The major central banks are starting to exit crisis measures as economies recover.

The major central banks are starting to exit crisis measures as economies recover. Monetary tightening may increase volatility as 2021 ends but will still be slow, supporting risk assets in 2022.

Following the Federal Reserve’s decision to taper bond buying faster and end quantitative easing by March, the Bank of England decided to lift its Bank Rate from 0.10% to 0.25%, its first hike in three years, making the BoE the first major central bank to raise interest rates since the pandemic began.

The move was the second month in a row the BoE have surprised after deciding in November not to start hiking rates despite priming markets. Since last month, however, the latest data shows the UK economy continuing to recover.

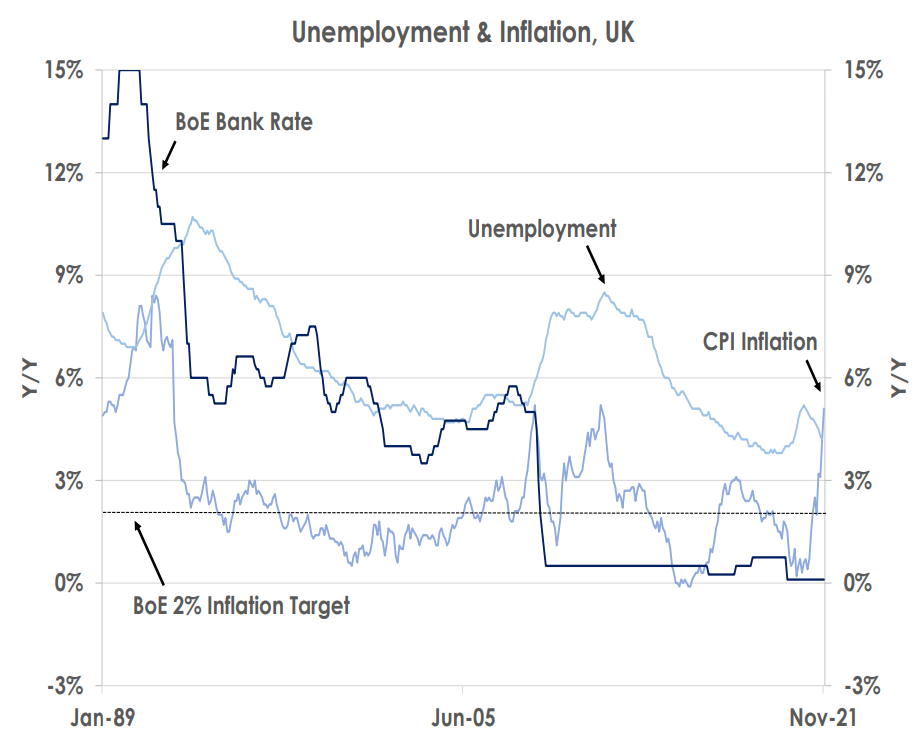

Unemployment has fallen to 4.2% - see first chart - even though the government’s crisis jobs subsidy scheme has ended, and inflation has hit a decade high of 5.1%. Despite soaring Omicron cases, the BoE chose to hike this month, noting: ‘the labour market is tight and has continued to tighten, and there are some signs of greater persistence in domestic cost and price pressures. Although the Omicron variant is likely to weigh on near-term activity, its impact on medium-term inflationary pressures is unclear at this stage.’

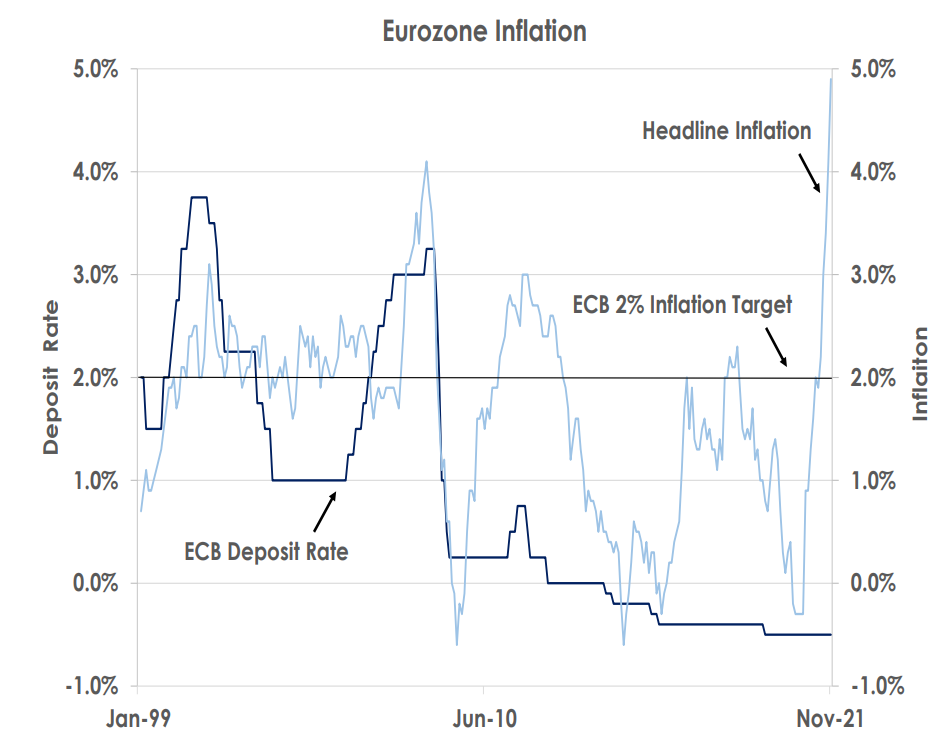

The European Central Bank also surprised by deciding to taper its quantitative easing steadily in 2022. The ECB will cut its pandemic bond buying in Q1’22 and finish it in March. An older round of quantitative easing will temporarily be stepped up to allow a smoother exit. But the monthly pace of total ECB asset purchases will still fall from EUR90 billion now to potentially EUR60 billion in Q1’22, EUR40 billion in Q2’22, EUR30 billion in Q3’22 and EUR20 billion in Q4’22.

Following its first hike, we expect the BoE will now lift its Bank Rate three more times in 2022 to 1.00%. In contrast, the ECB continues to rule out raising its -0.50% deposit rate next year as it hasn’t set an end date for its quantitative easing. Moreover, while Eurozone inflation hit 4.9% in November as the second chart shows, the central bank forecasts inflation will fall to 3.2% in 2022 and below its 2% target to 1.8% in 2023 and 2024. Thus, the ECB is set to lag the BoE and the Fed in 2022 in hiking rates to the detriment of the EUR.

This article was first published by Bank of Singapore on Dec 17, 2021. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.