Overnight, reflation trades have surged across the board despite fears over winter virus waves

First, December’s manufacturing survey from the US Institute of Supply Management (ISM) hit its highest level since 2018, rising from 57.5 to 60.7.

Second, Saudi Arabia surprised oil markets by announcing it would cut production by 1 million barrels a day despite other OPEC members and Russia wishing to increase oil output.

Third, Chicago Federal Reserve President Evans signalled how the central bank is now willing to tolerate inflation rising temporarily above its 2% goal - under its new strategy of average inflation targeting - by noting: ‘I welcome above 2% inflation. Frankly, if we got 3% inflation that would not be so bad.’1

Fourth, vote counting shows the Democrats have a strong chance of unexpectedly winning both of Georgia’s Senate seats, enabling the incoming Biden administration to push stronger fiscal stimulus through Congress in future.

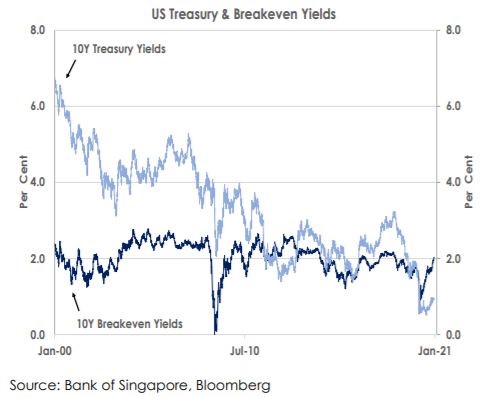

Financial markets have responded strongly. The first chart shows 10Y US Treasury yields have hit 1.00% for the first time since March 2020 when 10Y US Treasury yields fell to 0.31%. Inflation expectations have also increased with 10Y breakeven rates rising above 2.00%. Brent oil has jumped from USD50 to USD54 and copper has reached USD8,000 for the first time in eight years.

Resurgent reflation underscores our view that the economic outlook will keep favouring risk assets in 2021 to the detriment of the safe-haven USD.

Under its new strategy of seeking inflation to average 2%, we expect the Fed will keep its fed funds rate unchanged at 0.00-0.25% until 2024-25 - to induce inflation to exceed 2% and thus make up for the past few years when inflation fell short of the Fed’s 2% goal. This is likely to push US real interest rates deeper into negative territory. As the second chart shows, 10Y real yields are already at record lows of -1.07%, to the clear benefit of gold and other zero yielding commodities.

The Fed’s dovishness will thus keep supporting reflation trades while weakening the USD further. We forecast gold will make new highs above USD2,100, 10Y Treasury yields to rise further to1.20% over 2021 - but still remain at historically low levels - and the EUR and CNY to reach 1.25 and 6.30 against the falling greenback.

Source

1. https://www.bloomberg.com/amp/opinion/articles/2021-01-06/treasury-yields-hit-1-now-comes-the-hard-part

This article was first published by Bank of Singapore on January 6, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.