Prime Minister Truss’s resignation following last month’s catastrophic ‘mini-budget’ has been welcomed by financial markets. The GBP is stable at 1.12 against the USD compared to its record low of 1.0350 in September while 10Y gilt bond yields at 3.90% are well below their recent highs of 4.63%, We remain bearish, however, on the GBP and the UK economic outlook.

Firstly, the ruling Conservatives will hold a snap contest to replace Truss. Candidates will need to secure the votes of 100 Members of Parliament by Monday. If more than one candidate achieves this high bar of support from their fellow 357 Conservative MPs then the party’s members across the UK will also vote with a new leader, and thus new prime minister, emerging by Friday 28 October at the latest. The Conservatives do not need to hold a general election until 2025 and as the party is far behind the opposition Labour party in the polls, its MPs have no incentive to seek an early election now.

Candidates likely to run include markets’ favourite ex-Chancellor Sunak, who narrowly lost to Truss in the summer contest to succeed former PM Johnson, Johnson himself despite being forced out by his fellow MPs over repeated scandals, Leader of the House of Commons Mordaunt, Defence Minister Wallace and right wingers Braverman and Badenoch. New Chancellor Hunt who has helped calm financial markets by reversing almost all the mini-budget’s GBP45 billion of tax cuts has said he will not stand.

Source: Bank of Singapore, Bloomberg.

Secondly, a new leader may be unable to unify the fractious Conservatives. Frontrunner Sunak is blamed by Johnson for his ousting while Braverman and Badenoch are likely to be seen as even more extreme and inexperienced versions of Truss. This matters as the government’s upcoming budget on October 31 may need to be tightened by a further GBP40 billion to stabilise the UK’s finances, enabling public debt to decline relative to GDP and start restoring the UK’s badly damaged credibility with investors. If a new prime minister is unable to pass spending cuts or tax rises through rebellious Conservative MPs, then the UK will face another fiscal crisis.

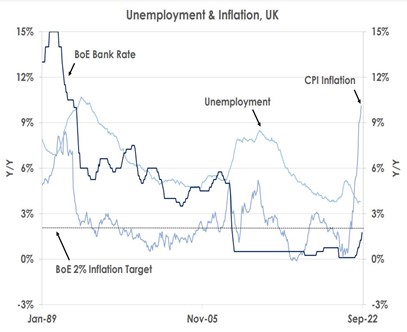

Thirdly, the Bank of England may still need to hike its 2.25% Bank Rate by 100bps at its next meeting on November 3 to regain credibility despite the UK facing recession after the energy shock from the war in Ukraine. This week September’s consumer price index (CPI) inflation hit a fresh 40-year high of 10.1% as the chart shows, far above the BoE’s 2% target.

We thus remain bearish on the UK outlook. Hunt’s actions and Truss’s demise have removed the risk of further sudden GBP plunges. But the UK budget deficit is still set to exceed 5% of GDP, the current account deficit is a huge 8% of GDP and we forecast the UK will contract by 0.8% of GDP in 2023. Even if Sunak wins and retains Hunt as Chancellor, the risks are a new PM will struggle against old challenges. We keep our forecast for GBP to fall back to 1.04 against the USD.

This article was first published by Bank of Singapore on October 4, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.