US inflation has jumped above the Federal Reserve’s 2%, target raising fears the central bank may start tapering its quantitative easing this year to the detriment of risk assets

Highlights

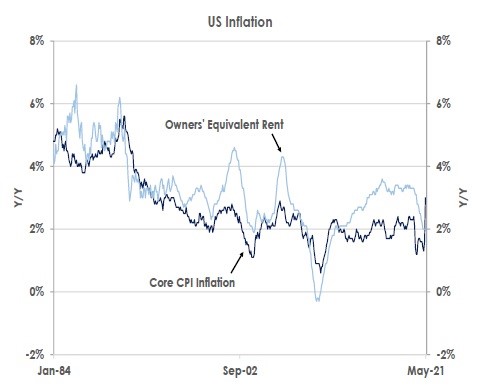

April’s gains in both the US consumer price index (CPI) and the producer price index (PPI) were far greater than expected, pushing core inflation - excluding volatile food and energy costs - above the Federal Reserve’s 2% goal. Core CPI jumped by 0.9%, its largest monthly gain since 1981, lifting its YoY rate from 1.6% in March to 3.0% in April as the chart shows. Core PPI also surged by 0.7% last month, increasing its YoY rate from 3.1% to 4.1%.

April’s huge MoM rise in CPI was driven by goods shortages and surging demand for services as the economy reopened. For example, second-hand car prices jumped by a record 10.0%MoM after semiconductor shortages globally reduced vehicle production. At the same time, increased demand for services from the reopening caused hotel and other lodging costs to leap by 7.6%MoM and air fares to spike by 10.2%MoM.

April’s CPI and PPI data show near-term inflation risks are significant. But it remains unclear that core inflation will escalate significantly beyond the Fed’s 2% target after the initial surge in prices caused by the economy’s reopening in Q2’21.

First, ‘base effects’ are exaggerating inflation rates. In April 2020, prices fell sharply at the start of the pandemic. Thus, comparing prices now to a year ago makes inflation appear higher.

Second, as the economy reopens and activity returns to pre-pandemic levels, the current sharp increases in services prices are likely to abate.

Similarly, supply chain disruptions should ease over time, reducing upward pressure on good prices. Thus, near-term surges in costs may prove to be only ‘cyclical’ or temporary with prices stabilizing again once the US economy has fully reopened and returned to pre-crisis levels

Third, more persistent or ‘structural’ sources of inflation were tamer in April. Owners’ equivalent rents (OER) rose by 2.0% - as the chart shows - well below the overall 3.0% core CPI rate. Healthcare costs were muted in both the CPI and PPI reports.

Thus, officials continue to see near term rises in core inflation above the Fed’s 2% target being only temporary. Vice Chair Clarida said after April’s CPI data: ‘these one-time increases in prices are likely to have only transitory effects on underlying inflation, and I expect inflation to return to - or perhaps run somewhat above - our 2 percent longer-run goal in 2022 and 2023.’

The Fed’s target measure of inflation - changes in personal consumption expenditures (PCE)- will be released on May 28 for April. Following the CPI and PPI reports, core PCE inflation is also set to jump from 1.8% to 2.8%YoY. But if core PCE inflation for May and June peaks near 3% before falling back towards 2% during the rest of 2021 - as we expect - then the Fed will look through near-term rises in inflation and keep supporting the recovery. Thus, the central bank would still benefit risk assets by not tapering its quantitative easing until 2022 nor lifting interest rates until 2024.

This article was first published by Bank of Singapore on May 14, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.