October’s data were all worse than expected, reflecting the adverse impact from China’s zero-Covid policies on activity, subdued demand in the economy and property market weakness.

Source: Bank of Singapore, Bloomberg.

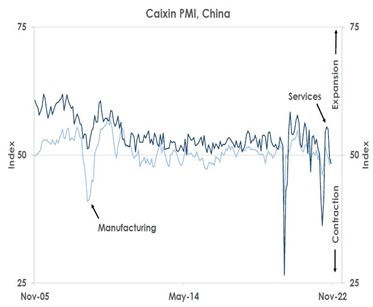

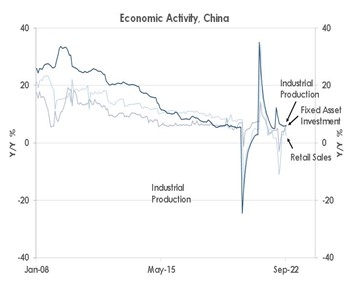

The first chart of October’s purchasing manager indices (PMIs) from Caixin show manufacturing and services firms both see activity contracting. The second chart shows October’s consumer price index (CPI) inflation rate remains tame at 2.1% while producer prices (PPI) are 1.3% lower than a year ago. And the last chart shows how lockdowns have hit consumption with October’s retail sales down 0.5% over the last 12 months while fixed asset investment and industrial production only expanded by 5.8% and 5.0%.

Source: Bank of Singapore, Bloomberg.

October’s investment data also highlighted the property market’s weakness with investment in the sector 8.8% lower than a year ago. Subdued demand was shown too by October’s lacklustre credit growth of 10.3% while export growth turned negative for the first time in two years.

Source: Bank of Singapore, Bloomberg.

The weak data thus underscores how important China’s key shifts this month are for the outlook. By easing zero-Covid controls, increasing aid for delivering housing projects and for property developers’ financing, and by lowering tensions with the US after Presidents Biden’s and Xi’s Bali summit, China’s GDP growth is likely to pick up from just 3.0% this year to 4.5% next year, marking an important turning point for China’s risk assets.

This article was first published by Bank of Singapore on October 4, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.