Federal Reserve Chairman Powell gave his most hawkish speech for the year on Friday at the Fed’s annual symposium in Jackson Hole, showing officials remain strongly committed to returning inflation to the central bank’s 2% target

Firstly, Powell said the Fed would keep lifting its fed funds rate from 2.25-2.50% to curb inflation even if it led to slow growth and pain in the economy.

‘The Federal Open Market Committee's (FOMC) overarching focus right now is to bring inflation back down to our 2 percent goal … reducing inflation is likely to require a sustained period of below-trend growth … while higher interest rates, slower growth, and softer labour market conditions will bring down inflation, they will also bring some pain to households and businesses.’

Secondly, the Fed may again raise interest rates by 75bps in September after hiking by 75bps each in June and July to set interest rates at levels that restrict activity and thus lower inflation.

'We are moving our policy stance purposefully to a level that will be sufficiently restrictive to return inflation to 2 percent … July's increase … was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook.’

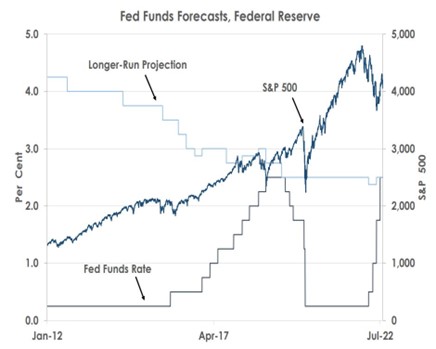

Source: Bank of Singapore, Bloomberg.

Thirdly, interest rates would need to stay high next year to keep curbing inflation rather than being cut quickly again and risk renewed inflation.

‘Restoring price stability will likely require maintaining a restrictive policy stance for some time. The historical record cautions strongly against prematurely loosening policy.’

Powell said the Fed’s rapid interest rate increases this year - the fastest since 1994 - were based on the lessons learned ‘from the high and volatile inflation of the 1970s and 1980s.’ In particular, the Fed Chair warned that successfully curbing inflation in the 1980s had only come after ‘multiple failed attempts to lower inflation over the previous 15 years [when interest rates had not been increased fast enough in the 1970s and had been cut too early again]. Our aim is to avoid that outcome by acting with resolve now.’

We think investors should stay cautious on risk assets and bullish on the safe haven USD as the Fed isn’t ready to slow its pace of aggressive hikes yet. We think the chances of a 75bps move next month have risen and will watch August’s payrolls and consumer inflation data closely.

Last, we expect the fed funds rate will hit 4.00% and remain there throughout 2023. The Fed has returned interest rates to neutral levels at 2.50% as the chart shows but Powell was clear the fed funds rate needs to be lifted further to levels that restrict activity ‘for some time’ to lower inflation.

This article was first published by Bank of Singapore on Agust 29, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.