The Federal Reserve’s May meeting minutes showed officials aren’t flinching from raising interest rates aggressively to curb inflation despite fears the US may suffer a recession.

The Federal Reserve’s May meeting minutes showed officials aren’t flinching from raising interest rates aggressively to curb inflation despite fears the economy may suffer recession.

First, the Federal Open Market Committee (FOMC) was willing to lift the fed funds rate again by 50bps at upcoming meetings in June and July after hiking rates by 50bps to 0.75-1.00% in May: ‘most participants judged that 50 basis point increases in the target range would likely be appropriate at the next couple of meetings.’

Second, FOMC officials were keen to return the fed funds rate quickly to neutral levels and to consider hiking interest rates further into restrictive settings above neutral if necessary to ensure inflation returns to the Fed’s 2% target.

‘Participants judged that it was important to move expeditiously to a more neutral monetary policy stance. They also noted that a restrictive stance of policy may well become appropriate depending on the evolving economic outlook and the risks to the outlook.’

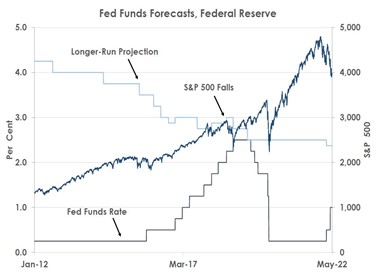

The FOMC thus wants to raise the fed funds rate to neutral levels around 2.25-2.50% as the chart shows, and, if inflation continues to be elevated, then officials are willing to keep lifting interest rates above neutral to higher levels that restrict activity. The chart also shows the Fed is willing to aggressively raise interest rates still despite the S&P 500 having tumbled by almost 20% this year.

We thus expect the Fed will keep lifting its fed funds rate to restrictive levels near 2.75-3.00% by early next year given its determination to bring inflation - currently above 5% on the Fed’s target measure of core prices - back to its 2% goal over the next couple of years.

We also think it is too soon for the Fed to signal it will step back from 50bps hikes after June’s and July’s meetings to less aggressive 25bps increases from September.

The FOMC minutes did suggest quickly raising interest rates now would allow officials to reconsider their strategy later in the year: ‘many participants judged that expediting the removal of policy accommodation would leave the committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.’

Source: Bank of Singapore, Bloomberg.

But given the uncertainty over high inflation rates and the strength of the US labour market, the Fed is likely to stay hawkish and keep raising interest rates by 50bps in June and July without signalling yet it will slow its pace of tightening back to 25bps moves from September.

We thus remain concerned that the Fed’s hawkish stance may continue to pressure risk assets over the next few months, leave US Treasury yields volatile and keep the safe-haven USD in demand still over the summer.

We thus expect the Fed will keep lifting its fed funds rate to restrictive levels near 2.75-3.00% by early next year given its determination to bring inflation - currently above 5% on the Fed’s target measure of core prices - back to its 2% goal over the next couple of years.

We also think it is too soon for the Fed to signal it will step back from 50bps hikes after June’s and July’s meetings to less aggressive 25bps increases from September.

The FOMC minutes did suggest quickly raising interest rates now would allow officials to reconsider their strategy later in the year: ‘many participants judged that expediting the removal of policy accommodation would leave the committee well positioned later this year to assess the effects of policy firming and the extent to which economic developments warranted policy adjustments.’

But given the uncertainty over high inflation rates and the strength of the US labour market, the Fed is likely to stay hawkish and keep raising interest rates by 50bps in June and July without signalling yet it will slow its pace of tightening back to 25bps moves from September.

We thus remain concerned that the Fed’s hawkish stance may continue to pressure risk assets over the next few months, leave US Treasury yields volatile and keep the safe-haven USD in demand still over the summer.

This article was first published by Bank of Singapore on May 26, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.