China recovery keeps the country to be the only economy with full year growth in 2020

Highlights

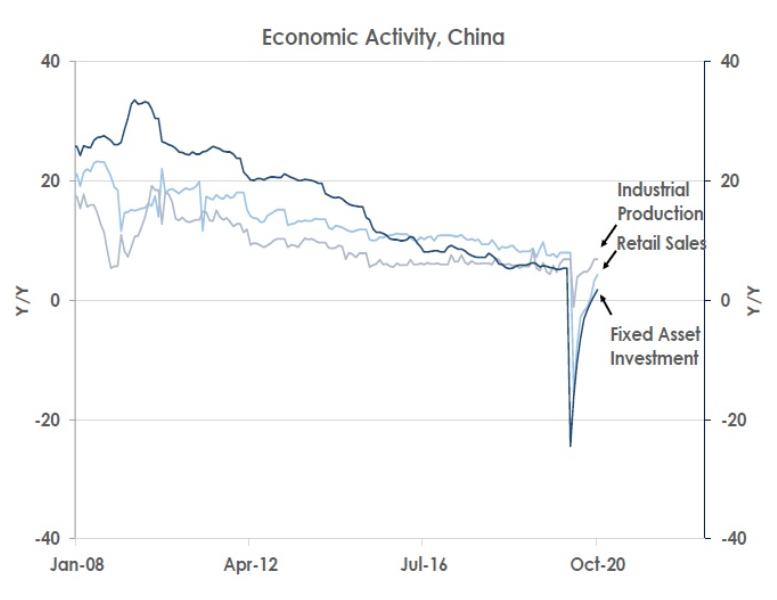

October’s monthly activity data shows China’s V-shaped recovery continues to strengthen at the start of Q4’20 with industrial production, retail sales and fixed asset investment rising by 6.9%YoY, 4.3%YoY and 1.8%YoY, respectively.

Source: Bank of Singapore, Bloomberg

China’s industrial production growth has already recovered to levels just below 7.0%YoY that it was expanding at prior to the pandemic breaking out in Q1’20. This reflects the authorities’ early push for state-owned enterprises to re-start supply side activities from Q2’20 onwards.

But in Q3’20 and now Q4’20, China’s demand side is also catching up with supply, showing the rebound is broadening and becoming more sustainable. Retail sales have not recovered yet to pre-crisis growth rates of 8.0%YoY, but China’s consumers are spending more now as fears of the virus recede.

Source: Bank of Singapore, Bloomberg

Similarly, the growth of fixed asset investment - another key demand side indicator - has now returned to positive territory in YoY terms as the chart opposite shows.

Source: Bank of Singapore, Bloomberg

A more even balance between China’s demand and supply side will allow the recovery to continue. We thus maintain our forecast for GDP to expand by 2.5% in 2020 and 8.1% in 2021, projecting the economy to be 10% larger at the end of 2021 compared to the close of last year.

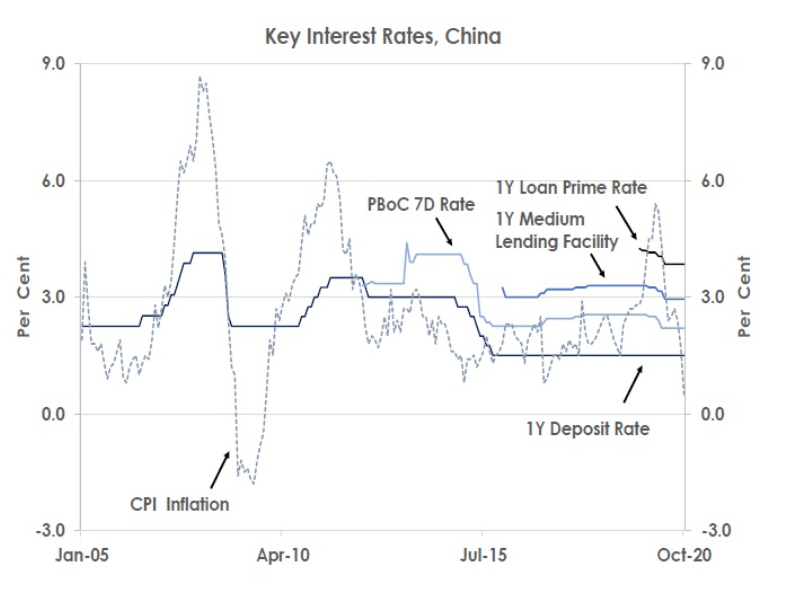

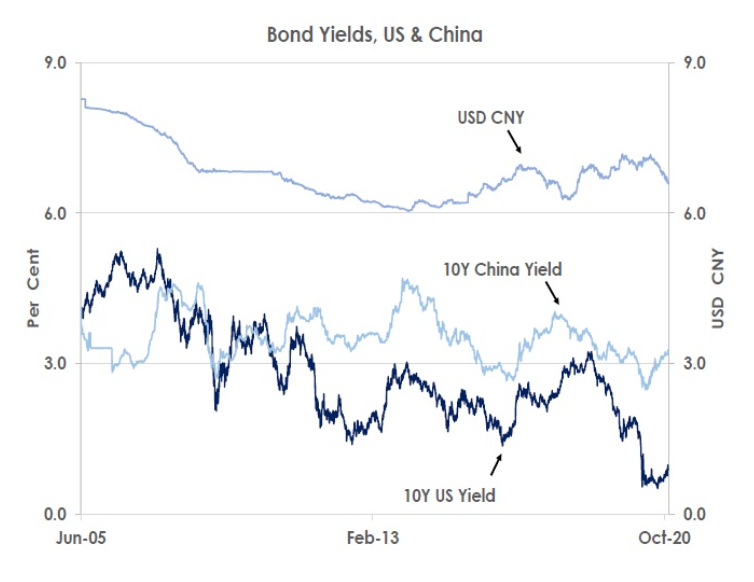

At the same time, October’s consumer prices only rose by 0.5%YoY as the chart above shows. The benign inflation picture will allow the People’s Bank of China to let the recovery keep running without having to raise interest rates. The economy’s sweet spot continues to support local risk assets and the CNY with the currency nearing our one year forecast of 6.55 against the USD.

This article was first published by Bank of Singapore on November 16, 2020. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.