The European Central Bank said it will conduct its quantitative easing at a ‘moderately slower pace’ as conditions improve in the Eurozone.

Highlights

The European Central Bank said it will conduct its quantitative easing at a ‘moderately slower pace’ as conditions improve in the Eurozone.

Source: Bank of Singapore, Bloomberg.

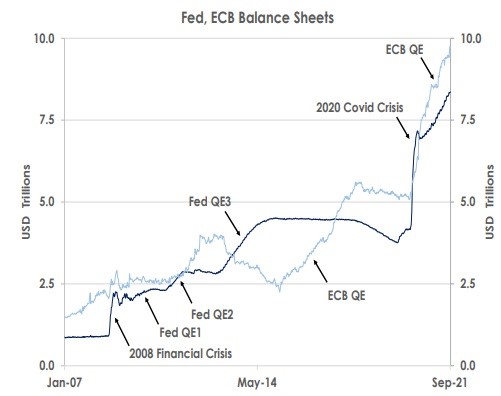

We expect the ECB will slow its monthly bond buying to EUR60 billion in Q4’21 from EUR80 billion in Q2’21 and Q3’21. Thus, it will likely return to its same pace as Q1’21 as the first chart shows.

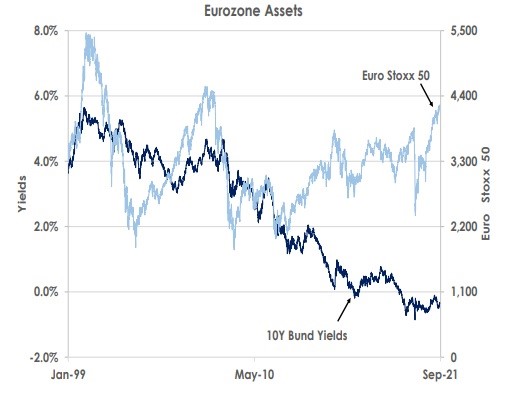

But President Lagarde was dovish, noting the ECB was only ‘recalibrating’ its bond buying rather than starting to ‘taper’ and eventually end its quantitative easing. ‘The lady isn’t tapering,’ she said, echoing former UK Prime Minister Thatcher, ‘we are recalibrating, just as we did back in December and back in March.’ Her stance eased bond yields lower as the next chart shows.

Source: Bank of Singapore, Bloomberg.

Though the ECB upgraded its 2021 GDP forecast to 5.0% and inflation to 2.2%, it is set to be well behind the Federal Reserve and Bank of England in finishing quantitative easing after the crisis. The ECB may announce in December that it will end its Pandemic Emergency Purchase Programme (PEPP) in March 2022. But it will likely expand its older Asset Purchase Programme (APP).

Source: Bank of Singapore, Bloomberg.

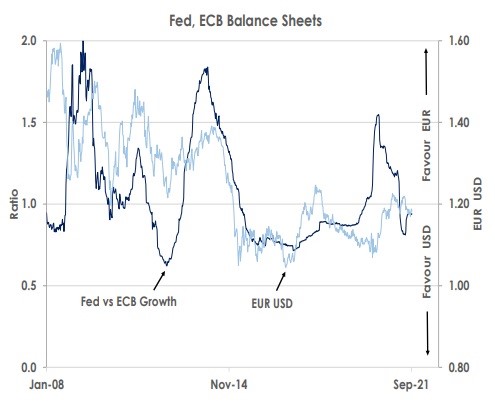

The ECB’s prolonged printing of money will keep benefiting Eurozone equities but weigh on the EUR. The last chart shows the exchange rate tends to follow the relative pace of quantitative easing between the Fed and the ECB over time. If ECB bond buying outlasts the Fed’s, the EUR will struggle to rally longer term. Our new 12 month forecast here is 1.18 for the EUR against the USD.

This article was first published by Bank of Singapore on September 10, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.