Jakarta, 29 March 2023 – Committed to continue implementing a sustainable business, Bank OCBC NISP received a Renewable Energy Certificate (REC) with a total supply equivalent to 11,000 (MWh). Through this REC, PLN will ensure that the electricity purchased by Bank OCBC NISP is produced from renewable energy power plants and will be used in all Bank OCBC NISP branches throughout Indonesia.

Renewable Energy Certificate (REC) is a certificate given to companies that use clean energy in their business operations, and is one of PLN's green product innovations to make it easier for companies to get recognition for using EBT that is transparent, accountable and internationally recognized. The certificate is a document that proves the production of Electric Power per MegaWatt-hours (MWh) comes from Renewable Energy Power Plants.

Filipus H. Suwarno, Head of Operations & Information Technology Bank OCBC NISP stated “Bank OCBC NISP believes that implementing a sustainable business must be carried out from upstream to downstream, including in the bank's daily operations. Therefore, we are committed to implement responsible operational practices and contribute positively to make a friendlier environment. Purchasing REC from PT PLN is our concrete step in consistently and continuously implementing Environmental, Social, and Governance (ESG).”

He also added that Bank OCBC NISP's commitment to become an environmentally friendly company is reflected in the availability of Solar Panel facilities in its new office building called ON Space, located in BSD, Tangerang.

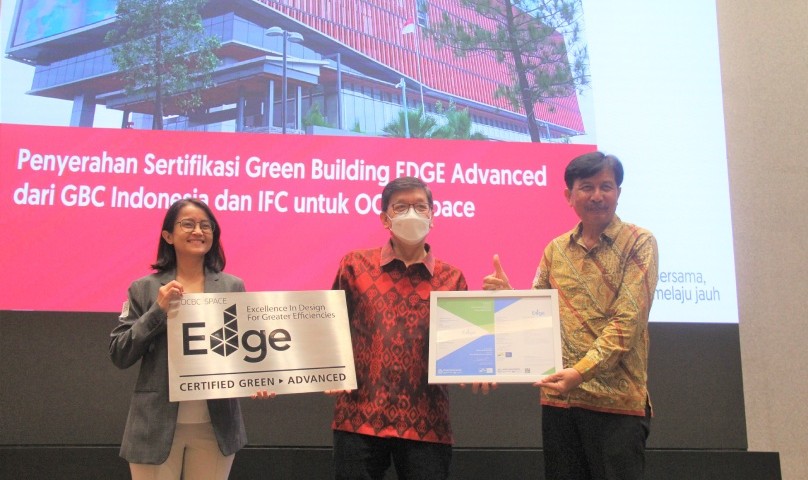

Aside from just using renewable energy, Bank OCBC NISP also received IFC EDGE green building certification on July 25, 2022, for its ON Space Building. Its design, construction, and operations consider sustainability, pollution reduction (net zero carbon), and increase employees and communities quality of life. Following the certification, Bank OCBC NISP has made 28% energy savings, 61% water savings, and 25% savings on embodied energy material use.

Bank OCBC NISP is also the first private bank in Indonesia to receive funding from IFC for both green and gender bonds. The Bank also provides green financing to support customers in implementing ESG principles, and always strive to educate the public and debtors regarding ESG principles implementation that emphasize sustainable environment and operations.

Inu Supriyanto, Senior Manager of Commerce and Customer Service at PLN Unit Induk Distribusi (UID) Jakarta Raya, said, “We appreciate Bank OCBC NISP's contribution in supporting clean energy transition program by utilizing REC. We hope the steps taken by the Bank will inspire more companies in Indonesia to switch using renewable energy power plants."

REC is an international standard certificate for the production of electricity generated from renewable energy plants. In 2022, the use of REC in Jakarta reached 137,439 units, or equivalent to 137,439 MWH of green energy has been distributed to customers.

“PLN is ready to collaborate to achieve carbon emissions reduction target. Not only REC, but it also includes the development of the electric vehicle ecosystem,” convey Doddy B. pangaribuan, General Manager PLN UID Jakarta Raya,

Doddy added that through the REC, PLN provides options for providing an easy and more affordable renewable electricity.

Customers can purchase PLN REC, both for individuals and corporations through website https://layanan.pln.co.id/renewable-energy-certificate.

This REC from PLN uses an international standard electronic tracking system to ensure that once the certificate is issued, it cannot be bought or sold to other parties.

Overview of Bank OCBC NISP

Bank OCBC NISP was established in Bandung in 1941 under the name Nederlandsch Indische Spaar en Deposito Bank. As of 31 December 2022, Bank OCBC NISP serves customers through 200 office networks in 54 cities in Indonesia. Furthermore, customers could conduct transaction through the Bank's 496 ATM, more than 98,000 ATM networks in Indonesia, and connected to more than 600 OCBC Group ATM networks in Singapore and Malaysia. Bank OCBC NISP also serves customers through various digital channels, including mobile banking and internet banking – both for individuals and corporations. Bank OCBC NISP is one of the banks with the highest credit ratings in Indonesia, namely AAA(idn)/stable from PT Fitch Ratings Indonesia.

Brand & Communication Division, Bank OCBC NISP

OCBC NISP Tower, Jl Prof Dr Satrio Kav 25, Jakarta 12940

Tel: 021- 25533888; Fax: 021-57944000

brand.communication@ocbcnisp.com

Website : www.ocbcnisp.com

|

Aleta Hanafi Division Head aleta.hanafi@ocbcnisp.com, Mobile: 62-8119860068 |

Novi Henriatika Publicist novi.henriatika@ocbcnisp.com Mobile: 62-8119812329 |

Achievement - 29 Feb 2024

Achievement - 14 Nov 2023