Chairman Powell’s speech at the Federal Reserve’s annual gathering at Jackson Hole was dovish, lifting the S&P 500 to a new record high.

Chairman Powell’s speech at the Federal Reserve’s annual gathering at Jackson Hole was dovish, lifting the S&P 500 to a new record high.

First, Powell reinforced the Federal Open Market Committee’s (FOMC) view that the Fed may start tapering its quantitative easing this year if the US economy keeps recovering but still gave no specific timeline for when the Fed would begin reducing its asset purchases in 2021.

‘At the FOMC's recent July meeting, I was of the view, as were most participants, that if the economy evolved broadly as anticipated, it could be appropriate to start reducing the pace of asset purchases this year. The intervening month has brought more progress in the form of a strong employment report for July, but also the further spread of the Delta variant. We will be carefully assessing incoming data and the evolving risks.’

Second, Powell was optimistic about the labour market’s recovery but argued joblessness was still too high: ‘the unemployment rate has declined to 5.4 percent, a post-pandemic low, but is still much too high, and the reported rate understates the amount of labor market slack.’

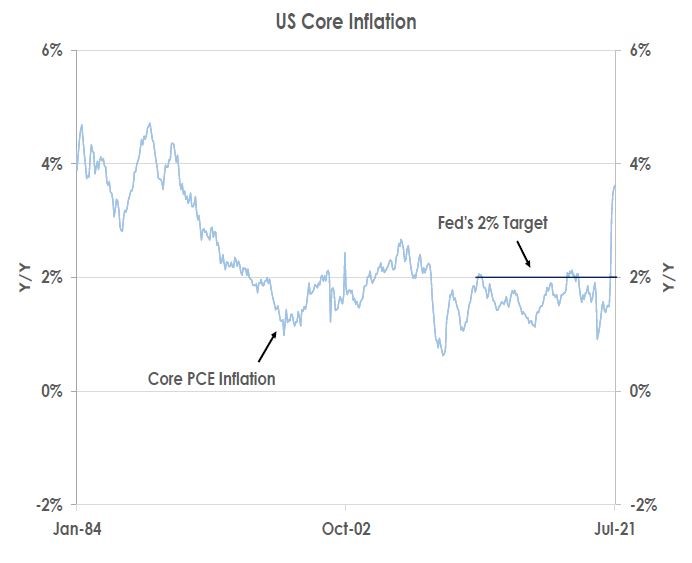

Third, the Fed Chair discussed why this year’s increases in inflation - the chart shows changes in core personal consumption expenditure (PCE) prices at 3.6% in July were well above the Fed’s 2% target - are still likely to be only temporary.

Source: Bank of Singapore, Bloomberg.

Powell argued that price rises were ‘so far largely the product of a relatively narrow group of goods and services that have been directly affected by the pandemic and the reopening of the economy’ while wage growth and inflation expectations remained in line with the Fed’s 2% inflation target. He also noted technology, globalization and aging were all likely to keep exerting downward pressure on inflation still.

Last, Powell said there was no direct link between the Fed tapering its asset purchases and when it would start raising interest rates.

‘The timing and pace of the coming reduction in asset purchases will not be intended to carry a direct signal regarding the timing of interest rate liftoff, for which we have articulated a different and substantially more stringent test.’

After Jackson Hole, the focus now turns to the US payrolls report for August due this week on Friday. If the labour market again generates large job gains - June’s and July’s payrolls increased by almost one million each - then the Fed is likely to warn further at its September meeting that it may start tapering its quantitative easing this year.

But the dovish Fed is still likely to wait for more evidence of recovery given the delta variant. Thus, we expect it will only formally announce in November that it will start cutting asset purchases from December. Thus, we think the Fed’s stance will continue to support risk assets this year.

This article was first published by Bank of Singapore on August 30, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.