communication Division

OCBC NISP Tower, Jl Prof Dr Satrio Kav 25, Jakarta 12940

Tel: 021- 25533888; Fax: (62)-021-57944000

Email: brand.communication@ocbcnisp.com

Website : www.ocbcnisp.com

Aleta Hanafi Duhita Rahma Mahatmi (Gandis) Masniar Hutajulu

Division Head Brand & Communication Head Brand & Communication

aleta.hanafi@ocbcnisp.com, duhita.mahatmi@ocbcnisp.com masniar.hutajulu@ocbcnisp.com

Mobile: 62-8119860068 Mobile: 62-8111071069 Mobile: 62-8118439880