The Federal Reserve is set to lift interest rates as soon as its quantitative easing ends in March after December’s consumer price index (CPI) report showed US inflation soaring to 7.0%.

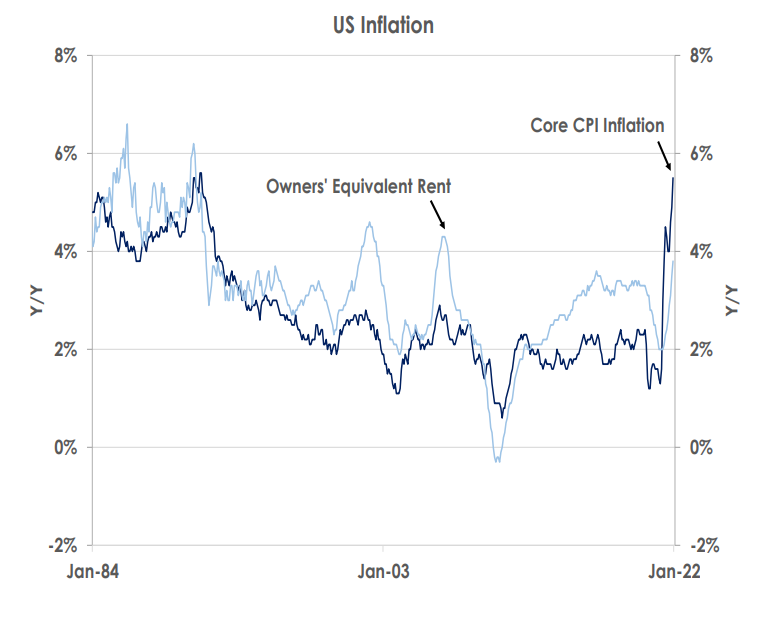

The Federal Reserve is set to lift its fed funds rate from 0.00-0.25% as soon as its quantitative easing ends in March after December’s consumer price index (CPI) report showed US inflation hitting 7.0% for the first time since 1982. Excluding food and energy costs, core inflation also rose to 5.5% as the chart above shows.

America’s monthly pace of price gains remained strong with headline consumer prices increasing by 0.5% last month and core prices rising by 0.6%. Moreover, inflationary pressures were broad-based. Pandemic-affected sectors including cars, hotels and airfares continued to show large gains - used car prices surged by a further 3.5% in December - while rents, a more persistent source of inflation, also firmed again too.

US inflation is set to peak in the next few months as supply disruptions already appear to be easing and the government budget deficit will fall sharply this year. But December’s strong CPI data makes it likely the Fed will bring forward the start of interest rate rises to cool the economy. We thus expect the central bank will lift its fed funds rate from March rather than June now.

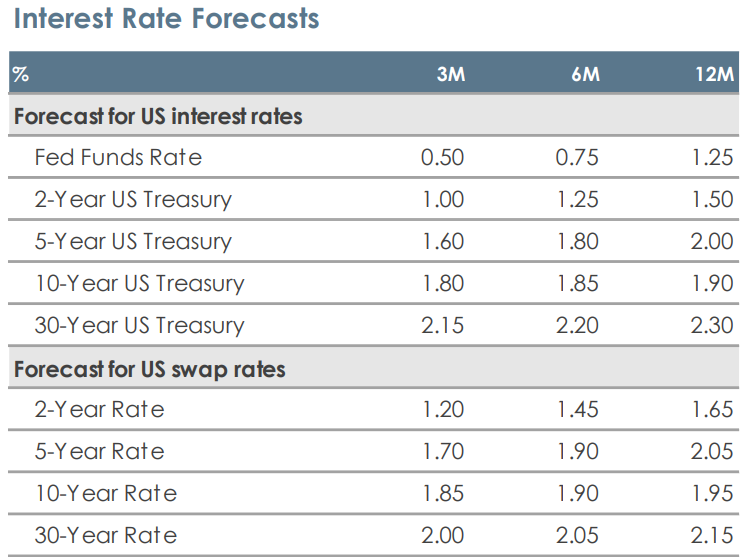

The start of the tightening cycle is set to keep risk assets volatile in the near term. But the Fed is still likely to only increase interest rates by 25bps each quarter this year, a gradual pace that shouldn’t shock financial markets. This week, Chairman Powell testified to Congress and didn’t signal the Fed would be more aggressive.

Powell simply said: ‘I would expect that this year, 2022, will be a year in which we take steps toward normalization. That will involve raising the federal funds rate. That will involve ending asset purchases in March and perhaps later this year … to allow the balance sheet to shrink.’

We thus expect risk assets will stay supported as bond yields are likely to remain at historically low levels. Earlier Fed hikes should keep flattening the US Treasury yield curve. We therefore revise higher our forecasts for 2Y and 5Y yields as the table above shows. But we continue to see longer-term bond yields staying low with our 12-month forecast for 10Y Treasury yields remaining unchanged at 1.90%.

This article was first published by Bank of Singapore on Jan 13, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.