Overnight, global bond yields jumped after hawkish Bank of England (BoE) and Norges Bank meetings.

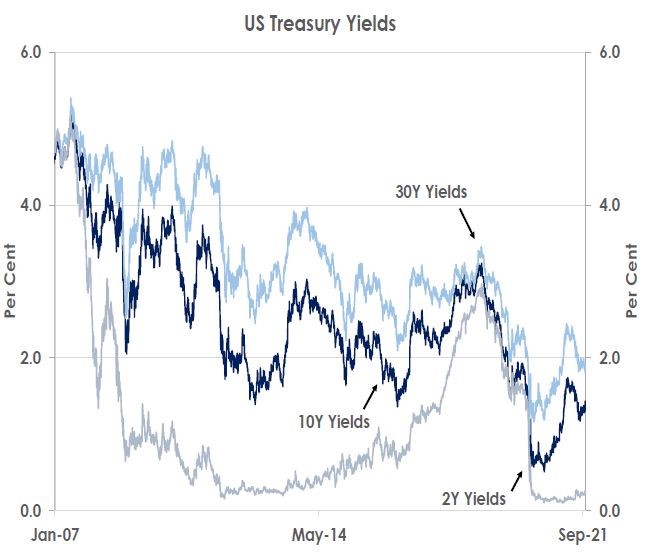

Overnight, global bond yields jumped after hawkish Bank of England (BoE) and Norges Bank meetings. With the Federal Reserve this week signaling it would start tapering quantitative easing at its next meeting in November, 10Y US Treasury yields surged at the fastest pace since February from 1.30% to 1.43% as the chart shows.

As expected, Norges Bank raised its deposit rate from 0.00% to 0.25%, becoming the first developed market central bank to hike since the pandemic began. But it also forecast several further rate rises to 1.75% by the end of 2024. Similarly, the BoE left its Bank Rate at 0.10% and kept its quantitative easing unchanged in line with expectations but made three hawkish tilts.

First, two of its nine Monetary Policy Committee (MPC) members voted to end its current round of quantitative easing now rather than wait until its scheduled finish in December given rising inflationary pressures in the UK economy.

Second, the MPC strengthened its forward guidance from its meeting in August that warned ‘modest tightening’ of monetary policy was likely by now observing that ‘some developments during the intervening period appear to have strengthened that case, although considerable uncertainties remain.’

Third, and most surprising, the MPC signaled it could start lifting its Bank Rate even before its quantitative easing finishes by the end of 2021.

The MPC statement said: ‘tightening of monetary policy should be implemented by an increase in Bank Rate, even if that tightening became appropriate before the end of the existing UK government bond asset purchase programme.’

The MPC is turning hawkish because it now sees UK inflation rising from 3.2% in August to over 4.0% before year end due to the UK reopening, supply disruptions and the recent spike in energy costs.

The BoE is still unlikely to start increasing interest rates in 2021 as the MPC will want to see if UK unemployment rises when the government’s pandemic Jobs Retention Scheme finishes this month. The full labour market data showing the impact of the scheme’s end doesn’t come out until just before the BoE’s last meeting of the year on December 16. But by the time of the BoE’s first meeting of 2022 on February 3, however, the impact will be clear. If the UK labour market continues to recover, then we expect the BoE will become the first major central bank to start increasing interest rates since the pandemic with its Bank Rate set to rise from 0.10% to 0.25%.An early BoE hike in February will support the GBP. In contrast, we don’t expect the Fed to start increasing its fed funds rate until the second half of 2023. Later Fed tightening will keep benefitting risk assets now. But Fed tapering is set to push bond yields higher, potentially causing financial market volatility. We forecast 10Y Treasury yields will rise further to 1.90% over the next 12 months.

This article was first published by Bank of Singapore on September 24, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.