Pre-emptive tightening of FX policy by the MAS likely the first step in policy normalisation process

FX Focus: MAS Lift-Off Begins

Our base case is that the Monetary Authority of Singapore (MAS) will again raise the slope of the SGD NEER policy band in April 2022 after deciding to make a pre-emptive move to normalise FX policy at the October meeting.

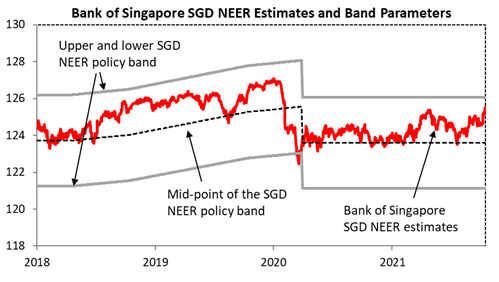

In the semi-annual announcement Oct 14 2021, MAS unexpectedly raised slightly the slope of the SGD NEER policy band from flat. We believe a slight raise of the SGD NEER appreciation slope likely means a 0.5-1.0% appreciation per annum.

The width of the band was unchanged and there was no re-centering. MAS is now the second Asian central bank after the Bank of Korea to normalise its monetary policy.

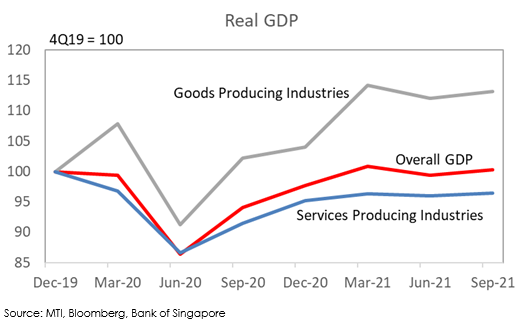

The pre-emptive start to policy normalisation signals policymakers’ confidence that the Singapore economy’s recovery is on track. 3Q21 advance GDP estimates show the economy returning to above pre-COVID levels following a temporary setback in 2Q21.

References to above-potential growth and closing of the negative output gap in 2022 suggest optimism that rapid vaccination progress should sustain growth momentum despite lingering COVID-related growth uncertainties.

We expect Singapore's strategy to continue opening up to make further progress in 4Q21

Growing concerns around inflation globally may also have played a role in tilting the MAS towards FX policy tightening. The MAS Core Inflation is forecast to rise to 1-2% next year on the back of imported inflationary pressures, accumulating cost pressures and firming wage growth on lower labour market slack over the coming year.

MAS action is consistent with a backdrop of hawkish action by other central banks in response to risks of rising inflation expectations, as supply-chain issues (e.g. elevated shipping costs) and higher energy prices challenge the 'transitory' inflation narrative.

Singapore’s central bank has given the green light for a stronger SGD. USDSGD moved lower and broke through the 1.35 level. The SGD NEER also traded higher and is currently 1.6% above the midpoint of our estimated SGD NEER band.

We expect USDSGD at 1.34 by year-end and 1.32 in a year’s time. While a more hawkish MAS benefits the SGD, the Fed’s hawkish tilt is set to hasten USD’s transition onto a stronger path. Our broad USD view implies only a measured move lower in USDSGD.

This article was first published by Bank of Singapore on October 15, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.