January’s key US data were surprisingly strong showing the economy has not cooled enough yet to return inflation to the Federal Reserve’s 2% target despite last year’s aggressive interest rate hikes.

Source: Bank of Singapore, Bloomberg.

Firstly, the employment report showed payrolls surged 517,000 versus forecasts of 188,000 gains while unemployment fell to a new 53-year low of 3.4% as the chart above illustrates. The US labour market thus remains very tight after reopening from the pandemic, keeping wage growth well above 4%, fuelling inflationary pressures.

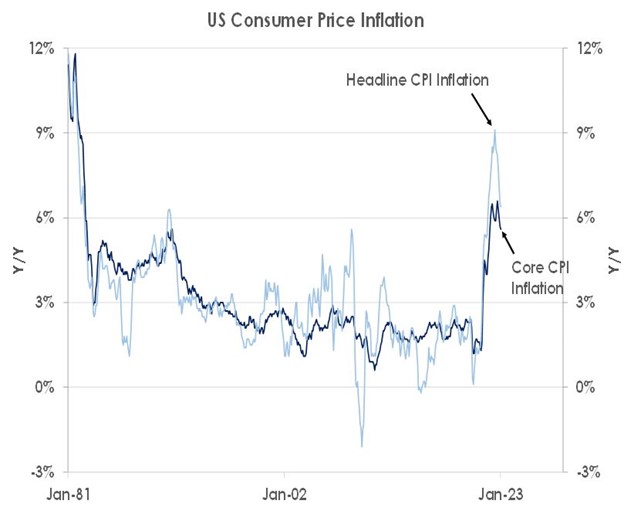

Secondly, January’s CPI inflation only dipped from 6.5% YoY to 6.4% YoY as the next chart shows. Inflation peaked at 9.1% but remains sticky due to the tight labour market.

Source: Bank of Singapore, Bloomberg.

Thirdly, January’s producer price index (PPI) was also stronger than expected. Excluding food and energy costs, PPI inflation was 5.4% YoY.

Lastly, January’s retail sales beat expectations too, increasing by 3.0% alone last month.

The Fed targets inflation to be at 2% over the next 2-3 years. Last month, core consumer prices rose a firm 0.4%. Thus, core CPI inflation at 5.6% YoY remains far above the Fed’s 2% goal. With the labour market also still very tight, we expect the Fed will need to continue raising interest rates throughout the first half of this year now to ease the economy’s overheating and curb inflation.

We think the Fed will lift interest rates by 25bps in March and May and we now expect a 25bps hike in June too. The fed funds rate is therefore set to peak at 5.25-5.50% in the summer. We also do not see the central bank cutting interest rates later this year even if the US economy suffers a recession in the second half of 2023 – as we forecast – as officials will continue to focus on curbing inflation rather than supporting growth.

The Fed’s hawkishness will thus likely challenge financial markets’ strong start to 2023. We stay Neutral on US equities while favouring US Treasuries and Investment Grade bonds as hedges against recession risks. We also continue to see 10Y Treasury yields settling at 3.50% over the next year as Fed rate hikes slow the economy and push long-term yields lower during 2023.

This article was first published by Bank of Singapore on January 20, 2023. The Opinions expressed in this publication are those of the authors. They do not purport to reflect the opinions or views of Bank OCBC NISP Private Banking Tbk. or its affiliates.

OCBC NISP Private Banking provides a suite of products for wealth creation, preservation and transmission including holistic wealth management services, independent research, customized solutions for all investor preferences, and genuine open architecture, with expertise in Indonesia and Asia Pacific markets. OCBC NISP Private Banking is a part of OCBC Group.