September’s US employment data released on Friday shows the labour market remains very tight, keeping the pressure on the Federal Reserve to continue lifting its fed funds rate in outsized 75bps hikes.

Source: Bank of Singapore, Bloomberg.

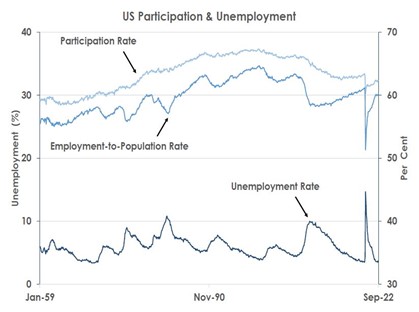

Payroll rose by 263,000 last month, only slowing modestly from August’s large 315,000 gains. The unemployment rate also fell back from 3.7% to 50-year lows of 3.5% as the chart shows. Labour market tightness was compounded by the participation rate dipping from 62.4% to 62.3%

The strength of the US jobs market led to average hourly earnings rising by 0.3%month-on-month (MoM). Wages are growing by 5.0%YoY still despite the Fed’s rapid interest rate hikes this year

Source: Bank of Singapore, Bloomberg.

September’s payrolls report thus shows the US labour market remains too hot for inflation to return to the Fed’s 2% target without further large increases in the fed funds rate from 3.00-3.25%.

The Fed can keep aggressively tightening monetary policy to curb inflation as the near-term risks of recession are low. The ‘Sahm Rule’ in the second chart shows that the onset of each US recession since 1960 has seen unemployment - on a three-month moving average basis - rise by 0.5% points from its low over the preceding 12 months. The US jobless rate would therefore need to increase from 3.5% now to 4.0% within the next 12 months for the US to face recession.

With US consumer price inflation still very high at 8.3% in August and unemployment at just 3.5% in September, we forecast the Fed will raise its fed funds rate again by 75bps in November for the fourth time in a row this year. We thus do not expect the Fed to ‘pivot’ to a slower pace of rate hikes until December at the earliest when we anticipate a 50bps rate increase and a further 25bps in February to lift fed funds to 4.50-4.75%.

The hawkish Fed is set to keep investor sentiment fragile. On Friday after the jobs data, the S&P 500 fell 2.8%, 10Y Treasury yields jumped to 3.88% and the safe-haven USD rallied. We expect risk assets to stay under pressure before November’s Fed meeting and see the USD rising further to 0.95 and 7.25 against the EUR and CNY respectively in the next three months.

This article was first published by Bank of Singapore on October 4, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.