The Federal Reserve raised its fed funds rate by 50bps to 4.25-4.50% overnight, slowing its pace of rate hikes from 75bps increases at its last four meetings as US inflation peaks and interest rates become increasing elevated.

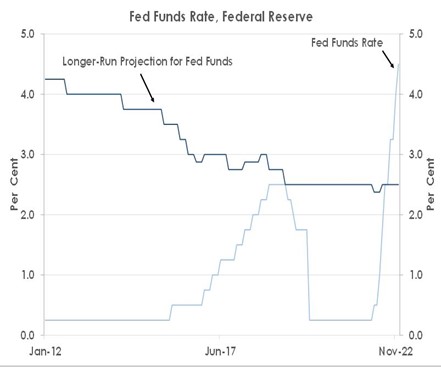

The chart shows the fed funds rate is now well above the ‘longer-run’ level Federal Open Market Committee members project to be consistent with neutral interest rates that neither stimulate nor contract activity. The fed funds rate is clearly at levels now that will restrict US growth to lower inflation back towards the Fed’s 2% target.

The Fed’s decision was expected. However, the rest of its meeting was hawkish. The S&P fell 0.6% and 10Y US Treasury yields remained near 3.50%.

Firstly, FOMC members revised their interest rate forecasts higher, projecting the fed funds rate to reach 5.00-5.25% in 2023 to curb inflation. Strikingly, 17 of the 19 participants anticipated the fed funds rate to be increased to 5.00-5.25% or even higher next year. Officials also expected interest rates would not be cut until 2024 and 2025.

Secondly, policymakers raised their inflation forecasts, anticipating annual increases in core prices would only fall from 4.8% at the end of 2022 to 3.5% at the end of 2023 and 2.5% at the end of 2024. Only in 2025 was core inflation expected to return towards the Fed’s 2% target.

Source: Bank of Singapore, Bloomberg.

Thirdly, FOMC members forecast unemployment will now increase from 3.7% this year to 4.6% in 2023. Historically, a rise in the US jobless rate of 0.5% points or more within a 12-month period has always seen the US suffer recession.

Lastly, Chairman Powell pointedly warned the Fed still had more work to do curb inflation: ‘over the course of the year, we have taken forceful actions to tighten the stance of monetary policy. We have covered a lot of ground and the full effects of our rapid tightening so far are yet to be felt. Even so we have more work to do.’

Following the Fed meeting, we raise our forecast for the peak in fed funds from 5.00% to 5.25% in 2023. We add a 25bps hike in March to our projection of another 50bps rise in February. It’s possible the Fed may step down to 25bps rate hikes next year. But the FOMC is almost unanimous in expecting the fed funds rate to be increased by at least 75bps further in 2023 to bring inflation back towards the Fed’s 2% target. If inflation and labour market data between now and the next Fed meeting at the start of February remain tight, then risk assets will stay pressured, and the USD will recover some of its recent losses.

We expect the US will suffer recession in the second half of next year. The risks of an even harder landing are rising as the Fed keeps hiking. We thus see 10Y Treasury yields being capped at 3.50% during 2023 to the benefit of high-quality developed market corporate bonds.

This article was first published by Bank of Singapore on December 15, 2022. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.