The US labour market generated 559,000 jobs in May, double the pace of April’s gains, as America’s economy reopened from the pandemic.

HighlightsThe US labour market generated 559,000 jobs in May, double the pace of April’s gains, as America’s economy reopened from the pandemic. The unemployment rate fell from 6.1% to 5.8% and average hourly earnings showed firm wage growth of 0.5%MoM (2.0%YoY).

Last month’s solid job increases, however, are still unlikely to be sufficient for the Federal Reserve to discuss tapering its quantitative easing yet.

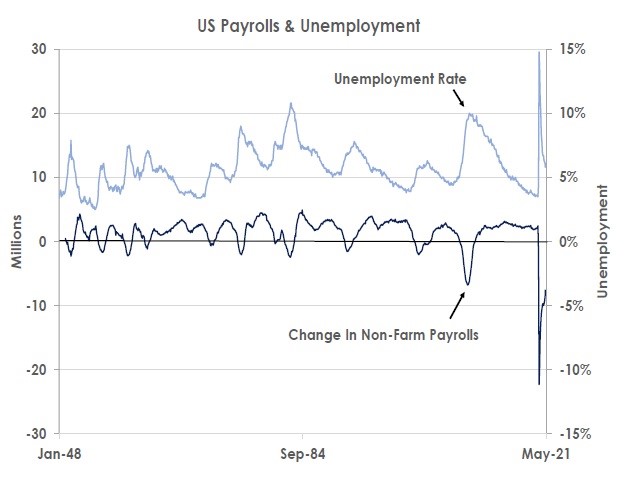

The Fed has said it wants to see ‘substantial further progress’ towards reaching its goals of maximum employment and stable 2% inflation before it will consider scaling back its USD120 billion a month of bond buying. The first chart above shows payrolls are still 7.6 million jobs lower than their pre-pandemic levels.

Similarly, the second chart shows the labour market continues to have considerable slack despite the US economy booming as it reopens.

Unemployment at 5.8% is still well above its 3.5% rate prevailing at the start of 2020. Labour force participation at 61.6% is almost two percentage points below its pre-crisis level of 63.4% and the employment-to-population ratio at 58.0% is three percentage points lower than early 2020.

Thus, the Fed is likely to keep looking through summer increases in inflation above its 2% target - consumer price rises the central bank sees as only temporary as the economy reopens - and wait instead for further jobs gains this year before tapering its quantitative easing in early 2022.

May’s firm wage growth of 0.5%MoM signals some employers are finding it hard to hire new employees despite the overall slack in the labour market. But the supply of new workers is likely to improve as vaccinations reduce fears of returning to work, schools re-open and jobless benefit top-ups end in September.

We therefore see the Fed staying dovish in 2021 and only start tapering in early 2022 - a stance that benefits risk assets, keeps US Treasury yields low and weighs on the USD. Tellingly, after the jobs data on Friday, the S&P closed near record highs at 4,230, 10Y Treasury yields fell to 1.55% and the EUR rallied above 1.2150 against the USD in line with our bullish 12-month forecast of 1.25 for the single currency versus the greenback.

This article was first published by Bank of Singapore on June 7, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.