This week Federal Reserve Chairman Powell warned interest rate hikes of more than 25bps may be needed in future to curb inflation after last week’s 25bps rate rise, the first since 2018.

• This week Federal Reserve Chairman Powell warned interest rate hikes of more than 25bps may be needed in future to curb inflation after last week’s 25bps rate rise, the first since 2018.

• Powell’s comments add upside risk to our forecast that the Fed will lift the fed funds rate by 25bps at every remaining meeting of 2022 from 0.25-0.50% to 1.75-2.00% by year end.

• Thus, investors will be wary of the risk of 50bps hikes at the Fed’s May and June meetings if US inflation shows no signs of peaking or surging oil prices keep boosting inflation expectations.

• The Fed’s hawkishness is set to keep pushing yields higher, support the USD against the EUR and JPY and remain a headwind to risk assets.

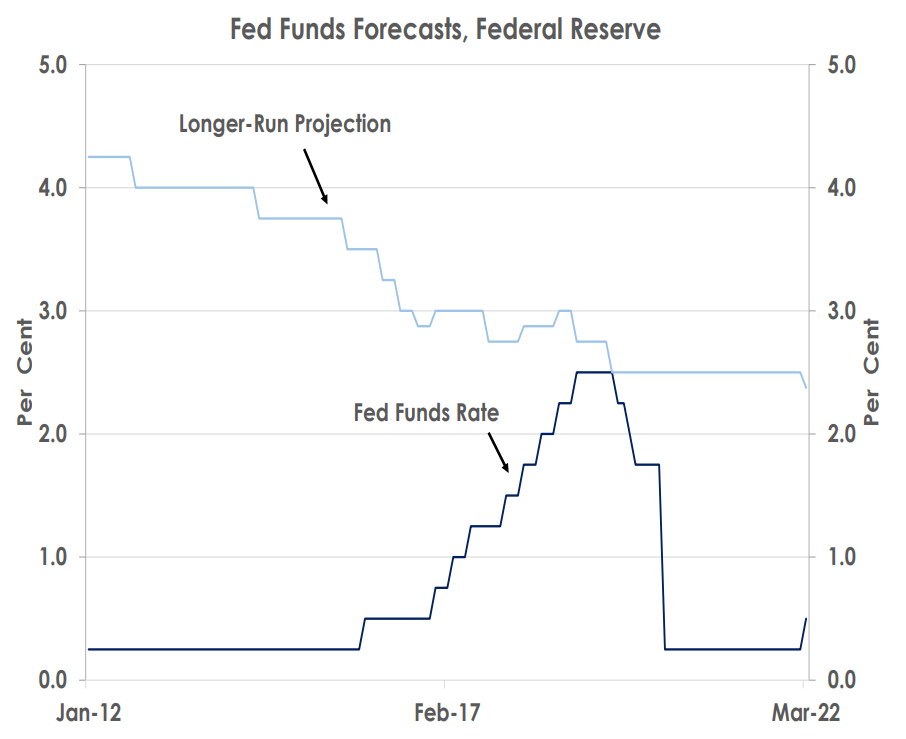

This week Federal Reserve Chairman Powell continued to turn more hawkish, warning interest rates may need to be increased by more than 25bps at upcoming Fed meetings to curb inflation: ‘if we conclude that it is appropriate to move more aggressively by raising the federal funds rate by more than 25 basis points at a meeting or meetings, we will do so.’Powell’s comments follow last week’s 25bps rise in the fed funds rate from 0.00-0.25% to 0.25-0.50% - the central bank’s first increase since 2018 - and its new forecasts projecting seven 25bps hikes in total in 2022 and four in 2023 to lift the fed funds rate up to 1.75-2.00% by the end of this year and 2.75-3.00% by the end of next year. His remarks thus add upside risk to our forecast that the Fed will stick with 25bps rate increases at each remaining meeting of the year when raising the fed funds rate to 1.75-2.00%.Powell also warned the Fed was willing to tighten policy into ‘restrictive’ territory by lifting interest rates above levels thought to be neutral for growth: ‘if we determine that we need to tighten beyond common measures of neutral and into a more restrictive stance, we will do that as well.’The first chart shows the Fed’s estimate of the neutral ‘longer run’ fed funds rate consistent with its 2% inflation goal is currently 2.25-2.50%. Thus, Powell is signaling the fed funds rate may need to be hiked from 0.25-0.50% to levels above 2.50% to restrict activity and lower inflation again.

Investors will therefore be wary now of the risk the Fed may accelerate its pace of rate hikes when it meets in May and June by voting for 50bps increases rather than 25bps moves if US core inflation, currently at 6.4% for consumer prices (CPI), shows no signs of peaking or if surging oil keeps boosting inflation expectations. For example, the chart below shows 10Y breakeven rates - a measure of inflation expected for the next decade - have hit a record 3.0% this month.

We think the Fed will continue with 25bps hikes at its upcoming meetings. But its hawkishness is set to keep pushing US yields higher while presenting near-term headwinds to risk assets. We see 10Y Treasury rates rising to 2.55%, the USD rallying to 1.05 against the EUR and to 125 against the JPY.

This article was first published by Bank of Singapore on Mar 23, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.