This week the Federal Reserve increased its fed funds rate for the first time since 2018 by 25bps to 0.25-0.50% to curb rising inflation while also giving a more hawkish outlook for interest rates.

This week the Federal Reserve increased its fed funds rate for the first time since 2018 by 25bps to 0.25-0.50% to curb rising inflation while also giving a more hawkish outlook for interest rates.

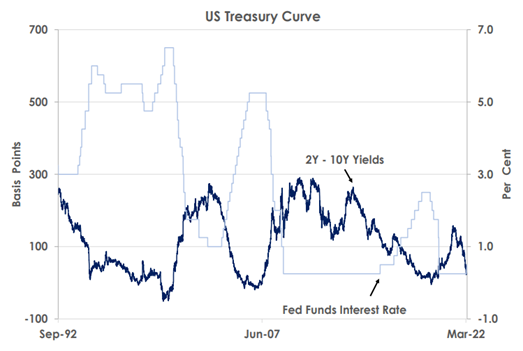

We now expect the Fed will raise its fed funds rate seven times this year (compared to five increases before) while keeping our view of four further hikes next year. We thus see the fed funds rate reaching 1.75-2.00% by the end of 2022 and 2.75-3.00% by the end of 2023. This would be a steeper path of tightening compared to the Fed’s last hiking cycle as the chart shows when fed funds reached 2.25-2.50% from 2015 to 2018.

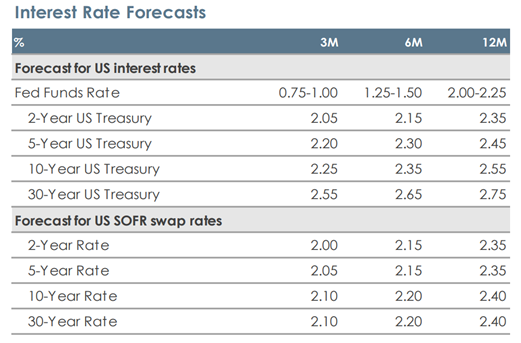

The table shows our new interest rate forecasts. Following the changes to our Fed view, we revise up our 12-month forecast for 10Y Treasury yields up from 2.35% to 2.55%. Higher yields are a headway for risk assets. But our new forecasts envisage bond yields would still be at low levels historically over the next year. We think that only if 10Y Treasury yields were to conclusively breach 2.80-3.00% would the decades-long downtrend in Treasury yields since the 1980s be in danger of reversing to the strong detriment of risk assets.

We also expect faster Fed tightening will turn yield curves almost flat this year. Shorter-term 2Y and 5Y yields would rise more than longer-term 10Y and 30Y yields as investors would likely mark down future long-term growth prospects as the Fed increases its short-term fed funds interest rate.

Source: Bank of Singapore, Bloomberg.

The risk here is that very flat yield curves may lead to periods where both Treasury and swap curves periodically invert if financial markets fear Fed tightening will cause either stagflation or outright recession. As the chart shows the spread between 2Y and 10Y Treasury yields tends to turn negative at the top of Fed rate hiking cycles.

For 2022, however, we think the US economy’s reopening from the pandemic will continue to keep growth firm. That would help counter yield curve flattening. In addition, we expect the Fed will begin unwinding its pandemic quantitative easing to lower inflation by shrinking its balance sheet from as soon as May. As the Fed holds more longer-dated bonds, its ‘quantitative tightening’ would result in comparatively more selling pressure on 10Y and 30Y Treasuries and thus also help counter any yield curve inversions this year.

This article was first published by Bank of Singapore on Mar 18, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.