What started as a small ripple is turning into a big wave of USD rally

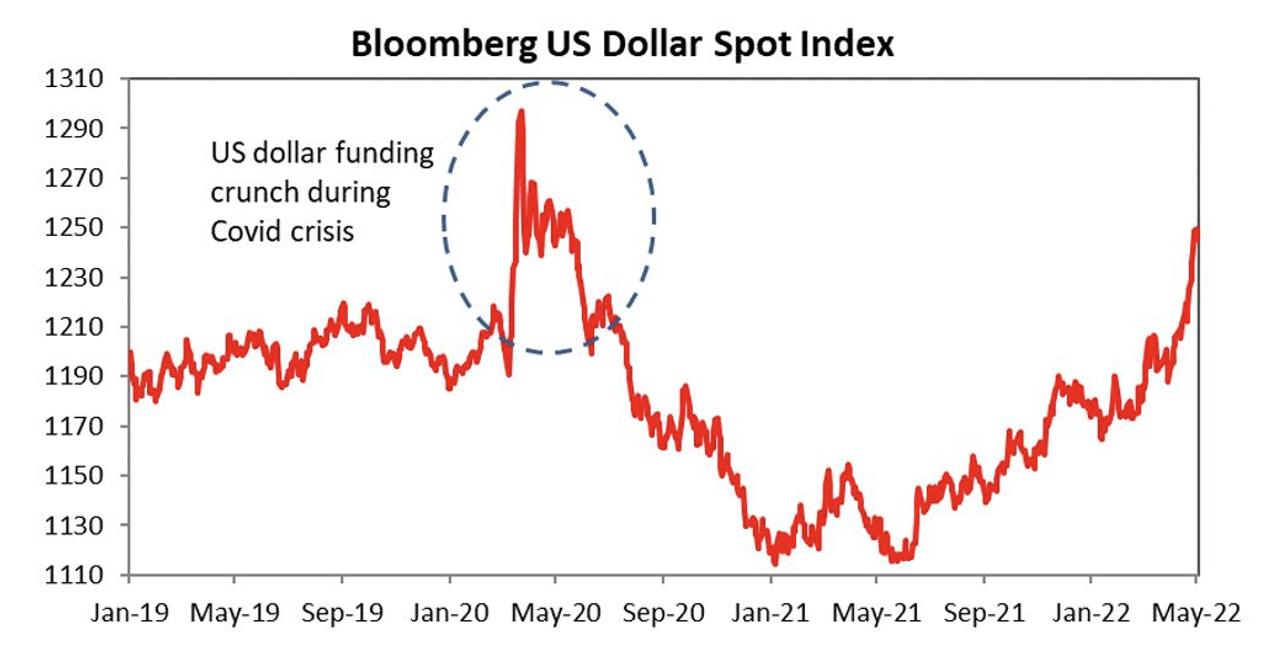

What started as a small ripple is turning into a big wave of USD rally. This is defying those who thought sanctions would undermine the USD’s reserve currency status and spark a shift into other currencies. During 1Q22 and into early April, FX returns have been divided between commodity exporters gaining and importers weakening, with AUD and CAD appreciating against the USD. Since then, USD gains are getting more broad-based, including versus commodity exporters. While the USD rally is in overshoot territory, our FX strategist Sim Moh Siong believes that it is too soon to look for a USD peak this quarter and expects further near-term USD strength.

It is too soon to look for a USD peak this quarter as the USD rally overshoots

Source: Bloomberg, Bank of Singapore.

We expect the Fed to launch Quantitative Tightening and hike rates by 50bps in May, June, and July, and by 25bps thereafter. Our view that the Fed will stay on a hawkish path is reinforced by the recent month-on-month pickup in the US headline and core CPIs of 0.3% and 0.6%, respectively, which were both higher than consensus expectations. The sustained price uptick in core services remains a source of concern, signalling that underlying price pressures, especially from labour costs, are unlikely to peak soon.

The USD rally could ultimately reverse in 6-12 months’ time as the US economy soft lands. The drifting of US CPI back closer to target could give the Fed greater scope to hold off hiking just when laggard central banks like the ECB and BoJ may come under greater pressure to catch up on tightening. The greenback could also turn lower by then as investor concerns over a global recession ease to the benefit of commodity and EM currencies. Possible catalysts might include large-scale infrastructure stimulus in China and/or a de-escalation in the Russia-Ukraine war.

The impact on equities

At a broad level, we believe that USD strength could imply defensive positioning by investors as it could signal concerns regarding the global economic growth picture. In other words, a weaker USD should intuitively be more beneficial to risk assets such as equities as it implicitly signals more confidence in the global growth backdrop – which is unfortunately the opposite of our situation today.

Still, it is important to acknowledge that there could be a short-term impact on corporates from foreign currency translation. This would for instance be applicable to media companies with global audiences and could also translate into guidance headwinds to the constant currency revenue forecasts for a number of tech firms.

Nonetheless, we believe that there are few instances where these currency effects should have pronounced implications on fundamental valuations. From the perspective of long-term investors, we remain much more focused on the secular trends and organic growth of companies under our coverage; longer-term valuation differences between our fair values and market prices should be based on differences in fundamental views by market participants as opposed to shorter-term swings in FX.

Which EM sovereign and corporate issuers are most at risk?

We believe sovereigns with high external account vulnerabilities will be most at risk from persistent USD strength – particularly Frontier Market countries with a high dependence on food and energy imports, high levels of external debt and low export capabilities. On the other hand, corporate balance sheets that are highly exposed to hard currency debt will feel the most pressure – particularly in Latin America and Turkey where domestic corporate issuer balance sheets have relatively high levels of dollarisation.

USD strength (local currency weakness) also poses challenges for debt servicing capabilities of countries with high levels of external debt and growing questions as to how they will finance their current account deficits, given rising import bills. Since the pandemic started, elevated levels of sovereign external debt have coincided with a fall in export earnings, exacerbated by disrupted supply chains.

We prefer EM corporate and sovereign issuers with “defensive” characteristics

We prefer sovereign issuers with defensive characteristics during the current market environment. These include the high-grade oil-exporting countries of the GCC (Gulf Co-operation Council) region, which will continue to benefit from elevated energy prices and post current account surpluses if oil prices stay elevated. In addition, the larger ASEAN (Association of Southeast Asian Nations) economies are also well-placed to weather current market headwinds, given a high export orientation and strong external buffers to weather tightening financial conditions over the short-term.

In the EM corporate issuer domain, we continue to favour issuers with strong pricing power, relatively inelastic demand curves and a significant export bias, to hedge against local currency weakness. Such entities include public utilities, market-leading telcos, food and beverage companies and national champions in the energy sector.

This article was first published by Bank of Singapore on May 18, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.