November’s employment report released on Friday shows the US labour market remains too strong, keeping the Federal Reserve (Fed) under pressure to lift interest rates further over the next few months.

Payrolls beat expectations, rising by 261,000 jobs, unemployment stayed near 50-year lows of 3.7% and labour force participation fell to 62.1%.

Source: Bank of Singapore, Bloomberg.

The first chart shows each month payrolls are still rising much faster this year than before the pandemic began in 2020 as employers keep adding jobs rapidly after the US economy reopened last year. The second chart shows participation in the labour market remains well below its pre-pandemic levels, further increasing the tightness of the jobs market.

Source: Bank of Singapore, Bloomberg.

US wages are thus growing strongly as firms struggle to attract new employees. November’s jobs report showed average hourly earnings last month jumped 0.6% with wages rising by 5.1% over the past year. This is much faster than the 2-3% annual wage growth recorded between the 2008 financial crisis and the 2020 pandemic.

Source: Bank of Singapore, Bloomberg.

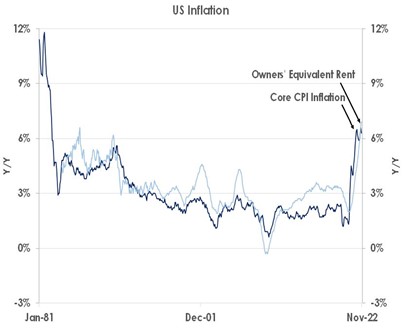

Strong payrolls growth makes it tough for the Fed to hit its 2% inflation target. If next week’s consumer price index (CPI) data stays hot – for example, if core inflation remains well above 6% as the last chart shows – then our forecast for the fed funds rate to be raised by 50bps each in December and February to hit 4.75-5.00% may prove too low. If the Fed instead needs to keep hiking well into 2023 then the near-term outlook for risk assets will remain challenging for investors.

This article was first published by Bank of Singapore on December 5, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.