Yesterday, Russia shocked financial markets by launching a full-scale invasion of Ukraine, aiming to depose the government in Kyiv.

Yesterday, Russia shocked financial markets by launching a full-scale invasion of Ukraine, beyond the contested Donbas region in the east, with the aim of overthrowing the government in Kyiv by force.

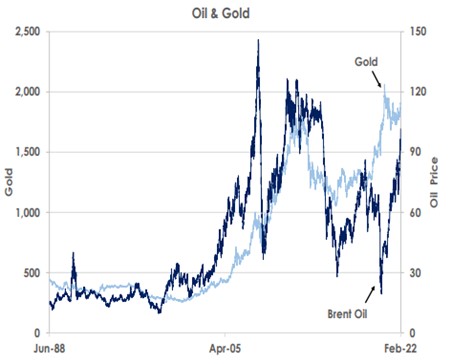

The largest threat to Europe’s sovereign order since the end of the Cold War caused major volatility overnight. Oil prices reached USD105 a barrel, for the first time since 2014 as the chart shows, as investors feared energy supplies would be disrupted. Similarly, gas prices surged. Global stock markets were whipsawed. Russian bonds, equities and the RUB plunged again. The EUR and GBP fell on concerns that the Eurozone and UK will incur an even greater energy squeeze than they are already facing over the winter while, in contrast, safe havens including US Treasuries, the USD and gold rose with the latter exceeding USD1,950 overnight before retracing.

The situation remains highly fluid with Russia’s invasion set to keep driving the near-term outlook for financial markets. As civilian casualties emerge, the pressure on the US, UK, European Union, and the North Atlantic Treaty Organization (NATO) to help Ukraine defend its territory will increase. But while volatility will remain elevated given the uncertainty induced by the conflict, forward-looking investors are also likely to consider when buying opportunities will emerge again in financial markets.

Source: Bank of Singapore, Bloomberg.

First, the US significantly increased sanctions on Russia yesterday but continues to refrain from targeting energy supplies that would cause a greater shock to the global economy. Thus, Russia’s largest bank has been cut off from the US financial system and from using the USD, and several other banks have had their assets frozen. But the US did not impose harsh sanctions on Russia’s main bank handling foreign payments for oil and gas nor on Russia’s energy firms. The US and the EU for now have also not acted to remove Russian banks from the international Swift messaging system that banks use globally for payments. Oil prices receded after the news.

Second, the global recovery from the pandemic remains resilient. Confidence has rebounded sharply from winter Omicron waves as February’s purchasing manager indices (PMIs) show.

Third, central banks are likely to act cautiously when raising interest rates to curb inflation. Higher oil prices act as a stagflationary tax, increasing inflation but lowering consumers’ purchasing power. The latter is likely to slow growth in the near-term and thus reduce the need for central banks to increase interest rates aggressively by 50ps hikes rather than 25bps rises. Thus, safe-haven US Treasuries, USD and gold are set to stay in demand in the near-term. But the global recovery will continue if energy flows remain undisrupted, offering opportunities again for investors over time.

This article was first published by Bank of Singapore on Feb 25, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.