The SGD is one of the better-performing Asian currencies this year against headwinds from a more hawkish Fed and the energy price shock sparked by the Russian-Ukraine war

The SGD is one of the better-performing Asian currencies this year against headwinds from a more hawkish Fed and the energy price shock sparked by the Russian-Ukraine war. Resilience in the SGD is underpinned by a hawkish central bank, a strong external position and Singapore’s economic reopening.

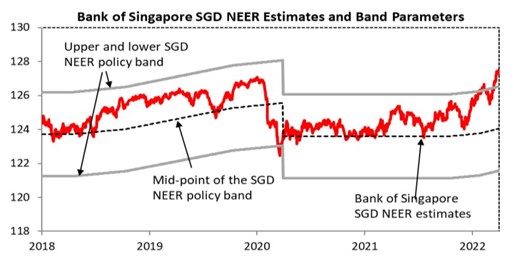

The Monetary Authority of Singapore (MAS), which uses a FX-centered monetary policy framework by managing the SGD against a basket of currencies (SGD NEER) within a policy band, has been one of the ‘early hikers’ in Asia. The MAS increased the slope of its SGD NEER policy band by an estimated 50bps at its October 2021 meeting and then again by another 50-100bps in an off-cycle move in January.

The Ukraine conflict has increased stagflation risk by introducing downside risks to global growth and upside risks to inflation as energy and food prices surged. Singapore, being a highly open economy and given its strong trade links with the Euro area, will not be immune to downside growth risks. But these risks look manageable as the country’s re-opening should help offset the squeeze on purchasing power from the energy shock.

As such, the MAS is widely anticipated to be on track to tighten policy at the April review, likely on 14 April. After briefly dipping following Russia’s invasion of Ukraine, the SGD NEER has since rallied back towards the top of the band, reflecting renewed expectations of policy tightening by the MAS. Rising inflation pressures driven by a tight labour market and higher global commodity prices warrant a tighter FX policy, although we acknowledge the extent of tightening is a close call.

Strength of the SGD NEER suggests a further tightening of FX policy is widely anticipated

Source: Bank of Singapore, Bloomberg.

The MAS has three policy levers – the slope, the midpoint of the band and the bandwidth – it can alter in its policy decision. It can change one or more of the levers each time. A band widening is an unlikely outcome in our view, as the current bandwidth of +/-2% seems adequate in coping with the choppier financial markets caused by geopolitical uncertainty.

The question is whether the MAS remains carefully hawkish by steepening the slope or turns aggressively hawkish by double-tightening through a steeper slope and re-centring the policy band higher. It is a close call. We assign a slightly higher probability of 60% of a carefully hawkish outcome with the MAS steepening the slope by a further 100bps to 2-2.5% annualised. This consequently leaves the odds of an aggressively hawkish outcome at 40%.

While Singapore’s core inflation has risen steadily to 2.2% YoY in February, the picture is far less alarming compared to developed market economies such as the US and UK, where core inflation is currently running at slightly over 5% YoY. As borders re-open, some of the labour supply constraints caused by an earlier drop in foreign workforce could ease. This, in turn, could help temper wage growth and inflationary pressures. It is therefore not clear that the MAS has fallen behind the curve and needs to further front-load its tightening.

We have been moderately positive on the SGD on expectations of further MAS policy tightening. A hawkish MAS strengthens conviction on our 12-month USDSGD forecast of 1.33 despite tailwinds for the USD as the Fed gears up for faster rate hikes.

This article was first published by Bank of Singapore on Mar 31, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.