Bank of England takes a break

Overnight, the Bank of England (BoE) made no changes to its monetary policy settings. Its Bank Rate remains at 0.10% and its quantitative easing target - to print money and hold GBP895 billion of bonds - was also kept unchanged.

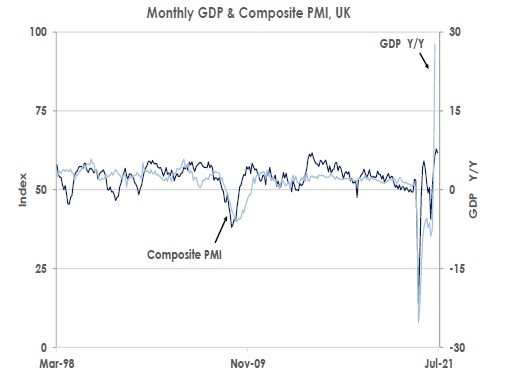

The BoE raised its near-term forecasts as the UK reopens. It now expects Q2’21 GDP to rise by a sharp 5.5%QoQ as lockdown restrictions are lifted. In April, UK GDP already increased by 2.3%MoM, almost 28% higher than a year ago when Britain was suffering its first lockdowns. The chart above also shows the UK’s purchasing manager indices (PMIs) of business sentiment hit record highs of 62.9 in May and 61.7 in June, further underscoring the strength of the UK economy’s recovery in Q2’21.

The BoE’s Monetary Policy Committee (MPC), however, decided not to further taper its pace of bond buying just yet despite the rebound.

First, the MPC sees consumer price index (CPI) inflation this year above the BoE’s 2% target being only temporary as the economy reopens: ‘CPI inflation was expected to pick up further above the 2% target in the months ahead, owing primarily to developments in energy and other commodity prices, and was likely to exceed 3% for a temporary period.’

Second, the MPC warned: ‘there had been a rise in the number of Covid cases in the United Kingdom, with the Delta variant making up almost all of the new cases over recent weeks.’

Third, there remains uncertainty over how low unemployment will remain - it is currently at 4.7% as the second chart shows - when the UK Jobs Retention Scheme subsidy ends in September.

The BoE, however, still remains on track to be the first major central bank to end quantitative easing altogether this year and to start lifting interest rates next year to the benefit of the GBP. The MPC has already started tapering its bond buying and has shown no desire to extend asset purchases when its current round finishes in December. Moreover, by the summer of 2022, the economy will largely have absorbed its spare capacity, letting the BoE begin raising its Bank Rate from its record emergency low of 0.10%.

This article was first published by Bank of Singapore on June 25, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.