There is potential for higher oil prices in 2021 as travel disruptions diminish amid vaccine progress

Highlights

Oil fundamentals are on the right track to warrant an upgrade to the 12-month Brent forecast to USD56/bbl (old: USD50/bbl). There is potential for higher oil prices in 2021 as travel disruptions diminish amid vaccine progress and with the OPEC+ likely to delay January's oil output increase.

Oil had been struggling in the recovery of risky assets and only recently picked up. Despite the current second Covid wave in the US and Europe and uncertainty around the resolutions of the ongoing OPEC meeting, the medium-term oil demand outlook is turning increasingly positive amid vaccine progress that could break the link between infection and mobility.

Vaccine progress is good news for medium-term oil demand outlook

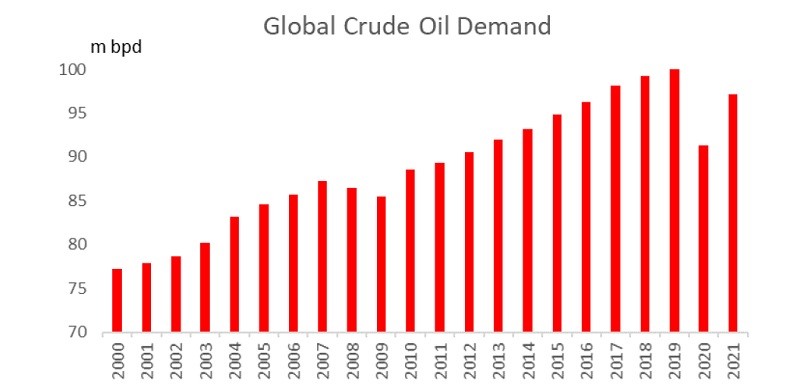

Note: IEA projections for 2020 and 2021. Source: Bloomberg, International Energy Agency (IEA), Bank of Singapore

Although uncertainties remain on logistics and the roll-out timeframe, vaccine roll-out -- when it happens -- should lead to normalisation of economic activity, especially in sectors that have a relatively high correlation with oil demand, such as travel, hospitality and food services. US energy demand, for example, is still principally driven by transportation (68% according to the US Energy Information Administration) and industrial (26%).

We expect OPEC+ will continue to fine-tune the duration of its pledged voluntary supply cuts with market developments. The near full reinstatement of Libya’s oil supply suggests that the additional supply from OPEC+ may not be needed just yet. With OPEC+ likely to delay its planned January ramp-up, this should help limit the near-term risk of oil markets tipping back into glut.

A significant revival of US shale oil output is unlikely anytime soon

Note: Bloomberg, Baker Hughes, US Dept of Energy, Bank of Singapore

A significant revival of US shale oil output looks unlikely until 2H 2021, at the earliest after months of minimal capital spending. US oil production is also likely to see limited growth under Biden’s presidency, although fears of a “Green New Deal” that severely limits and/or raises the regulatory cost of US oil production seem exaggerated.

The possibility of more Iranian oil hitting the market is a bearish risk for 2021 oil outlook on the supply front. While US sanctions on Iranian oil could eventually ease, we do not expect a restart of US-Iran negotiations until after Iran holds its own presidential election in June 2021.

Vaccine progress could help oil catch up with the rally in industrial metals. We see “catch-up” potential for oil-linked currencies (e.g. CAD, NOK and RUB) in 2021 relative to the 2020 commodity outperformers (AUD, NZD) that have benefitted from the rally in industrial metals and on the back of improving Asian growth.

This article was first published by Bank of Singapore on December 9, 2020. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.